- Yellen is not likely to provide the markets with sufficiently soothing remarks

- MBA mortgage applications benefit from fall in mortgage rates

- 10-year T-note auction to yield near 1.74%

- EIA report expected to show another increase in U.S. crude oil inventories

- U.S. oil production has only fallen -4% despite the 69% plunge in active U.S. oil rigs

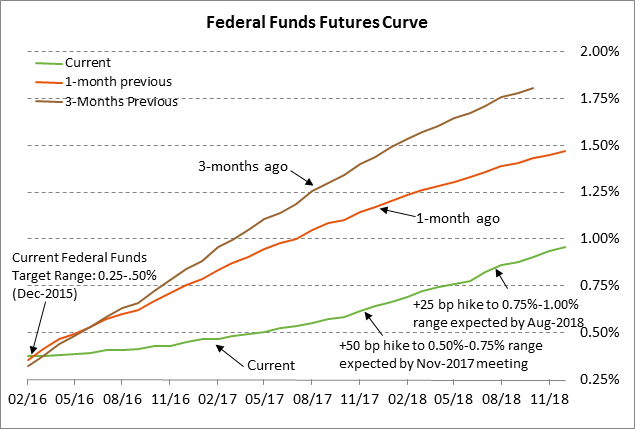

Yellen is not likely to provide the markets with sufficiently soothing remarks — In the current near-panic environment, the markets would love to hear Fed Chair Yellen say today, on the first day of her 2-day testimony to Congress, that the Fed has turned neutral and has officially halted its bias toward raising interest rates. However, that is very unlikely to happen and the markets may well be disappointed with Ms. Yellen’s remarks. Instead, Ms. Yellen is likely to acknowledge that while the U.S. economy is facing some headwinds, the Fed believes the U.S. economy is still in solid shape and that the Fed is still leaning toward gradual rate hikes.

Ms. Yellen’s language is likely to remain far more hawkish than the market’s view. Indeed, the “Fed dots” from the FOMC’s December meeting showed that FOMC members at that time expected four 25 bp rate hikes in 2016. By contrast, the federal funds futures market is not forecasting a 100% chance of even the first 25 bp rate hike for 1-3/4 years, i.e., until Nov 2017. The market is then expecting only one +25 bp rate hike in 2018. Even if Ms. Yellen today were to say that the Fed now expects a more gradual path for higher rates than it did at its recent FOMC meetings, Ms. Yellen’s outlook would still be more hawkish than the markets.

The markets today would like to hear an honest assessment by Ms. Yellen on various topics, including (1) whether U.S. consumers can continue to single-handedly keep the U.S. economy afloat amidst the weak world economy, (2) the odds of a U.S. recession, (3) whether U.S. wages are now on a sustainable upward track, (4) whether there is any real hope of U.S. inflation reaching the Fed’s 2% target over the medium-term as the Fed still says it expects, (5) the extent of the problems in China and the carry-over risks for the rest of the global economy, (6) the extent to which the petroleum sector recession is dragging down world markets and economies, and (7) whether there are new systemic risks for the financial sector that are behind the recent plunge in world bank stocks. Most of these questions are very difficult to answer at this point, which means Ms. Yellen will likely stick to a narrow script in order to avoid causing any fresh panic in the markets.

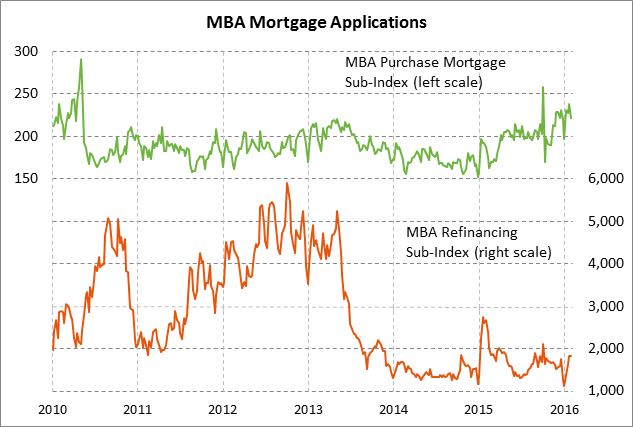

MBA mortgage applications benefit from fall in mortgage rates — The markets are waiting to gauge the sustainability of the surge in MBA mortgage applications since the beginning of the year. The MBA mortgage purchase sub-index last week fell by -7.0% but is still up by a net +13% in the past four weeks. Meanwhile, the MBA refinancing sub-index has surged by a net +64% over the past four weeks due to the sharp drop in mortgage rates. The 30-year mortgage rate in the past 6 weeks has dropped by -29 bp to a 10-month low of 3.72% from 4.01% on Jan 1.

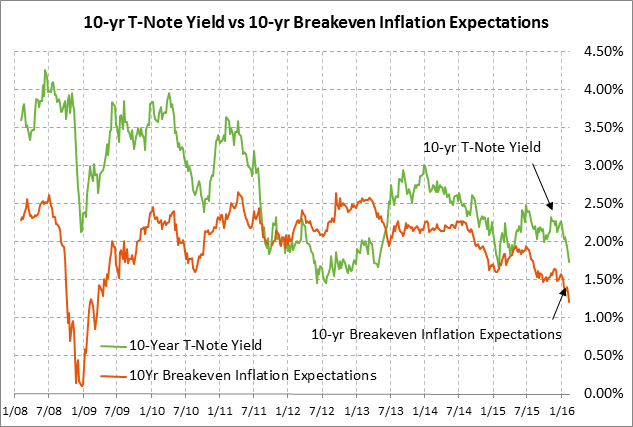

10-year T-note auction to yield near 1.74% — The Treasury today will sell $23 billion of 10-year T-notes. The Treasury will then conclude this week’s $52 billion quarterly refunding operation by selling $15 billion of 30-year T-bonds on Thursday. The Treasury is selling new 10-year and 30-year securities this week as opposed to reopening previous issues. The $23 billion size of today’s 10-year auction is $1 billion smaller than the $24 billion size seen since May 2010, reflecting the Treasury’s intent to reduce coupon sales and boost T-bill sales. The $15 billion size of Thursday’s 30-year bond auction is $1 billion smaller than the $16 billion size since seen since Nov 2009.

Today’s 10-year T-note was trading at 1.74% in when-issued trading late yesterday afternoon. That translates to an inflation-adjusted yield of 0.53% against the current 10-year breakeven inflation expectations rate of 1.21%. The 12-auction averages for the 10-year are as follows: 2.65 bid cover ratio, 3.8 bp tail to the median yield, 11.4 bp tail to the low yield, and 51% taken at the high yield. The 10-year T-note is the second most popular security behind the 10-year TIPS among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of 60.5% of the last twelve 10-year auctions, well above the average of 55.1% for all recent Treasury coupon auctions.

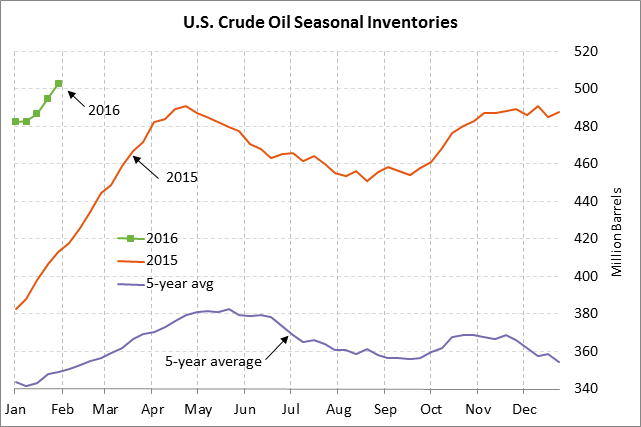

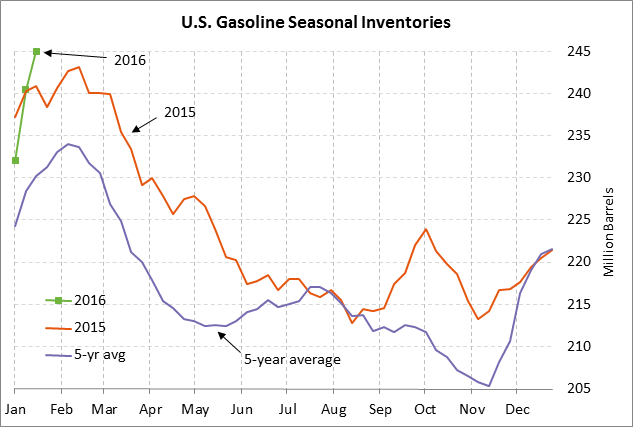

EIA report expected to show another increase in U.S. crude oil inventories — The market consensus for today’s weekly EIA report is for a +3.2 million bbl rise in U.S. crude oil inventories, a +1.0 million bbl rise in gasoline inventories, a -1.6 million bbl decline in distillate inventories, and a -0.5 point decline in the refinery utilization rate to 86.1%. U.S. crude oil inventories in the past three weeks have risen sharply by 20.1 million bbls (+4.2%) as oil producers rebuild inventories after the year-end draw-down tied to tax savings and as U.S. oil producers continue to produce more oil than refiners can use. U.S. crude oil inventories remain in a massive glut at +37.6% above the 5-year seasonal average. Meanwhile, product inventories are plentiful with gasoline inventories at +8.2% above average and distillate inventories at +16.2% above average.

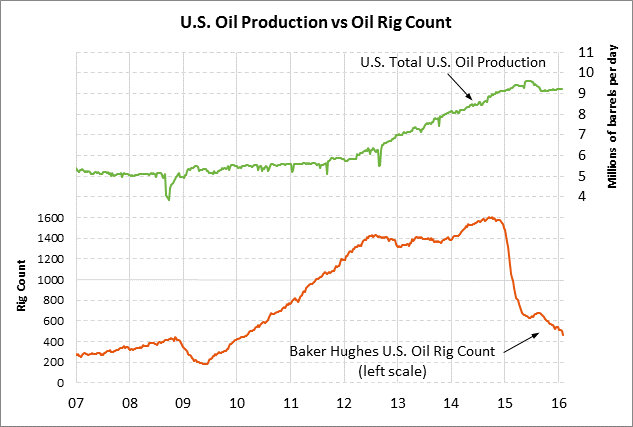

U.S. oil production has only fallen -4% despite the 69% plunge in active U.S. oil rigs — U.S. oil production fell by -0.3% over the past two reporting weeks but is still only -4.1% below the 43-year high of 9.610 million bpd posted in June 2015. U.S. oil production has so far shown only a mild decline despite the fact that the number of active U.S. oil wells has plunged by -1,142 rigs (-71%) to 467 rigs from the 27-year high of 1,609 posted in Oct 2014. Nevertheless, U.S. oil production cannot continue to levitate since the declining number of oil rigs and severe financial stress on U.S. oil producers will eventually push U.S. oil production lower. Until there is a sharp decline in U.S. oil production, however, the epic U.S. oil inventory glut will continue and will keep downward pressure on WTI crude oil prices.