- FOMC minutes indicate QE tapering by year-end and spark -1% sell-off in stocks

- Claims expected to show continued labor market improvement

- U.S. LEI expected to show continued strength although GDP growth expected to decelerate into year-end

- 10-year TIPS auction

FOMC minutes indicate QE tapering by year-end and spark -1% sell-off in stocks — The S&P 500 index yesterday sold off sharply after the release of the July 27-28 FOMC meeting minutes indicated that most FOMC members expect QE tapering by the end of this year. The S&P 500 index closed the day down -1.07%, while the Nasdaq 100 index closed the day down -0.97%.

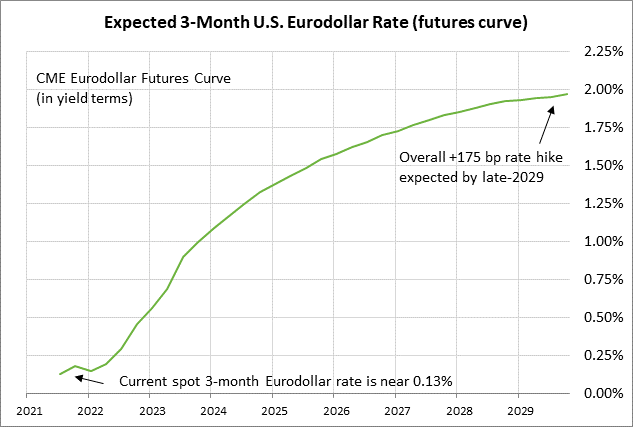

However, the federal funds futures curve was little changed after the QE tapering news, indicating that the news did not significantly affect market expectations for when the Fed will implement its first rate hike. The market is still expecting the Fed’s first rate hike in early 2023.

The Fed has taken pains to say that the timing of QE tapering does not have implications for the timing of the first rate hike. Nevertheless, the sooner the Fed implements QE tapering, the sooner the Fed will have the flexibility to start raising interest rates, depending on how the pandemic and the economy unfold over the next 1-2 years.

Specifically, the FOMC minutes said that most participants “judged that it could be appropriate to start reducing the pace of asset purchases this year.” There was some dissent to that view, however, since the minutes also said “several others” indicated that a reduction in the pace of asset purchases was more likely to become appropriate early next year.”

Notably, the FOMC minutes also said that “most participants” said that their standard for progress had been achieved with respect to the price stability goal. However, FOMC members made clear that there is still a long way to go before their labor market goals are met.

The stock market yesterday seemed to be surprised that the FOMC members are settling so quickly on a consensus for QE tapering by the end of this year. FOMC members just started seriously discussing the issue at the July 27-28 meeting, and the pandemic resurgence has yet to peak.

Nevertheless, a monthly survey by Bank of America released on Tuesday said that 84% of the fund managers surveyed expected the Fed to announce tapering by the end of the year.

The FOMC now seems likely to officially announce the QE tapering at the next FOMC meeting on September 21-22 or at the following meeting on November 2-3. An obvious time for the Fed to start the QE tapering process would be January 1, 2022, thus allowing for adjustments to be based on calendar quarters. Some FOMC members have already said they would like to get the QE tapering program over quickly and be finished by mid-2022.

The markets will now be on edge ahead of the Fed’s Jackson Hole conference late next week since Fed Chair Powell may deliver a more explicit warning that the QE tapering decision is coming soon. Yesterday’s FOMC minutes represented the Fed’s first clear indication that QE tapering is coming soon, but Mr. Powell might want to reinforce the warning so that the markets are not surprised if the QE tapering announcement comes as soon as the next FOMC meeting on September 21-22.

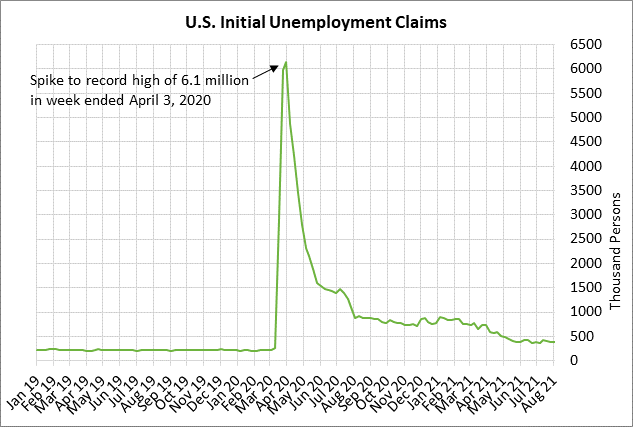

Claims expected to show continued labor market improvement — The consensus is for today’s weekly initial unemployment claims report to show a decline of -11,000 to 364,000, adding to last week’s -12,000 decline to 375,000. Continuing claims are expected to fall -66,000 to 2.800 million, adding to last week’s -114,000 decline to 2.866 million.

Initial claims are now just 7,000 above June’s 17-month low of 368,000. Continuing claims in last week’s report fell to a new 17-month low of 2.866 million. Relative to the pre-pandemic level, initial claims are still elevated by 159,000 and continuing claims are elevated by 1.158 million.

On labor front, the markets were encouraged by the last two payroll reports (+938,000 in June and +943,00 in July) although some businesses might start curbing their hiring due to the unrelenting pandemic resurgence.

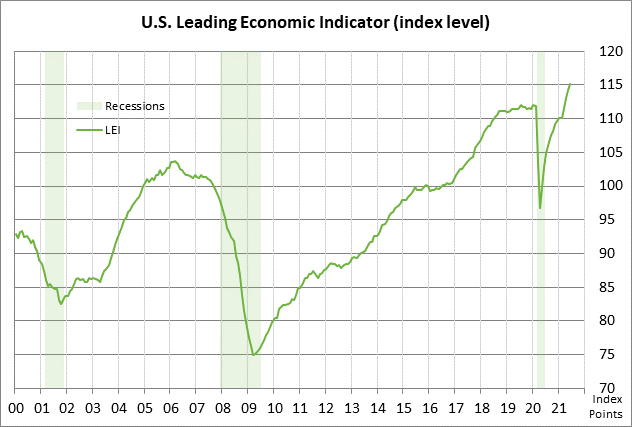

U.S. LEI expected to show continued strength although GDP growth expected to decelerate into year-end — The consensus is for today’s July leading indicators to show another strong increase of +0.7% m/m, matching June’s increase. On a year-on-year basis, the LEI in June was up +12.0% y/y.

U.S. GDP growth is expected to peak at +6.9% (q/q annualized) in Q3 and then start fading to +5.6% in Q4, +3.8% in Q1-2022, and +3.0% in Q2-2022.

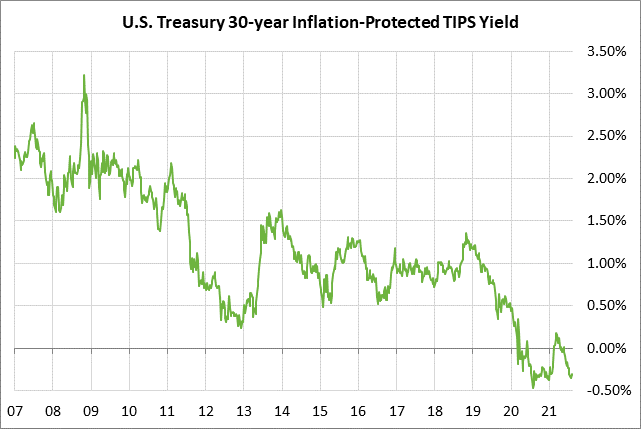

30-year TIPS auction — The Treasury today will auction $8 billion of 30-year TIPS in the first and only reopening of the 1/8% 30-year TIPS of February 2051 that the Treasury first sold in February. The benchmark 30-year TIPS yield yesterday closed at -0.30%.

The 12-auction averages for the 30-year TIPS are as follows: 2.47 bid cover ratio, $11 million in non-competitive bids, 6.7 bp tail to the median yield, 19.9 bp tail to the low yield, and 54% taken at the high yield. The 30-year TIPS is the most popular coupon security among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of 74.8% of the last twelve 30-year TIPS auctions, which is well above the median of 62.2% for all recent Treasury coupon auctions.