- ADP employment report is expected to be mildly below trend as hiring incentives dissipate

- Fed Beige Book

- MBA mortgage apps remains generally strong due to low mortgage rates

- EIA report expected to show another increase in U.S. crude oil inventories

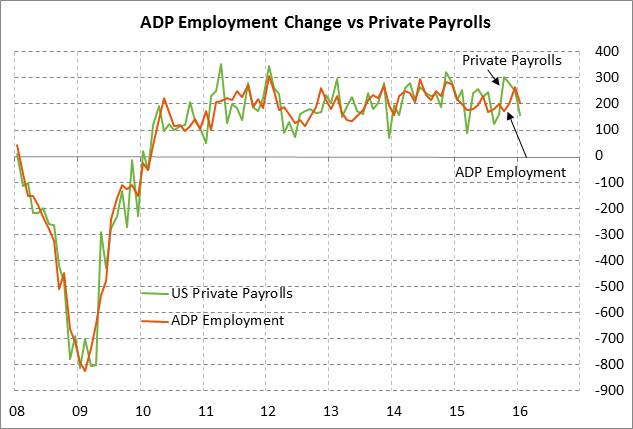

ADP employment report is expected to be mildly below trend as hiring incentives dissipate — The market is expecting today’s Feb ADP employment report to show an increase of +185,000, falling back from the +205,000 increase seen in January and falling mildly below the 2015 monthly average increase of +199,000. The markets will be watching today’s report very carefully to better assess whether businesses are still hiring at the levels seen in 2015 or whether they are pulling back on hiring in Jan-Feb to gauge the outcome of the recent overseas turmoil and the U.S. stock market correction.

On the labor front, the market is mainly looking ahead to Friday’s Feb unemployment report. The market consensus is that Feb payrolls will improve to +195,000 from January’s weak report of +151,000. However, the expected Feb payroll report of +195,000 would still be well below the 2015 monthly average increase of +228,000. Moreover, the 2-month Jan-Feb average of +173,000 would be even farther below the 2015 average of +228,000.

A dip in hiring in early 2015 would be a negative development for consumer confidence, income, and spending, as well as the overall economy. Yet the labor market may be due for some correction considering that U.S. businesses have hired a net 13.6 million people since the jobs trough was posted in early 2010. With the poor U.S. Q4 GDP growth rate of +1.0% and with overseas growth prospects looking dim, U.S. businesses may start curbing their hiring somewhat. This is particularly the case since labor productivity growth has been non-existent over the past two years, which means that companies are not getting much bang for their buck out of their employees. In addition, weak earnings growth means that companies are under some pressure to reduce labor costs and boost earnings.

Fed Beige Book — The Fed today will release its regional Beige Book report ahead of the FOMC meeting in two weeks on March 15-16. The markets will be watching today’s Beige Book report for signs of economic weakness after the poor Q4 GDP report of +1.0% and the dearth of business investment seen in Q4. In the Fed’s last Beige Book report released in January, the Fed staff found that regional economic conditions were mixed. The report said that economic growth was “flat” in the NY and Kansas City districts, “moderate” in the Atlanta and San Francisco districts, and “modest” in the Philadelphia, Cleveland, Richmond, Chicago, St. Louis, Minneapolis, and Dallas districts.

The Jan Beige Book report found that consumer spending growth was “slight to moderate” in most Districts and that manufacturing sectors displayed weakness except in motor vehicles and aerospace. The report said that real estate activity generally improved. The report said that labor markets continued to improve and that wage increases were running from flat to moderate.

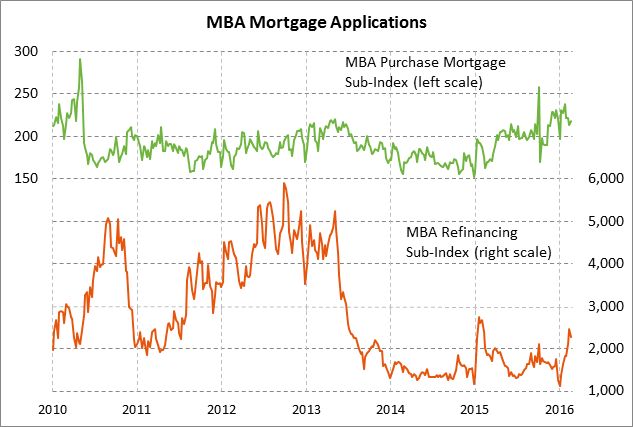

MBA mortgage apps remains generally strong due to low mortgage rates — U.S. mortgage activity remains generally strong thanks to the drop in mortgage rates seen so far this year. The 30-year mortgage rate dropped sharply by 39 bp to last week’s 1-year low of 3.62% from 4.01% at the end of 2015. The drop in mortgage rates has caused a surge in refinancing activity as seen by the fact that the MBA mortgage refinancing sub-index has doubled since the beginning of the year and is near a 1-year high. The drop in mortgage rates has also helped to boost home-buying activity as seen by the fact that the MBA mortgage purchase sub-index has risen by +11% since the beginning of the year. Existing home sales in January rose by +0.4% to post a 6-month high of 5.47 million units, which was just slightly below the 8-3/4 year high of 5.48 million units posted in July 2015.

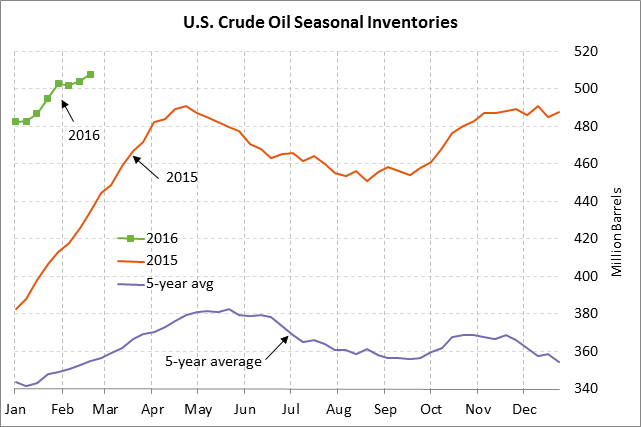

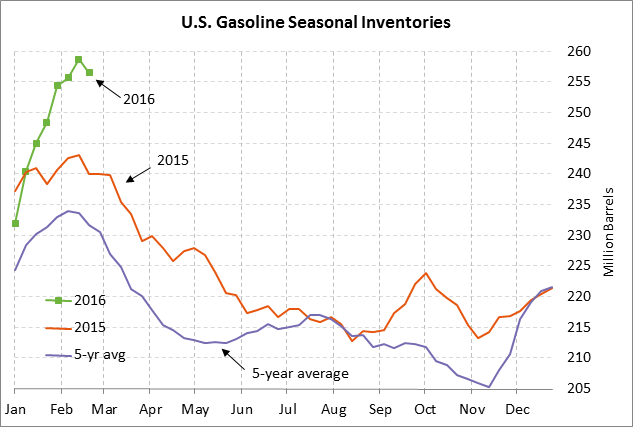

EIA report expected to show another increase in U.S. crude oil inventories — The market consensus for today’s weekly EIA report is for a +2.75 million bbl rise in U.S. crude oil inventories, a -1.5 million bbl decline in gasoline inventories, a -1.5 million decline in distillate inventories, and a -0.4 point drop in the refinery utilization rate to 86.9%.

U.S. crude oil inventories last week rose by +0.7% to post a new record high of 507.607 million bbls, illustrating that the glut of U.S. oil is getting even worse. U.S. crude oil inventories are now +36.1% above the 5-year seasonal average. Moreover, oil inventories as the Cushing hub, the pricing point for Nymex WTI crude oil futures, reached a record high of 65.1 million bbls last week. Oil continues to pour into U.S. oil storage facilities and is not being used fast enough by U.S. refiners, producing the record-high level of U.S. oil inventories. Moreover, product inventories are reaching glut levels as well, meaning that refiners are under pressure to cut back on production. Gasoline inventories are +9.7% above the 5-year seasonal average and distillate inventories are +20.8% above average.

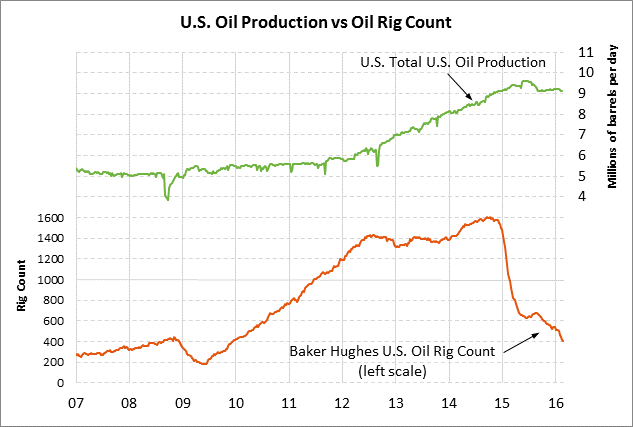

On the production front, U.S. oil production has finally started dropping again on a sustained basis with a 6-week decline of -1.4%. U.S. oil production in the latest reporting week was just +0.1% above the 1-1/4 year low of 9.096 million bpd posted in Oct 2015, meaning that U.S. oil production within in the next week or two is likely to drop to a new 1-1/4 year low. U.S. oil production has now fallen by -5.3% from the 43-year high posted in June 2015. The latest drop in production is being caused by the fact that another 138 oil rigs have closed just since the beginning of the year. The number of active U.S. oil rigs has now plunged by a total of 1,209 rigs (-75%) to a 6-1/4 year low of 410 rigs from the peak of 1,609 rigs seen in Oct 2014.