- House and Senate set to vote on omnibus spending bill today in what could be a squeaker

- Markit U.S. services PMI expected to edge lower but remain in relatively strong shape

- Weekly market focus

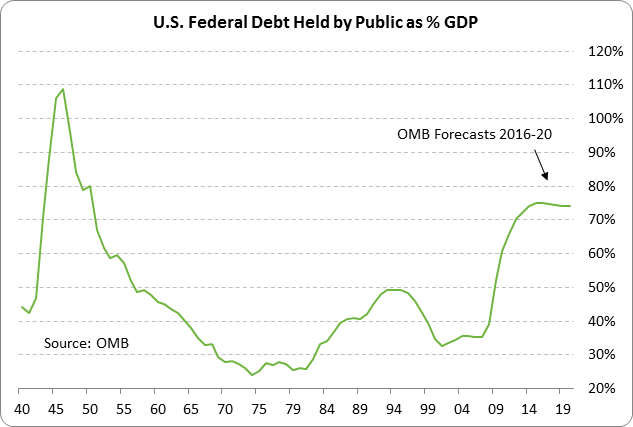

House and Senate set to vote on omnibus spending bill today in what could be a squeaker— The House today is expected to vote on the omnibus spending bill that would provide budget spending authority through the remainder of the fiscal year that ends in Sep 2016. If the bill passes Congress within the next few days, then the markets will not have to face the possibility of a U.S. government shutdown until Oct 1, 2016 when the new fiscal year begins. The markets are already protected against the threat of a Treasury default from debt ceiling constraints since the debt ceiling has been suspended until March 2017, i.e., until after the Nov 2016 presidential election. That means the markets will not see any new interference from Congress until Oct 1, 2016 at the earliest. The markets will, however, have to deal with a possible hit to consumer and business confidence that may be seen during the highly contentious presidential and congressional campaigns ahead of elections in Nov 2016.

Today’s vote in the House may be somewhat of a squeaker because many Democrats are planning to vote no and right-wing Republicans are expected to vote no. House Democratic leader Pelosi supports passage of the bill and is trying to get at least 100 of her members to vote in favor. Speaker Ryan is ok with his right-wing members voting against the spending bill as long as they don’t put up a big fuss about pushing the bill over the goal line with Democratic votes. The House approved the tax extenders bill yesterday by a comfortable margin of 318-109.

If and when the House approves the omnibus spending bill, it will then be forwarded to the Senate for its consideration. Presidential candidate and Senator Marco Rubio yesterday said he will try to delay the spending bill because it is too lax on foreign worker visas. However, Senate leaders have already agreed to hold a vote on the spending bill on Friday and said that Mr. Rubio will not be able to stop or slow down the vote.

The odds currently appear to be good that the omnibus spending bill and the tax extenders bill will both receive final Congressional approval by Friday night, thus easily meeting the budget deadline of this coming Tuesday and eliminating the possibility of a U.S. government shutdown.

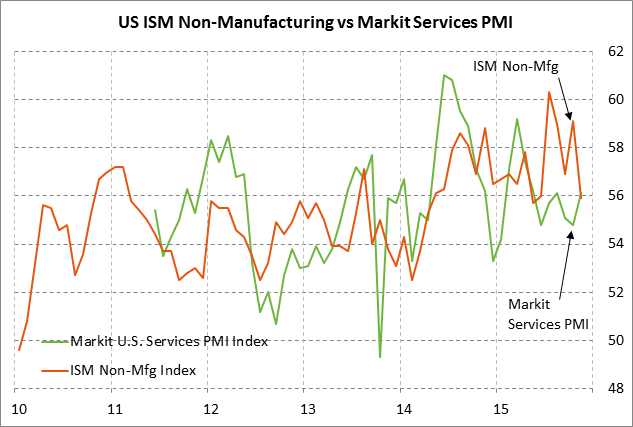

Markit U.S. services PMI expected to edge lower but remain in relatively strong shape — The market is expecting today’s preliminary Markit U.S. services PMI to show a small -0.2 point decline to 55.9, giving back a small part of November’s solid +1.3 point advance to 56.1. The services PMI in Nov matched the 6-month high of 56.1 posted in August, but remained well below the peak of 61.0 posted in June 2014. The current 56.1 level of the services PMI is much better than the Markit U.S. manufacturing PMI of 52.8, indicating how U.S. service sectors are doing relatively well compared to the recessionary U.S. manufacturing sector. The market consensus is for relatively steady U.S. GDP near +2.4% over at least the next few quarters.

Weekly market focus — The markets next week in theory should settle down as the end-year holiday season begins and as investors close their books for the year. The excitement over this week’s Fed rate hike is over and there is virtually no chance of another Fed rate hike now until mid-2016. In addition, Congress by late today should have approved the omnibus spending bill and tax extender bill and left Washington for the holiday break.

However, the markets next week will still be heavily focused on crude oil prices, which have been a prime driver of the markets lately, dragging down both stocks and the junk bond market. Jan WTI crude oil on Thursday fell by another -1.60%, adding to Wednesday’s plunge of -4.90% that was due mainly to a bearish weekly EIA report. Jan crude oil on Thursday remained just slightly above Monday’s contract low of $34.53, which was a 7-year low on the nearest-futures chart. Natural gas prices also plunged and fell to a new 16-3/4 year low on Thursday. If oil and natural gas prices continue to fall next week, that would cause credit quality to deteriorate further for oil and gas companies and put new downward pressure on the junk bond market.

The iBoxx High Yield Corporate Bond ETF (HYG) on Thursday fell by -1.11%, reversing part of the +2.40% recovery seen on Tue/Wed. The junk bond market this week has stabilized somewhat after plunging last week on the news that the Third Avenue junk bond mutual fund halted redemptions. However, the junk bond market is likely to see renewed downward pressure if oil and gas prices continue lower this week, particularly given reduced liquidity at year-end.

Next week’s U.S. economic calendar is busy. Tuesday brings revised Q3 GDP (expected +1.9% vs last +2.1%), Oct FHFA house price index (expected +0.4%), and Nov existing home sales (expected -0.1% after Oct’s -3.4%). Wednesday brings Nov personal income and spending (expected +0.2% and +0.3%, respectively), Nov PCE deflator (expected +0.4% y/y vs Oct’s +0.2%) and core PCE deflator (expected unch at +1.3% y/y from Oct), Nov durable goods orders (expected -0.7% and unch ex-transportation), Nov new home sales (expected +1.0% after Oct’s +10.7%), final-Dec US consumer sentiment (expected +0.2), and the Treasury’s auction of 2-year floating rate notes. Thursday brings the unemployment claims report and early closes for the equity and futures markets.