- Aug U.S. CPI expected to remain strong

- House Committee seeks smaller-than-expected corporate tax hike

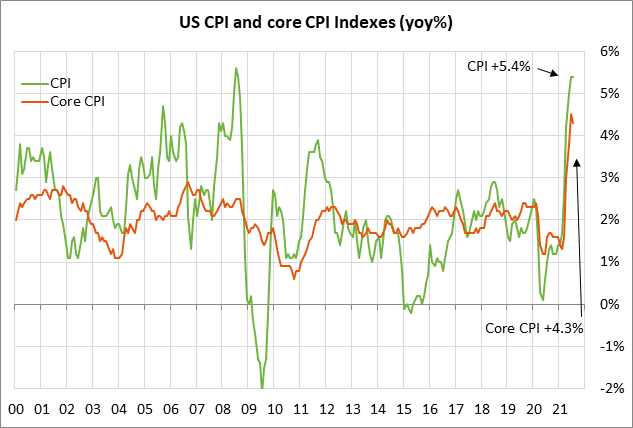

Aug U.S. CPI expected to remain strong — The consensus is for today’s Aug CPI to show an increase of +0.4% m/m and +5.3% y/y, which would be just mildly weaker than July’s report of +0.5% m/m and +5.4% y/y.

Today’s Aug core CPI is expected to show an increase of +0.3% m/m and +4.2% y/y, which would be close to July’s report of +0.3% m/m and +4.3% y/y.

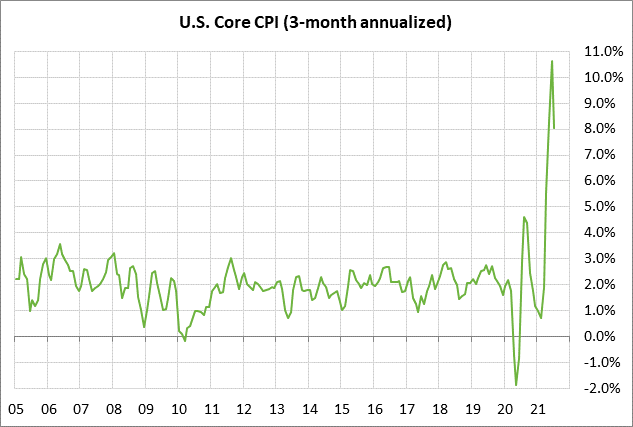

The year-on-year inflation figures are highly distorted by the low year-earlier base. The recent surge in inflation can be seen more clearly by looking at the inflation data over the last three months. On a 3-month annualized basis, the headline CPI in July was up by +8.4%, which was down from June’s peak of +9.7%. On a 3-month annualized basis, the core CPI in August fell to +8.1% from June’s peak of +10.6%.

The recent surge in inflation is expected to extend into today’s report for August. Yet the Fed continues to insist that the recent inflation surge will prove to be transitory since it is due to supply chain disruptions and pandemic reopening pressures that should ease going into next year.

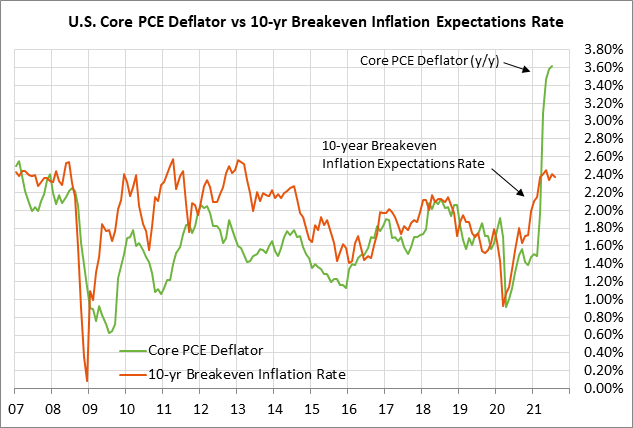

The FOMC in its June “Summary of Economic Projections” forecasted that the PCE deflator will be at +3.4% at the end of this year, but will then ease to +2.1% by the end of 2022 and +2.2% at the end of 2023. The FOMC expects the core PCE deflator to rise to +3.0% late this year but then ease to +2.1% by the end of 2022 and the end of 2023.

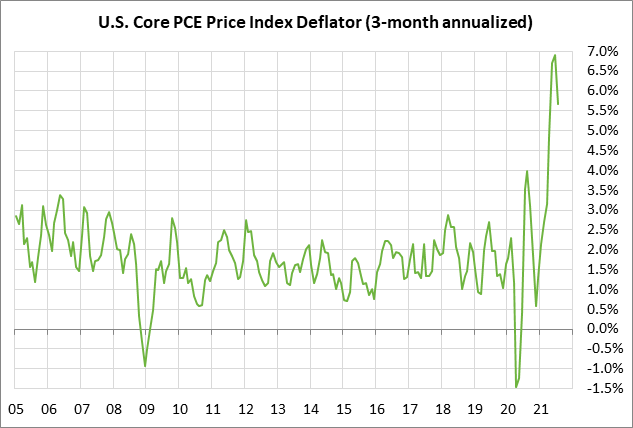

The Fed’s preferred inflation measure is the PCE deflator, which has not risen by as much as the CPI. On a 3-month annualized basis, the headline PCE deflator in July was up by +4.2% and the core deflator was up by +5.7%.

The markets generally agree with the Fed’s sanguine inflation outlook. The 10-year breakeven rate is currently trading at 2.37%, mildly below August’s 3-month high of 2.44%. The 10-year breakeven rate is comfortably below May’s 8-1/2 year high of 2.59%.

Last Friday’s Aug PPI report was strong and indicated that pressures continue to build at the producer level of the economy. The Aug PPI rose to a new peak of +8.3% y/y from July’s +7.8%, and the Aug core PPI rose to a new peak of +6.7% y/y from July’s +6.2%.

House Committee seeks smaller-than-expected corporate tax hike — The House Ways and Means Committee today will meet to mark up the tax portion of the Democrat’s $3.5 trillion spending and tax program. The Committee on Monday released an outline of its proposed tax plan.

The Committee’s plan would raise only $2.9 trillion, which is $600 billion short of the targeted $3.5 trillion of spending. Democratic Senator Tester from Montana said yesterday that he would insist that the spending plan is paid for 100%, meaning that revenue would need to be raised or spending would have to be cut to meet his demands.

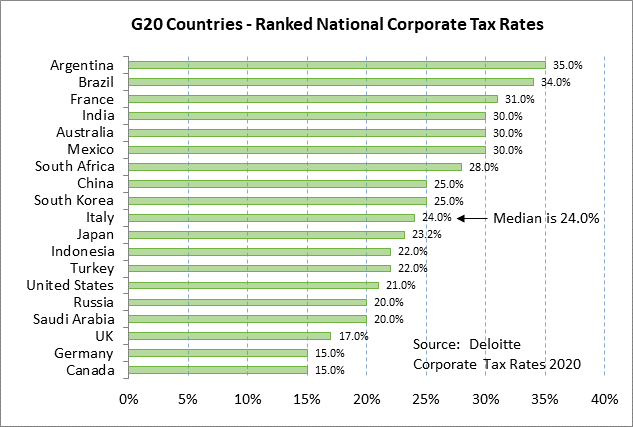

The Committee’s proposal would raise the corporate tax rate to 26.5% from the current level of 21% for companies making more than $10 million. The proposed 26.5% corporate tax rate is below President Biden’s target of 28%.

The stock market was mildly pleased that the latest Democratic proposal would not raise the corporate tax rate as high as 28%. However, any corporate tax hike at all means reduced after-tax earnings and thus lower stock prices.

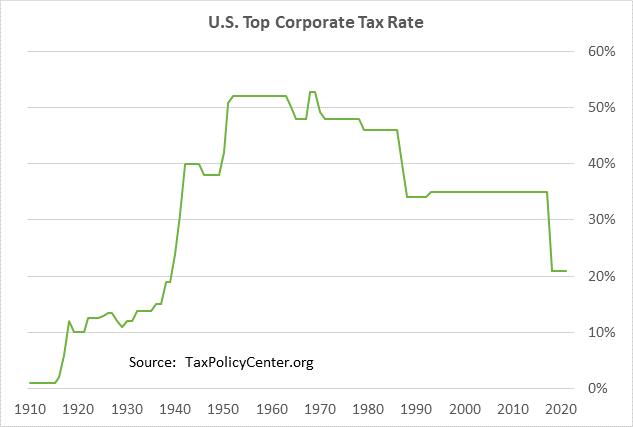

Republicans in December 2017 cut the corporate tax rate to 21% from the 35% level that prevailed since 1993. The new Democratic proposal for a corporate tax rate hike to 26.5% would leave the U.S. tax rate above the median corporate tax rate of 24% for the G-20 countries.

The Committee is proposing to raise the capital gains tax on high earners to 25% from 20%, which is much less than President Biden’s proposal for a hike to 39.6%.

The proposal from the House Ways and Means Committee will certainly not be the last word since the House is likely to make changes and adopt amendments. Also, the Senate Finance Committee is independently working on its own tax proposals.

Changes may also need to be made to placate individual Democratic Senators such as Manchin and Senema since the Democrats need every single Democratic Senator to vote in favor of the reconciliation bill.

Democratic leaders are aiming to get the $3.5 trillion reconciliation bill approved by Congress by the end of this month, which seems like an impossible task given the size of the bill and the opposition from moderate Democrats to some provisions.

Democratic Senator Manchin on Sunday again voiced his opposition to the $3.5 trillion plan, saying he would support only a $1.5 trillion plan and that there is no hurry in trying to approve the bill by the end of September.