- March payrolls are expected to show a respectable increase and indicate that the U.S. economy is still afloat

- U.S. ISM manufacturing index is expected to move back above 50.0 for the first time in six months

- Final-March U.S. consumer sentiment index is expected to be revised mildly higher

- U.S. vehicle sales expected to edge higher as truck sales continue to dominate

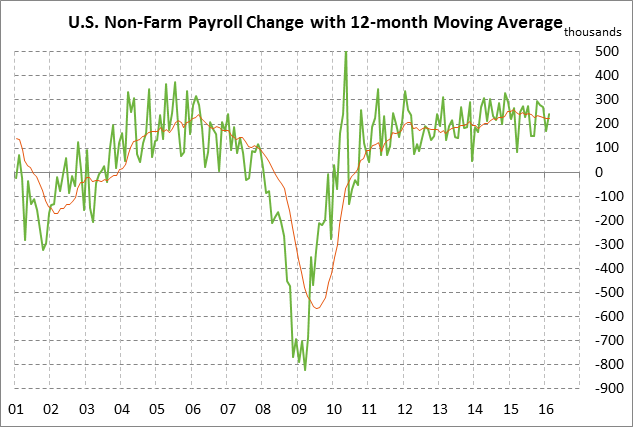

March payrolls are expected to show a respectable increase and indicate that the U.S. economy is still afloat — The market is expecting today’s March payroll report to show an increase of +

The markets were pleased that job growth held up during January and February when the U.S. stock market was in a full-blown downside correction and there was significant turmoil in China. However, the question is whether job growth will continue to hold up at strong levels going into spring. U.S. corporations are currently in a profit recession and they may be looking to curb their hiring and their labor costs, particularly due to poor labor productivity at present.

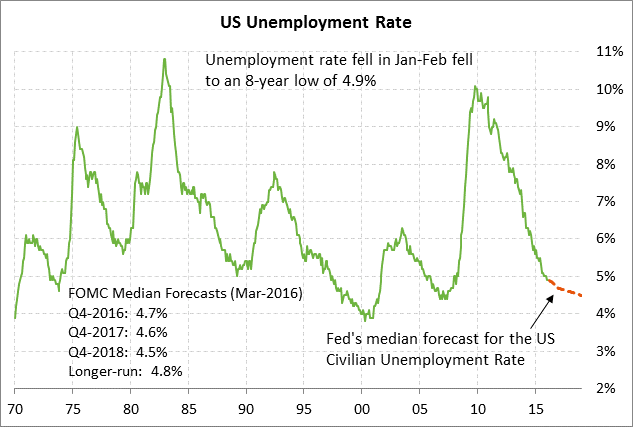

Meanwhile, the market is expecting today’s March unemployment rate to be unchanged from Feb’s 8-year low of 4.9%. The current U.S. unemployment rate of 4.9% is near the Fed’s idea of full employment considering that the FOMC is forecasting that the unemployment rate will drop by only another -0.4 points to 4.5% over the next three years and is forecasting the longer-run unemployment rate of 4.8%.

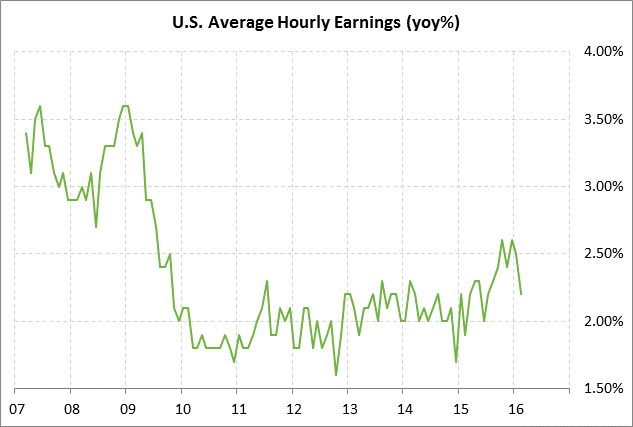

The market is expecting today’s March average hourly earnings report to be unchanged from Feb at +2.2% y/y. The markets temporarily became encouraged about stronger wage growth when average hourly earnings reached as high as +2.6% in Dec 2015. However, the series has since fallen back to a rather pedestrian +2.2%. Consumers need more income to support confidence and spending.

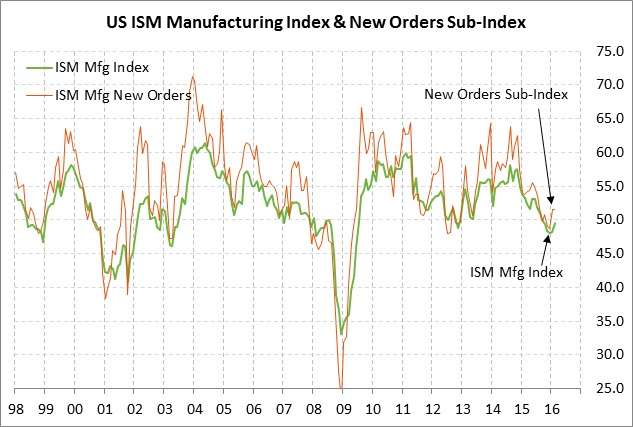

U.S. ISM manufacturing index is expected to move back above 50.0 for the first time in six months — The market is expecting today’s Mar ISM manufacturing index to show a +1.3 point increase to 50.8, adding to Feb’s +1.3 point increase to 49.5. The ISM manufacturing index has been below the expansion-contraction level of 50.0 for the past five months and a rise in the index today back above the 50.0 mark would be a welcome development. The ISM manufacturing index bottomed out at a 6-1/2 year low of 48.0 in December 2015 and then showed a combined +1.5 point recovery in Jan-Feb to 49.5

The rise in the ISM index indicates that U.S. executives are starting to see an improvement in the U.S. manufacturing sector after the weakness seen in 2015 caused by the strong dollar, weak overseas economic growth, and the recessions in the petroleum and mining industries. Indeed, the ISM manufacturing orders sub-index has been above 50.0 at 51.5 in the past two months (Jan-Feb), indicating an improvement in order flow. Still, the U.S. manufacturing sector in general remains weak and vulnerable to any fresh negative shocks.

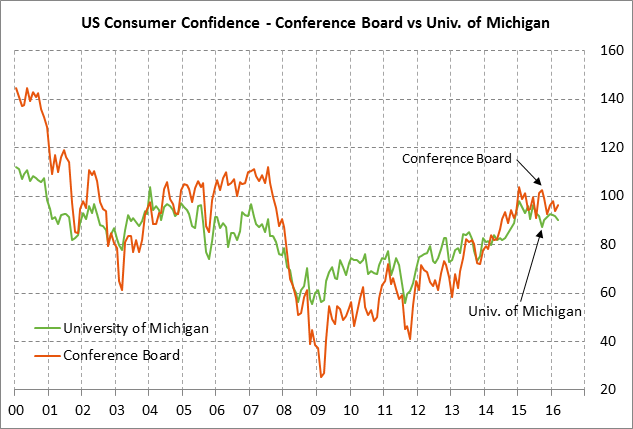

Final-March U.S. consumer sentiment index is expected to be revised mildly higher — The market is expecting today’s final-March U.S. consumer sentiment index from the University of Michigan to show a +0.5 rise to 90.5 from early March, which would leave the final-March figure down by -1.2 from February rather than the preliminary drop of -1.7 points. Expectations for an improvement in today’s final-March index are based in part of the news earlier this week that the Conference Board’s U.S. consumer confidence index in March showed a +2.2 point increase to 96.2, recovering part of Jan’s -3.8 point decline.

U.S. consumer confidence took a hit at the beginning of this year due to the downward stock market correction and the Chinese turmoil. However, the stock market has since recovered and that has provided some support for consumer confidence. Still, there are reasons for consumers to remain cautious such as the 34-cent rise in gasoline prices from the lows and questions about the U.S. economy given the weak Q4 U.S. GDP report of +1.4%.

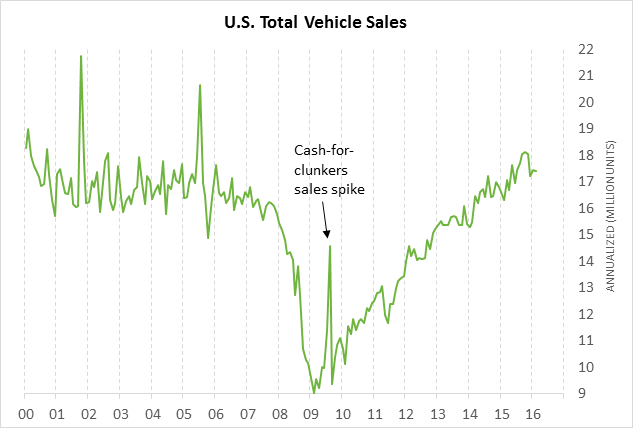

U.S. vehicle sales expected to edge higher as truck sales continue to dominate — The market is expecting today’s March total vehicle sales report to show a small improvement to 17.50 million from 17.43 million in February. U.S. vehicle sales continue to run at strong levels just mildly below the 10-1/2 year high of 18.12 million units posted in Oct 2015. The strength is vehicle sales is the main factor supporting the U.S. manufacturing sector as it struggles to deal with the negative effects of the strong dollar, weak overseas economic growth, and the petroleum and mining sector recessions.

The strength in vehicle sales continues to come mainly from truck sales, which in turn are being driven by low gasoline prices. U.S. truck sales posted a new 10-1/2 year high of 10.52 million units in October 2015 and have since backed off just mildly to 10.26 million units. Truck sales in February were sharply higher by +12.4% y/y. Meanwhile, car sales in February fell by -0.6% y/y and were at the lower end of the sideways range seen in the past three years.

Gasoline prices will continue to have a strong influence on truck and vehicle sales. The price of retail unleaded gasoline bottomed out at $1.70 in mid-February and has since risen to $2.04, according to AAA. That 34-cent rise in gasoline prices will not be helpful in stimulating new truck sales, although gasoline prices are still extraordinarily low compared with the average of about $3.50 seen in 2011-14.