- U.S. payroll report is expected to show an improvement from Jan’s poor report

- U.S. trade deficit expected to remain little changed near trend levels

- Markets are expecting fresh ECB stimulus next week

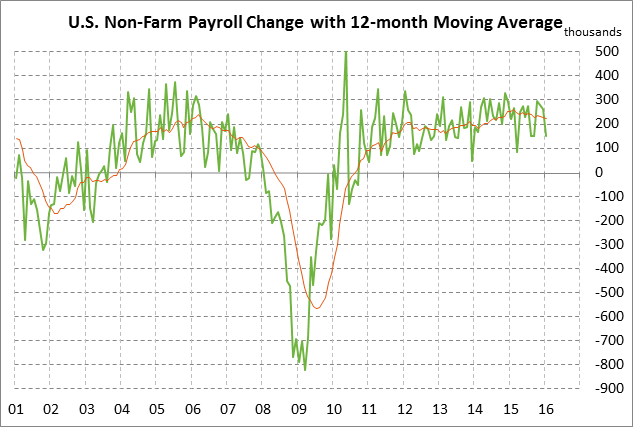

U.S. payroll report is expected to show an improvement from Jan’s poor report — The market consensus is for today’s Feb payroll report to improve to +195,000 from January’s weak report of +151,000. However, the expected Feb payroll report of +195,000 would still be well below the 2015 monthly average increase of +228,000. Moreover, the expected 2-month Jan-Feb average of +173,000 would be even farther below that 2015 average of +228,000.

Wednesday’s ADP report showed an increase of +214,00, which was better than the market consensus of +185,000 and bode well for today’s payroll report. Combined with Jan’s report of +193,000, ADP jobs showed an average monthly increase of +204,000 in Jan-Feb, which was very close to the 2015 monthly average increase of +207,000.

Today’s payroll report will show whether businesses are still hiring at the levels seen in 2015 or whether they are pulling back somewhat on hiring to gauge the outcome of the recent overseas turmoil and the U.S. stock market correction. A dip in hiring in early 2015 would obviously be a negative development for consumer confidence, income, and spending, as well as the overall economy. Yet the labor market may be due for some correction considering that U.S. businesses have hired a net 13.6 million people since the jobs trough was posted in early 2010. With the poor U.S. Q4 GDP growth rate of +1.0% and with overseas growth prospects looking dim, U.S. businesses may start curbing their hiring. This is particularly the case since labor productivity growth has been non-existent over the past two years, which means that companies are not getting much bang for their buck from their employees. In addition, weak corporate earnings growth means that companies are under some pressure to reduce labor costs and boost earnings.

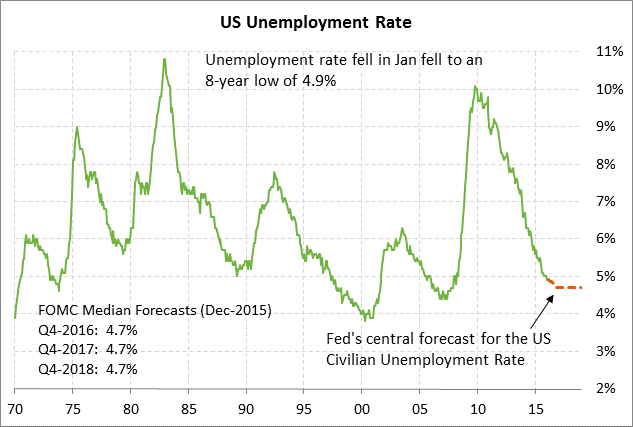

Meanwhile, the market consensus is for today’s Jan unemployment rate to be unchanged from January at 4.9%. The unemployment rate in January fell to that new 8-year low of 4.9%, which was only +0.2 points above the 4.7% level that the Fed is expecting as its long-run midpoint forecast.

The unemployment rate has fallen as sharply as it has in recent years partly because many people have dropped out of the labor market for various reasons. The low unemployment rate, therefore, does not provide any confirmation that the U.S. labor market has fully returned to health. The high drop-out rate from the labor force shows up as a decline in the labor force participation rate, which measures the percentage of the U.S. population that is in the labor market, either holding or looking for a job. The labor participation rate fell to a 38-year low of 62.4% in Sep-Oct 2015 and has since rebounded just slightly higher to 62.7% by January. That is down sharply from the record high of 67.3% posted in 2000.

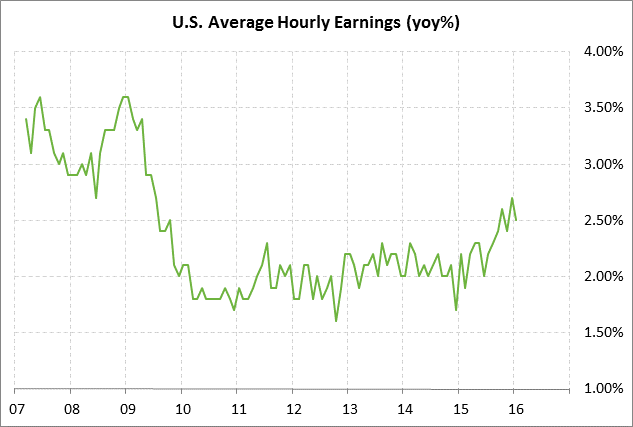

On the wage front, the market is expecting today’s Feb average hourly earnings report to show an increase of +0.2% m/m and +2.5% y/y following the Jan report of +0.5% m/m and +2.5% y/y. The hourly earnings series has improved mildly from the low-2% area seen in mid-2015, which is a good sign for U.S. workers.

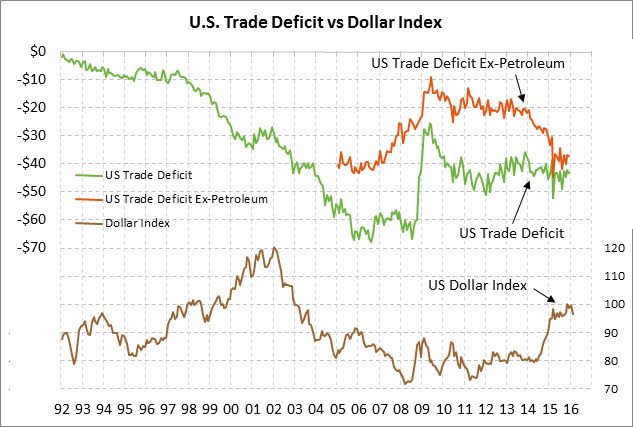

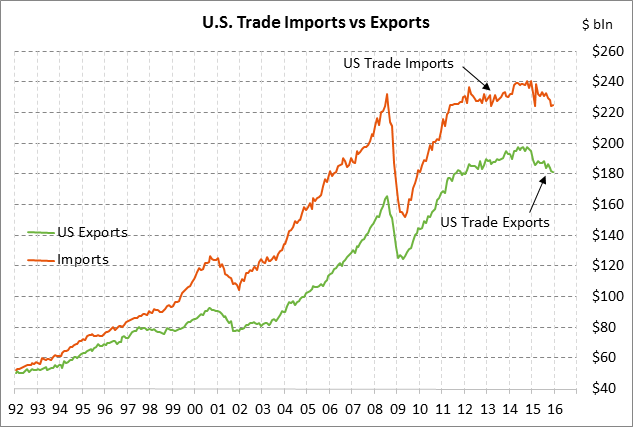

U.S. trade deficit expected to remain little changed near trend levels — The market is expecting today’s Jan trade deficit to expand mildly to -$44.0 billion from -$43.36 billion in December. Today’s expected deficit of -$44.0 billion would be close to the 12-month moving average of -$44.3 billion.

The U.S. trade deficit has recently moved sideways as exports and imports have been similarly weak. Imports have been pushed lower by falling oil and commodity prices, which have reduced the dollar value of imports. Meanwhile, exports have dropped due to weak overseas economic growth and the strong dollar, which has made U.S. exports more expensive for overseas buyers. Dec imports were down -6.5% y/y and also fell by a total of -6.5% from the record high posted in April 2014. Meanwhile, Dec exports fell by -6.9% y/y and fell by a total of -8.2% from the record high posted in Oct 2014.

The outlook is for the U.S. trade deficit to continue to move sideways as exports and imports continue to track at roughly similar levels. The persistent U.S. trade deficit continues to be a long-term bearish factor for the dollar as the dollars that are flowing out of the U.S. are sold into the FX market to the extent that the recipients of those trade dollars do not wish to hold and invest them in dollar-denominated assets.

Markets are expecting fresh ECB stimulus next week — The market consensus is that the ECB at its regular policy meeting next Wed/Thu will cut its deposit rate by another -10 bp from the current -0.30% level and may expand its QE program. The ECB is currently only about half-way through its QE program, which involves the monthly purchase of 60 billion euros of securities through March 2017, finally totaling 1.5 trillion euros. The ECB next week may introduce a tiered system for its deposit facility that puts less strain on banks’ profitability by subjecting a smaller amount of excess reserves to the negative deposit rate.

The ECB is seeking further stimulus measures to address weak GDP growth and low inflation. After two years of negative Eurozone GDP growth in 2013 (-0.9%) and 2014 (-0.3%), GDP in 2015 finally turned positive to +0.9%. However, the market consensus is that Eurozone GDP will improve to only +1.6% this year and then remain near that level in 2017-18. Meanwhile, the Eurozone CPI in February turned negative again to -0.2% y/y and the core CPI fell to +0.7% y/y, only +0.1 point above the record low of +0.6% posted in early 2015.