- Fed’s first rate hike is easily digested by the markets on confidence that the rate-hike regime will be gradual

- Congress set to approve omnibus budget bill and tax extenders bill by Friday although not without grumbling

- Unemployment claims are mildly elevated

- U.S. current account deficit expected to widen

- Nov LEI expected to edge higher after Oct’s +0.6% surge

- 5-year TIPS auction to yield near 0.50%

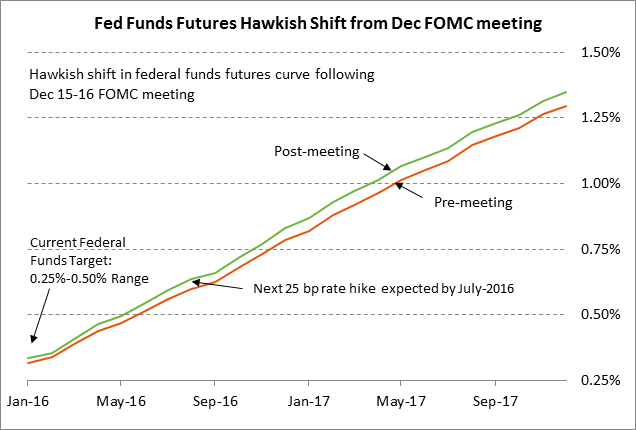

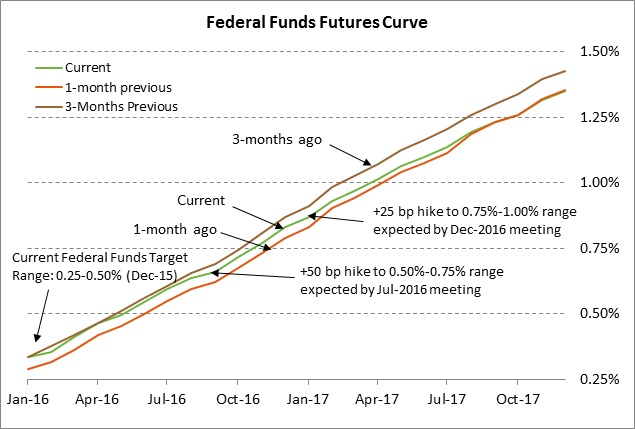

Fed’s first rate hike is easily digested by the markets on confidence that the rate-hike regime will be gradual — The FOMC yesterday mercifully implemented its long-awaited 25 bp rate hike to a new funds rate target of 0.25-0.50%. The outcome of the meeting was roughly in line with market expectations as the FOMC in its post-meeting statement promised a “gradual” rate hike dependent on data. However, the farther end of the federal funds curve on a yield basis moved higher by 5 bp, discounting a mildly higher chance for Fed rate hikes in 2016 and beyond.

The “Fed dots” were rather hawkish with the FOMC’s median prediction for an overall 100 bp rate hike in 2016, or a rate hike roughly every three months. However, the markets continued to pay little attention to the Fed dots, which consistently err in a hawkish direction. The federal funds futures market is not fully discounting the Fed’s 25 bp rate hike until July and the following 25 bp rate hike by December. The FOMC yesterday made clear that it is largely satisfied with the labor market but that inflation continues to be substantially below its target. The FOMC indicated that its next rate hike decision will depend heavily on the extent to which inflation will meet the Fed’s 2% inflation target over the medium term.

The S&P 500 index yesterday closed +1.1% as investors were glad to have the Fed’s rate hike out of the way and were reassured that the Fed’s rate hike regime will be gradual. March 10-year T-note prices closed down -13.5 ticks on the confirmation of higher short-term rates, although bond investors could at least be happy that the Fed had enough spine to start raising interest rates, perhaps heading off any future inflation surge.

The dollar index ended up only +0.2% higher as the market had already discounted the rate hike and the improved U.S. interest rate differentials. Feb gold closed up +1.0% as the FOMC’s promise for a gradual pace of rate hikes still leaves open the possibility of an inflation surge down the road. The $15 billion iBoxx High Yield Corporate Bond ETF (HYG) yesterday closed +0.8%, extending Tuesday’s +1.6% upside recovery as conditions continued to calm in the junk bond market. HYG was able to shake off yesterday’s -3.9% decline in Feb crude oil prices, which was negative for energy company credit quality.

Congress set to approve omnibus budget bill and tax extenders bill by Friday although not without grumbling — The House is expected to vote today on the tax extenders bill and on Friday for the omnibus spending bill, then forwarding those measures to the Senate for its consideration. House Speaker Ryan yesterday said he is not open to renegotiating either bill and there appears to be enough votes in Congress to get both bills approved. Bipartisan deals on those two bills were announced late Tuesday evening. The Senate hopes to finish its votes on Friday, thus allowing Senators to leave for the holiday break. The House yesterday approved a 6-day CR to extend the budget deadline until this coming Tuesday and the Senate was expected to approve that short-term CR by late last night.

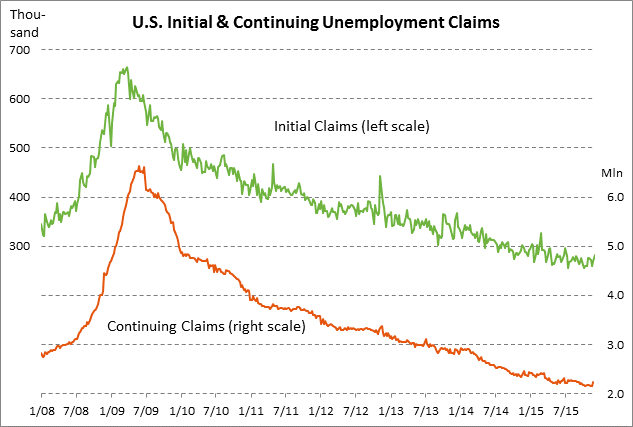

Unemployment claims are mildly elevated — The market is expecting today’s weekly initial unemployment claims report to show a decline of -7,000 to 275,000, reversing about half of last week’s +13,000 increase to 282,000. Meanwhile, the market is expecting today’s continuing claims report to show a decline of -43,000 to 2.200 million, reversing about half of last week’s +82,000 surge to 2.243 million. Both of the claims series are mildly elevated but not to the extent that there is any real concern about higher layoffs. The initial claims series is +27,000 above the 42-year low of 255,000 posted in July and the continuing claims series is +97,000 above the 15-year low of 2.146 million posted in October.

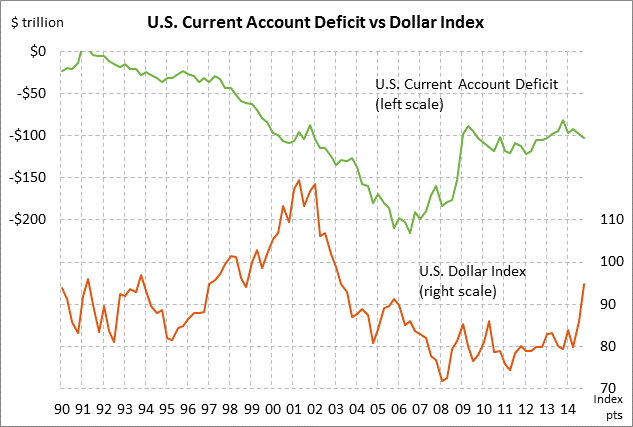

U.S. current account deficit expected to widen — The market is expecting today’s Q3 current account deficit to widen to -$118.5 billion from -$109.7 billion in Q2. The U.S current account deficit is seeing upward pressure from weak overseas demand for U.S. exports caused by the strong dollar and weak overseas economic growth. However, U.S. imports are seeing comparable-sized weakness that is keeping a cap on the deficit. Imports are being held down by the sharp drop in oil prices and the value of U.S. oil imports. The persistent U.S. current account deficit continues to be an underlying bearish factor for the dollar since $1.2 billion worth of dollars are flowing out of the U.S. each calendar day and are mostly being sold back into the forex market.

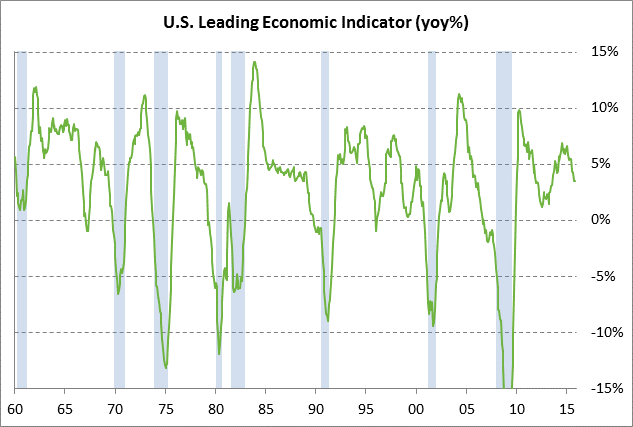

Nov LEI expected to edge higher after Oct’s +0.6% surge — The market is expecting today’s Nov leading indicators index to show a small increase of +0.1%, indicating at least some small upside momentum for the U.S. economy. The LEI was weak with an overall -0.2% drop over the 3-month period of July-Sep but then showed a nice +0.6% increase in October. The market consensus is for steady GDP growth near +2.4% over at least the next few quarters.

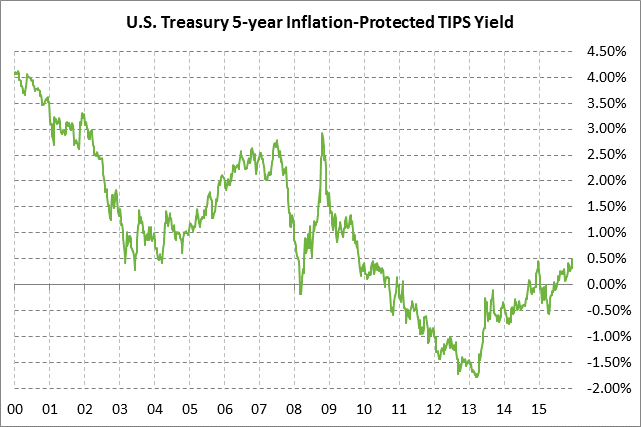

5-year TIPS auction — The Treasury today will auction $16 billion of 5-year TIPS in the second reopening of April’s 1/8% 5-year TIPS of April 2020. Today’s 5-year TIPS issue was trading at 0.50% in when-issued trading late yesterday afternoon. The 12-auction averages for the 5-year TIPS are as follows: 2.56 bid cover ratio, $45 million in non-competitive bids to mostly retail investors, a 5.9 bp tail to the median yield, a 13.5 bp tail to the low yield, and 52% taken at the high yield. The 5-year TIPS is below average in popularity among foreign investors and central banks with an average of 51.2% taken in the last twelve auctions, below the average of 53.8% for all recent Treasury coupon auctions.