- U.S. consumer confidence expected to remain weak

- U.S. new home sales expected to show small increase

- U.S. home prices expected to show another sharp gainÂ

- 2-year T-note auction

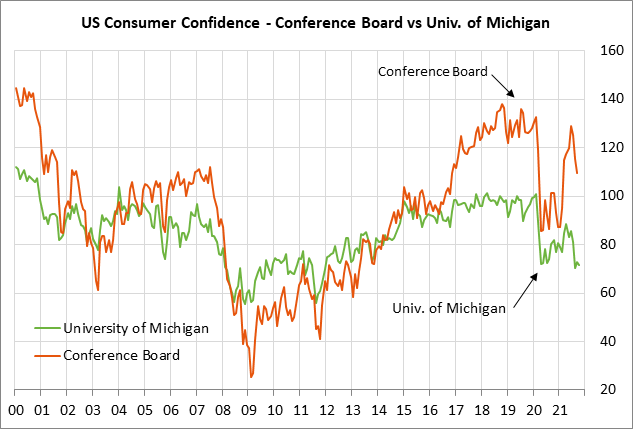

U.S. consumer confidence expected to remain weak — The consensus is for today’s Oct Conference Board U.S. consumer confidence index to show a -0.8 point decline to 108.5, adding to September’s -5.9 point decline to 109.3.

U.S. consumer sentiment remains in poor shape due to the pandemic’s resurgence that didn’t peak until mid-September. The Conference Board’s U.S. consumer confidence index in June reached a 1-1/2 year high of 128.9, but then fell by a total of -19.6 points in the following three months of July-September. The consumer confidence index remains -23.3 points below the pre-pandemic level of 132.6 seen in February 2020.

Consumer confidence fell from July through September because consumers were unsure about how bad the pandemic’s resurgence might get and whether there might be new shutdowns in the U.S. economy.

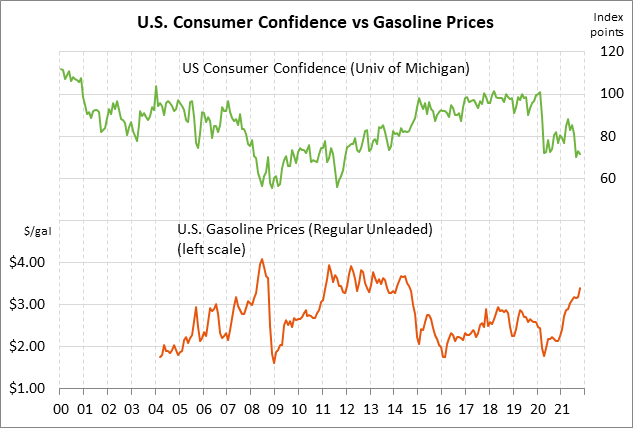

U.S. consumer sentiment has also been hurt by the surge in gasoline prices, which is taking a bite out of consumer pocketbooks. Consumers are also being hurt by inflation and the general rise in the price of many products and services, which is reducing their purchasing power.

Looking ahead, however, consumer confidence should begin to see some underlying support starting in October due to the sharp drop in U.S. Covid infections that began in mid-September. The drop in Covid infections will make more people more willing to go out to shop, go to restaurants, attend entertainment events, and travel.

Also, consumers should feel better due to the sharp rise in home and stock prices, which has substantially boosted household wealth. Also, wages are rising and jobs are plentiful. All in all, the picture looks favorable for consumers over at least the next few quarters.

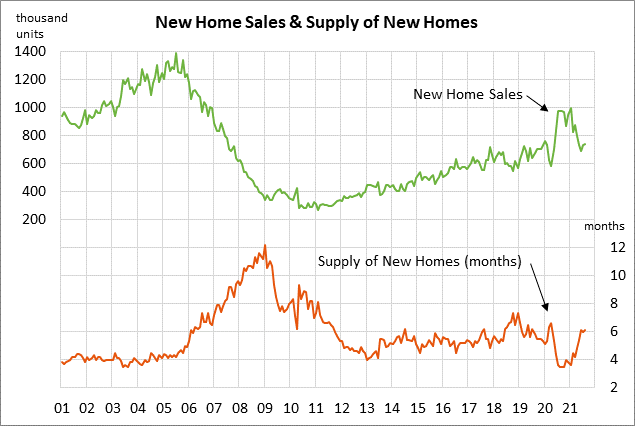

U.S. new home sales expected to show small increase — The consensus is for today’s Sep new home sales report to show a +2.2% m/m increase to 756,000, adding to August’s +1.5% increase to 740,000. New home sales have given back nearly all of the upward spike caused by the pandemic, but remain in good shape near pre-pandemic levels.

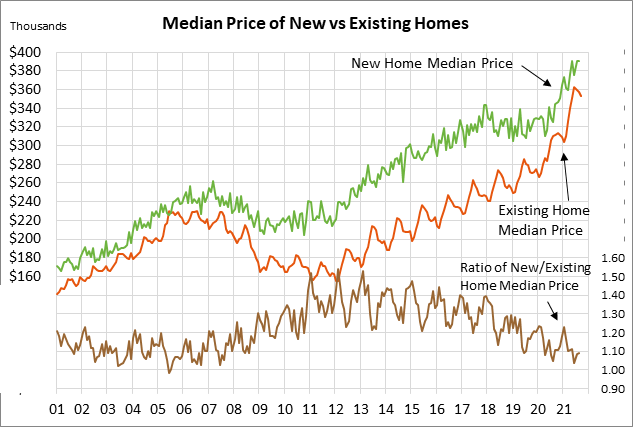

New home sales have been undercut in the past few months as pent-up demand was already met and as some potential homebuyers are refusing to pay such high prices. The median price of a new home in July-August rose to a record high of $390,900, up by +19% from the pre-pandemic price of $329,500 seen in Dec 2019.

However, new home sales continue to see support from generally low mortgage rates. The 30-year mortgage rate has risen to a 6-month high of 3.09%, but that is still well below the pre-pandemic level of 3.75% seen at the end of 2019.

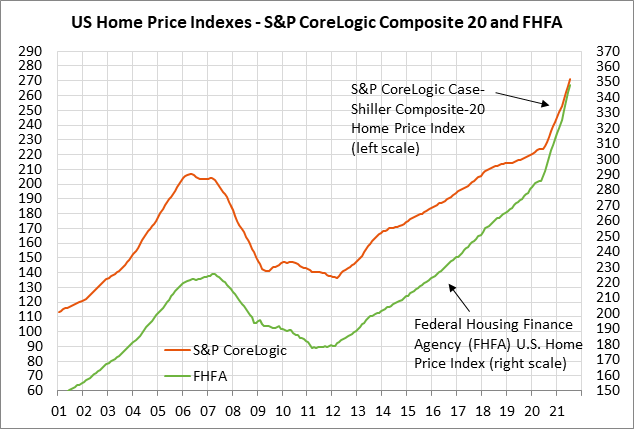

U.S. home prices expected to show another sharp gain — U.S. home prices are expected to show another very sharp gain in August. The consensus is for today’s Aug FHFA house price index to show an increase of +1.5% m/m, adding to July’s increase of +1.4%. The FHFA index has risen sharply by +11.2% year-to-date and by +24% since the pandemic began.

Meanwhile, today’s Aug S&P CoreLogic Composite-20 home price index is expected to show an increase of +1.5% m/m and +20.0% y/y, which would be close to July’s report of +1.55% m/m and +19.95% y/y. The Composite 20 index has risen by +11.8% year-to-date and by +19% since the pandemic began.

U.S. home prices continue to see an upward squeeze from strong demand and tight supplies. U.S. existing home sales are still stronger than before the pandemic. Also, the supply of existing homes on the market remains very tight at 2.4 months, which is much tighter than the average of about 4.0 seen during the 2017-2019 period.

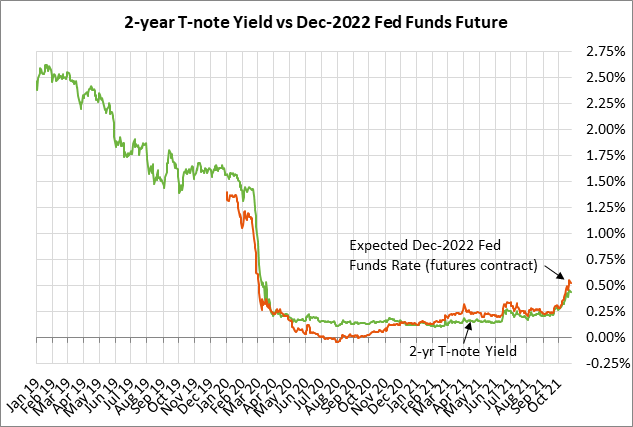

2-year T-note auction — The Treasury today will sell $60 billion of 2-year T-notes. The Treasury will then continue this week’s $211 billion T-note package by selling $61 billion of 5-year T-notes and $28 billion of 2-year floating-rate notes on Wednesday, and $62 billion of 7-year T-notes on Thursday.

The 2-year T-note yield yesterday closed at 0.44%, which was just modestly below last Friday’s 1-1/2 year high of 0.49%. The 2-year yield has risen sharply by about 20 bp in just the past month due to accelerated expectations for Fed tightening. The market is now expecting about an 80% chance of two rate hikes by the end of 2022, versus expectations this summer that the Fed would not start raising rates until early 2023.

The 12-auction averages for the 2-year are as follows: 2.52 bid cover ratio, 3.1 bp tail to the median yield, 10.4 bp tail to the low yield, and 50% taken at the high yield. The 2-year is the second least popular security among foreign investors and central banks behind the 3-year T-note. Indirect bidders, a proxy for foreign buyers, have taken an average of only 51.8% of the last twelve 2-year T-note auctions, well below the median of 63.7% for all recent Treasury coupon auctions.