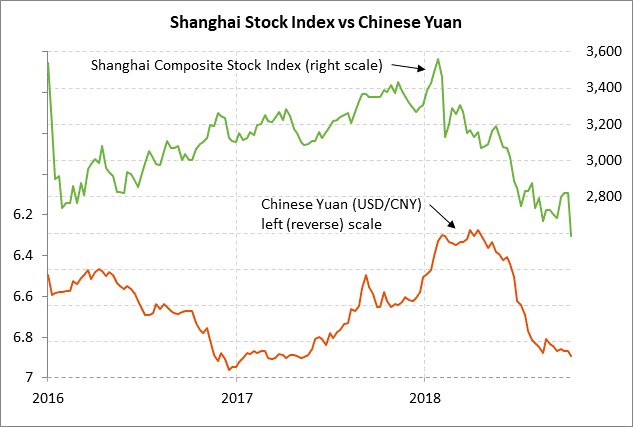

- Chinese stocks plunge to 3-3/4 year low on worries about deeper US/Chinese tensions

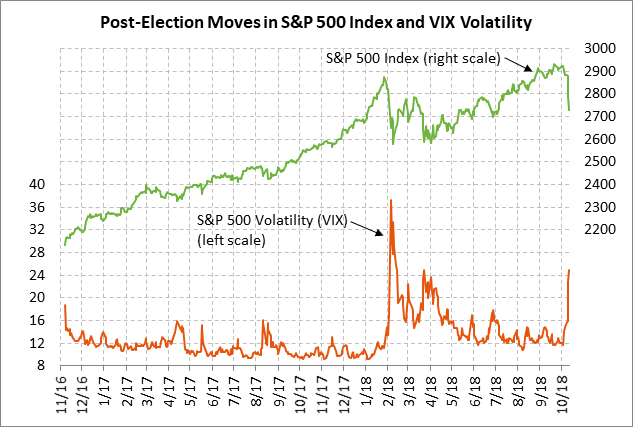

- VIX rises to 25% as stock market plunge continues

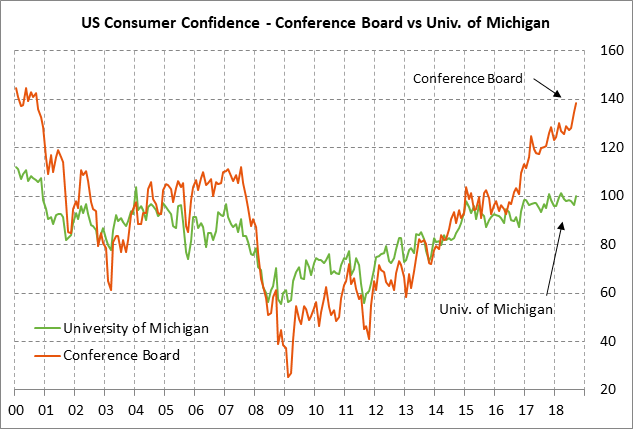

- U.S. consumer sentiment expected to remain strong

- U.S. import prices expected to ease in some good news for the inflation picture

Chinese stocks plunge to 3-3/4 year low on worries about deeper US/Chinese tensions — Turns out that the 2015 plunge in Chinese stocks isn’t over since the Shanghai Composite index on Thursday plunged by -5.2% to a new 3-3/4 year low. The Shanghai Composite never saw much of a recovery rally during 2016/17 in the first place and has now fallen to levels not seen since 2014.

Many investors have had a nagging feeling that the Chinese economy and markets have been a house of cards just waiting for an ill wind to send them into a collapse. The Chinese government was already battling an enormous debt problem with its deleveraging program when the Trump administration back in February began its assault on Chinese trade practices. The Chinese economy and markets are now getting a full-blown stress test. China may be able to muddle through but the situation could also quickly become much worse.

The markets in the past few weeks have grown much more worried about China since it has become increasingly clear that the Trump administration intends to force major changes in China beyond simply reducing the US/Chinese trade deficit. The Trump administration wants to force wholesale changes on China including a halt to currency management, a new respect for technology IP, and a phase-out of industrial subsidies and even state-owned enterprises. China believes, with good reason, that the Trump administration’s overarching goal is actually to contain China and its economy so that China cannot easily challenge the U.S. as a superpower in coming decades.

China views the Trump administration’s pressure as meddling with its fundamental economic development model and its freedom to grow its economy. For China, the Trump administration has grown from an initial nuisance into a major problem. The markets now believe that the US/Chinese tensions go deeper than trade and are not likely to be resolved soon.

Moreover, the Chinese government is on much thinner ice than it might appear because the unelected government could see mass protests if it does not deliver on its promised economic miracle. The Chinese government will go to nearly any lengths to ensure that there is sufficient economic growth and jobs to placate its massive population. On that basis, the Chinese government might simply dig in on its current economic development model and accept some short and medium-term pain with the idea of waiting out the end of the Trump administration, however long that may be.

At worst, the U.S. and Chinese economies could be headed towards disengagement if President Trump proceeds with his threat to slap tariffs on the remaining $267 billion worth of Chinese goods, which would mean that the U.S. would have a penalty tariff on virtually all U.S. imports from China. At best, this week’s sharp sell-off in both the U.S. and Chinese stock markets may encourage the two sides to at least start some serious talks.

VIX rises to 25% as stock market plunge continues — The VIX index on Thursday surged to an 8-1/4 month high of 28.84% as the stock market extended its drop, although the VIX then fell back to close +2.02 at 24.98% near the middle of the wide daily range. Even after Thursday’ continued rise, the VIX remains well below the 50% peak seen last February when the stock market plunged on trade tariffs and when the upward spike in the VIX raised questions about the viability of VIX ETFs.

In some good news for the market, the Nymex FANG+ index on Thursday was able to rebound upward from its 5-1/2 month low and close the day with a loss of only -0.44%, less than the -1.14% loss in the Nasdaq 100 and the larger -2.06% loss in the S&P 500 index.

U.S. consumer sentiment expected to remain strong — The market consensus is for today’s preliminary-Oct University of Michigan U.S. consumer sentiment index to show a +0.4 point increase to 100.5, adding to Sep’s +3.9 point increase to 100.1. The expected increase to 100.5 would be just 0.9 points below March’s 14-1/2 year high of 101.4.

U.S. consumer confidence through early October saw support from the strong economy, strong household balance sheets from strength in home prices and the stock market, and flush cash flow from the Jan 1 tax cuts. However, this week’s sharp stock market sell-off is likely to put a damper on consumer sentiment in the second half of October.

U.S. import prices expected to ease in some good news for the inflation picture — In some good news for the inflation picture, today’s Sep import price index is expected to ease to +3.1% y/y from Aug’s +3.7% and Sep import prices ex-petroleum are expected to ease to +0.5% y/y from Aug’s +1.0%. Strong petroleum prices continue to put upward on the headline import price index. However, import prices ex-petroleum are falling mainly due to strength in the dollar, and are declining even in the face of tariffs. Lower import prices are positive since they are taking some of the upward pressure off the overall U.S. inflation statistics.

There was some good news on the U.S. inflation front yesterday when the Sep CPI eased to +2.3% y/y from Aug’s +2.7% and from the June/July 6-3/4 year high of +2.9%. In addition, the Sep core CPI of +2.2% y/y was unchanged from Aug and was slightly weaker than market expectations for a small increase to +2.3%. On a 3-month annualized basis, both the Sep headline and core CPIs fell to +1.8%, below the Fed’s 2.0% inflation target.