- U.S. unemployment claims indicate a continued low level of layoffs

- 30-year T-note auction to yield near 2.67%

- 10-year inflation expectations rise by 40 bp to 1.50% but most of the Treasury yield curve is still in positive inflation-adjusted territory

- Markets are expecting fresh ECB stimulus today

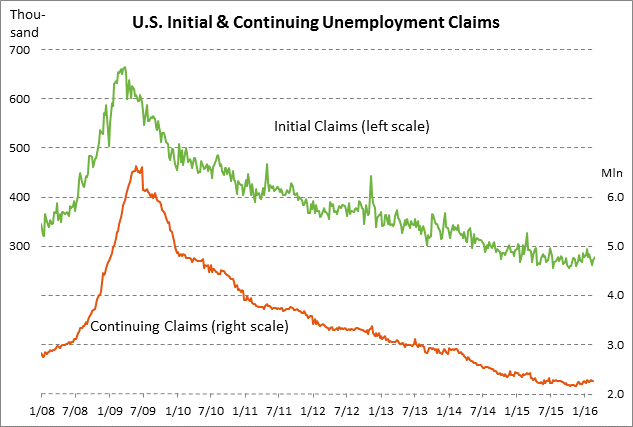

U.S. unemployment claims indicate a continued low level of layoffs — The initial unemployment claims series is currently only +23,000 above the 42-year low of 255,000 posted in July 2015. This indicates that the financial market turmoil seen so far this year has not yet led to any sustained increase in layoffs and suggests that businesses are shrugging off the recent turmoil. The continuing claims series is moderately above October’s 15-year low of 2.146 million by +111,000. Market confidence about the U.S. labor market improved after the recent news that Feb payrolls rose by a strong +242,000.

The market consensus is for small declines in today’s unemployment claims report. Specifically, the market is expecting today’s initial unemployment claims to show a -3,000 decline to 275,000 (after last week’s +6,000 to 278,000) and continuing claims to show a -7,000 decline to 2.250 million (after last week’s +3,000 to 2.257 million).

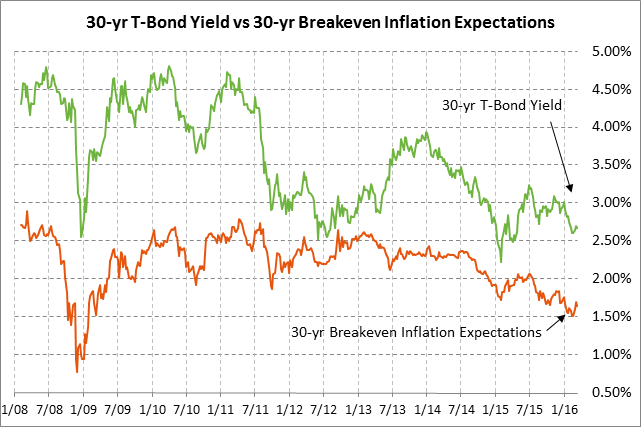

30-year T-note auction to yield near 2.67% — The Treasury today will sell $12 billion of 30-year T-bonds in the first reopening of the 2.5% 30-year T-bond of Feb 2046 that the Treasury first sold in February. Today’s auction will conclude this week’s $56 billion coupon package. The size of today’s 30-year auction is $1 billion smaller than the size seen over the last six years. The Treasury has reduced the size of coupon auctions in favor of boosting T-bill auction sizes in an effort to dampen long-term yields.

Today’s 30-year T-bond issue was trading at 2.67% in when-issued trading late yesterday afternoon. That translates to an inflation-adjusted yield of +1.03% against the current 30-year breakeven inflation expectations rate of 1.64%.

The 12-auction averages for the 30-year are as follows: 2.33 bid cover ratio, $11 million in non-competitive bids to mostly retail investors, 5.3 bp tail to the median yield, 14.5 bp tail to the low yield, and 59% taken at the high yield. The 30-year is slightly above average in popularity among foreign investors and central banks. Indirect bidders, a proxy for foreign buying, have taken an average of 55.8% of the last twelve 30-year T-bond auctions, which is slightly above the average of 60.7% for all recent Treasury coupon auctions.

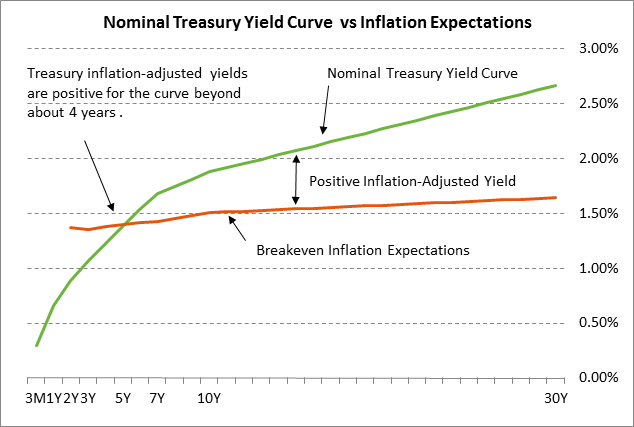

10-year inflation expectations rise by 40 bp to 1.50% but most of the Treasury yield curve is still in positive inflation-adjusted territory — The 10-year breakeven inflation expectations rate has risen by nearly 40 bp in the past several weeks to 1.50% from the intra-day low of 1.11% seen in mid-February. The rise in inflation expectations has been due mainly to the recovery in oil prices to $38 from the 13-year low of $26.05 posted in mid-February.

However, inflation expectations have also risen partially because of the recent rise in the U.S. inflation statistics. The core PCE deflator in January popped up to a 3-1/4 year high of +1.7% y/y from the 5-year low of +1.3% seen during most of 2015. The core PCE deflator is still below the Fed’s +2.0% inflation target, but the recent rise in the inflation rate suggests that some inflation pressures may be bubbling below the surface. Meanwhile, the core CPI in January rose to a 3-3/4 year high of +2.2% y/y and was up by +2.5% on a 3-month annualized basis.

The recent rise in inflation expectations has been a driver of the recent rise in nominal Treasury yields. Yet the Treasury curve remains above inflation expectations for the curve beyond about 4 years. The 10-year T-note yield of 1.88%, for example, is +0.38% above the 10-year inflation expectations rate of 1.50%, implying that investors buying the 10-year will get an annual return of 0.35% over the course of their 10-year investment if the actual 10-year inflation rate turns out to match current expectations of +1.47%. The 2-year yield of 0.89%, however, is below water since it is -0.48% below the 2-year inflation expectations rate of 1.37%.

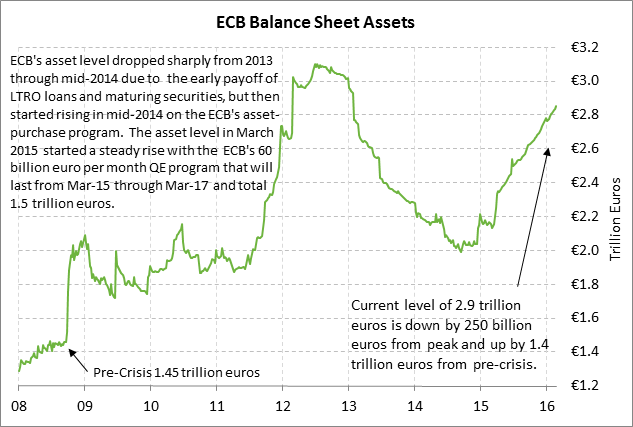

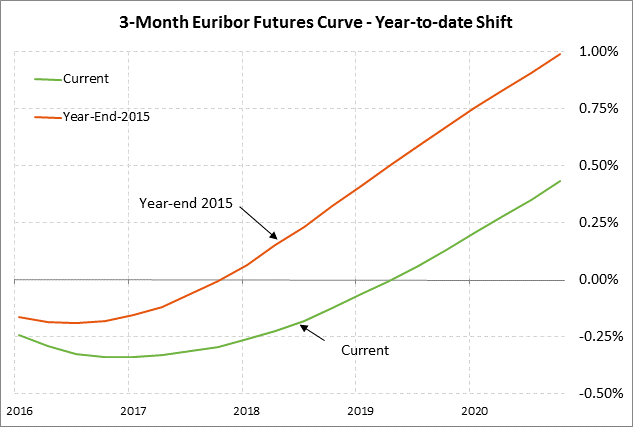

Markets are expecting fresh ECB stimulus today — The market consensus is that the ECB at its regular policy meeting today will cut its deposit rate by another -10 bp from the current -0.30% level and may also expand its QE program. The ECB is currently only about half way through its QE program, which involves the monthly purchase of 60 billion euros of securities through March 2017, finally totaling 1.5 trillion euros.

The ECB today may introduce a tiered system for its deposit facility that puts less strain on banks’ profitability by subjecting a smaller amount of excess reserves to the negative deposit rate. However, that would impede the transmission of negative interest rates to the public and thus reduce the effectiveness of the ECB’s attempt to use negative interest rates to force banks, businesses and consumers to put money to work in order to stimulate the economy.

The ECB is seeking further stimulus measures to address weak GDP growth and low inflation. After two years of negative Eurozone GDP growth in 2013 (-0.9%) and 2014 (-0.3%), GDP in 2015 finally turned positive to +0.9%. However, the market consensus is that Eurozone GDP will improve to only +1.6% this year and then remain near that level in 2017-18. Meanwhile, the Eurozone CPI in February turned negative again to -0.2% y/y and the core CPI fell to +0.7% y/y, only +0.1 point above the record low of +0.6% posted in early 2015.