- FOMC minutes may give hints on tapering timing ahead of next week’s Jackson Hole conference

- U.S. housing starts expected to fall mildly but remain strong

- 20-year T-bond auction

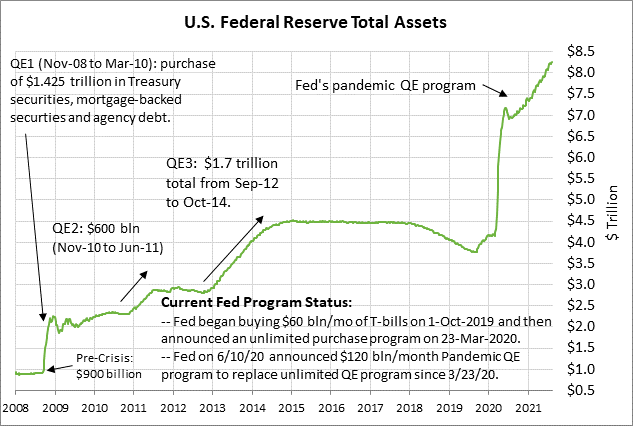

FOMC minutes may give hints on tapering timing ahead of next week’s Jackson Hole conference — The markets will be carefully dissecting today’s release of the minutes from the July 27-28 FOMC meeting. The FOMC at that meeting took its “first deep dive” into discussing QE tapering, according to Mr. Powell. However, Mr. Powell said at the time that the Fed still has “some ground to cover” before reaching the point of QE tapering.

The July FOMC meeting outcome did not seem to shift the market’s forecast of the timing of the Fed’s QE tapering. A Bloomberg poll taken on July 16-21 found that 74% of respondents expect the Fed to provide an early warning of QE tapering at next week’s (Aug 26-28) Jackson Hole conference or at the next FOMC meeting on September 21-22.

The survey found that 36% of the respondents expect the Fed to formally announce its QE program somewhere between September and November, while the largest plurality of 47% expect that announcement in December.

Regarding the actual implementation date, a hefty 71% of respondents expect the tapering to begin in Q1-2022. The remaining respondents were roughly split about whether the tapering will be either before or after Q1.

Boston Fed President Rosengren, in a CNBC interview on Monday, voiced an opinion that was a bit more hawkish on QE tapering than the consensus view. He said he expects there to be enough job growth to support a decision to formally announce QE tapering at the next FOMC meeting on September 21-22. He said he would support the implementation of the tapering beginning in October or November, and certainly not “any later than December.” He said he would want to conclude the tapering program by mid-2022.

A Wall Street Journal article on Monday also suggested that the Fed’s view on tapering is a bit more hawkish than the market consensus. The article said, “Federal Reserve officials are nearing agreement to begin scaling back their easy money policies in about three months if the economic recovery continues, with some pushing to end their asset-purchase program by the middle of next year.”

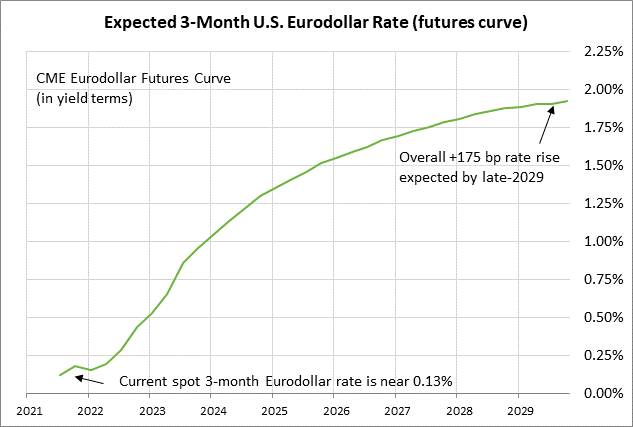

The concept of ending QE tapering by mid-2022 would leave the Fed the option of starting to raise interest rates in late 2022, if appropriate. Dallas Fed President Bullard recently said that he wants to start tapering QE in October and conclude the program by March. He said, “I don’t want to have to move too rapidly [to raise rates] because it can be very disruptive, so I think the pace I’m suggesting would give us a lot more optionality [on raising rates] in 2022 if we needed to use it.”

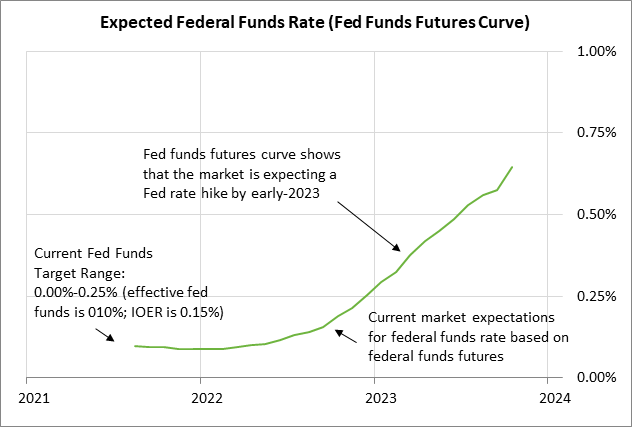

The market is not fully discounting the Fed’s first rate hike until early 2023, but that expectation could move forward to late 2022 if the U.S. economy continues to show unexpected strength.

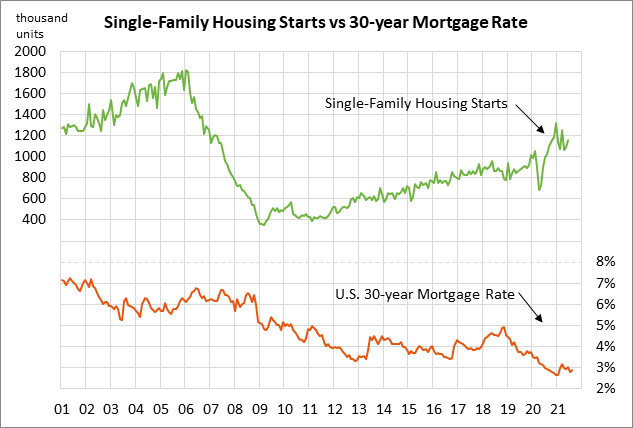

U.S. housing starts expected to fall mildly but remain strong — The consensus is for today’s July housing starts report to fall by -2.6% m/m to 1.600 million, reversing part of June’s +6.3% m/m increase to 1.643 million. Housing starts remain in very strong shape at only -5% below March’s 15-year high of 1.725 million units.

Housing starts have been spurred on by the strong demand for new homes that has resulted from the pandemic. Homebuilders are chomping at the bit to build new homes to satisfy the demand. Homebuilders have also received good news in the past two months as their costs returned closer to normal after lumber prices fell back to earth after the extraordinary upward spike seen from late-2020 to a record high in May 2021.

The continued low level of mortgage rates is another very bullish factor for home buyers and homebuilders. The 30-year mortgage rate is currently at only 2.87%, which is almost a full percentage point below the pre-pandemic (end-2019) level of 3.74% and the 10-year average of 3.84%.

However, homebuilders seem to be turning more cautious due to the resurgence of the pandemic, which could disrupt building schedules. Yesterday’s Aug NAHB housing market index fell by -5 points to 75, which was weaker than expectations of -1 to 80.

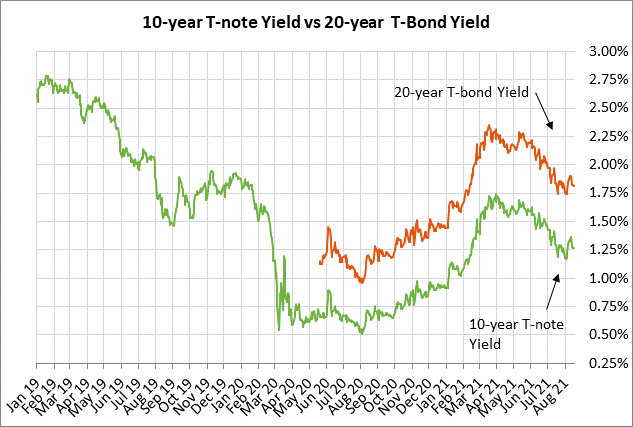

20-year T-bond auction — The Treasury today will auction $27 billion of new 20-year T-bonds. The benchmark 20-year yield yesterday closed at 1.81%, which is a relatively low level that is just 12 bp above the 6-1/2 month low of 1.69% posted in July.

Treasury yields have moved lower in the past three months due to the pandemic resurgence and perceptions that the economic boom is fading. Also, the markets are not expecting the Fed to start raising interest rates until early 2023, although QE tapering is likely to start by year-end.

The 12-auction averages for the 20-year are as follows: 2.34 bid cover ratio, $3 million in non-competitive bids, 6.3 bp tail to the median yield, 116.2 bp tail to the low yield, and 51% taken at the high yield. The 20-year is mildly below average in popularity among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have purchased an average of 59.8% of the last twelve 20-year bond auctions, which is mildly below the median of 62.2% for all recent Treasury coupon auctions.