- Weekly global market focus

- U.S./Chinese trade tensions remain high after weekend meeting produced little progress

- Europe begins the week with new governments in Italy and Spain

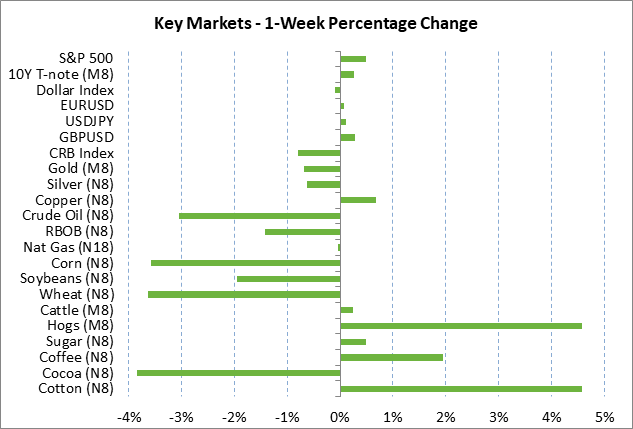

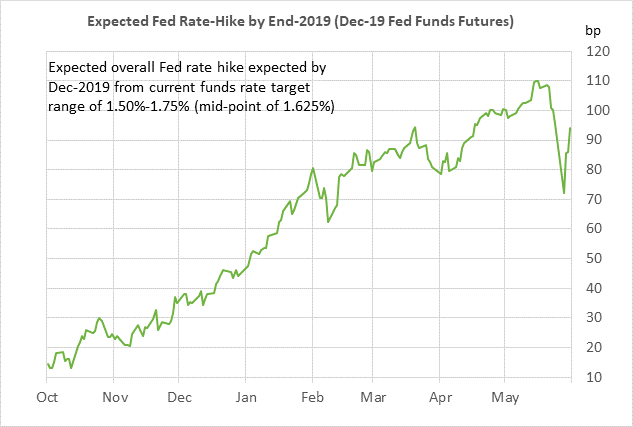

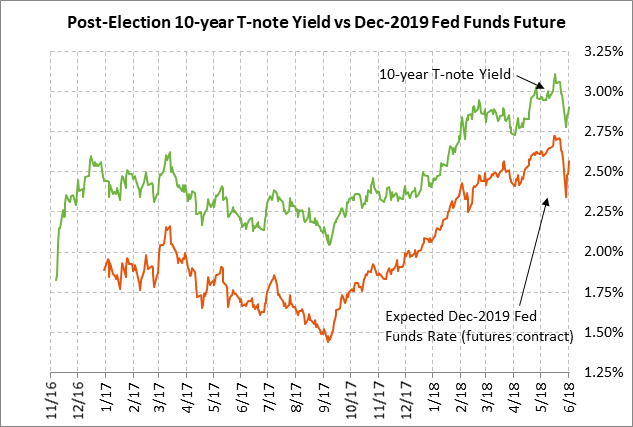

Weekly global market focus — The U.S. markets this week will focus on (1) trade tensions as details emerge about whether there was any progress at the U.S./Chinese trade talks this past weekend in China, (2) Fed policy ahead of next week’s FOMC meeting where there are unanimous market expectations for a +25 bp rate hike, (3) July WTI oil prices, which fell to a 1-1/2 month low last Friday as the market looks ahead to higher OPEC+ production after the June 22 meeting, (4) a very light earnings week with only 4 of the S&P 500 companies scheduled to report, and (5) T-note prices, which temporarily spiked higher last week on Italian political threats to the Eurozone.

In Europe, the focus will be on U.S./EU trade tensions and politics in Italy and Spain, where new governments have now taken control. The markets will be watching for any fresh euro-skepticism emerging from the new Italian government coalition between the populist Five Star and League parties. The markets this week will speculate about whether the ECB at its meeting next Thursday (June 14) will adjust its guidance to lay the groundwork for a wind-down of its QE program in Q4.

In Asia, the focus will be on trade tensions and whether the U.S. and China are headed towards reciprocal tariff blows after June 15. The markets are also watching the possibility of a U.S./North Korea summit next Tuesday in Singapore. Tonight’s China May Caixin PMI services index is expected to be unchanged at 52.9, holding April’s +0.6 point increase. Thursday night’s China May trade report is expected to show a strong +11.1% y/y increase in exports, near April’s +12.7%. China’s May CPI report on Friday night is expected to edge higher to +1.9% y/y from April’s +1.8%.

U.S./Chinese trade tensions remain high after weekend meeting produced little progress — The negotiations in China this past weekend between U.S. Commerce Secretary Wilbur Ross and Chinese officials appear to have produced little progress. Mr. Ross said that the meetings were “friendly and frank, and covered some useful topics about specific export items.”

However, there was a more ominous tone from China officials in a statement saying, “If the United States introduces trade sanctions including raising tariffs, all the economic and trade achievements negotiated by the two parties will be void.†The Chinese government’s stance on cancelling agreements reached thus far are a “red line,” according to commentary on state-run China Radio International.

President Trump last week surprised China and the markets by announcing that the U.S. will proceed with the 25% tariff on $50 billion of Chinese products with an announcement of the final product list next Friday (June 15) and implementation “shortly thereafter.” If the U.S. goes ahead with that tariff, China has already released the list of $50 billion of U.S. products that will be tagged with a reciprocal 25% tariff. The U.S. by June 30 is expected to release details of its restrictions on Chinese investment in the U.S.

Meanwhile, the fall-out continues from the Trump administration’s announcement last Thursday of the implementation of tariffs on steel and aluminum imports from Europe, Canada, and Mexico. Europe, Canada and Mexico all immediately announced retaliatory tariffs, expanding the size of the U.S. trade war against its trade partners.

Treasury Secretary Mnuchin received vociferous criticism at last week’s G7 meeting in Whistler among finance ministers and central bankers. The French finance minister said the meeting was actually more of a G6-plus-one meeting than a G7 meeting. The criticism against the U.S. will continue into the G7 summit to be held in Quebec this coming Friday and Saturday, which is likely to be a contentious affair.

Europe begins the week with new governments in Italy and Spain — Italy’s new government was sworn into office last Friday with Giuseppe Conte as the new prime minister. The markets will be watching carefully to see how far the new Five Star/League populist coalition goes in boosting the government’s budget deficit and national debt in order to meet their aggressive goals of tax cuts and a minimum income for the poor.

The markets will also be watching to see if Italian government officials continue to aggressively criticize the Eurozone and its fiscal rules, or whether they tone down their comments now that they are solely responsible for any fresh plunge in Italian stocks or rise in Italian bond yields.

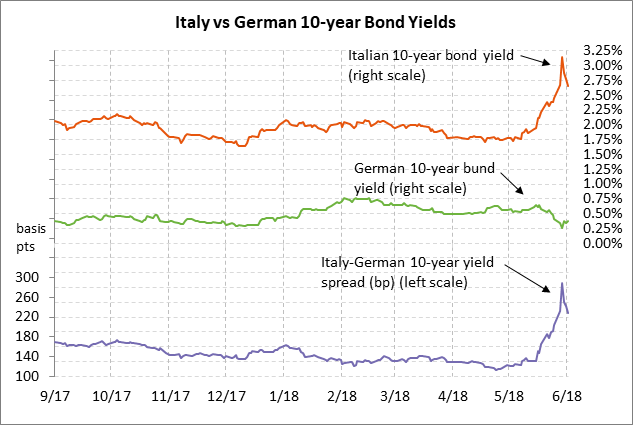

Italian risk measures eased late last week after the agreement for a new government averted new elections that would have given the populists even more seats in parliament. The 10-year bond yield late last week fell by a total of -49 bp to 2.66% from last Tuesday’s 4-year high of 3.15% bur remained far above the 1.80% level seen just three weeks ago. The 10-year Italy-German bond yield spread last Friday fell to 230 bp, which was down by 60 bp from last Tuesday’s 3-3/4 year high of 290 bp.

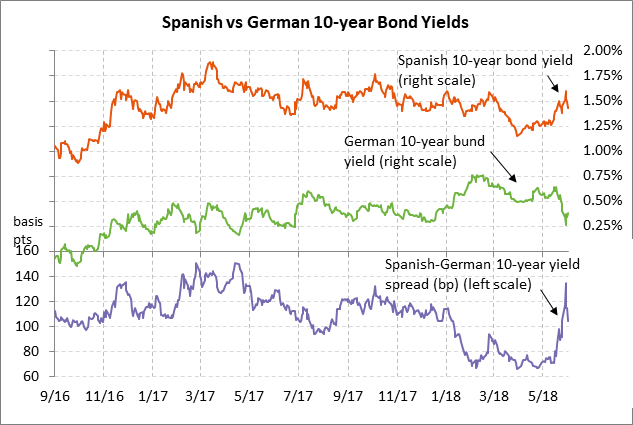

Meanwhile, Socialist leader Pedro Sanchez was sworn in as Spain’s new prime minister on Saturday. The Socialist government will be more of a challenge for the markets than the former Rajoy government since the Socialists are supported by smaller populist and regional parties. The Spanish-German 10-year yield spread last Friday fell to 105 bp, which was down by 31 bp from last Tuesday’s 1-year high of 136 bp.