- 10-year T-note yield spikes to 7-1/4 year high on increased inflation and rate-hike expectations

- U.S. unemployment claims expected to remain favorable ahead of Friday’s unemployment report

- U.S. factory orders expected to remain strong

- Italian stock and bond markets stabilize after government trims 2020-21 deficits

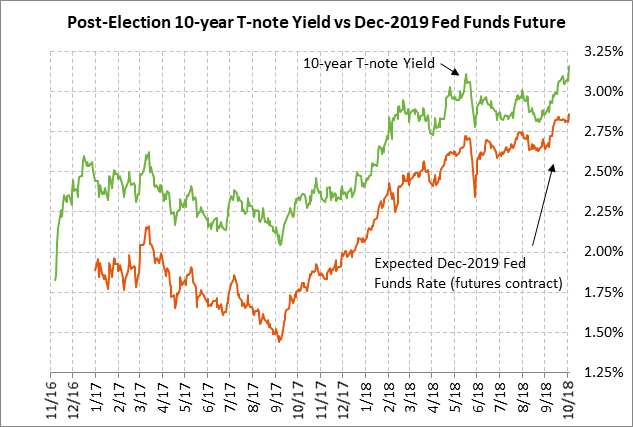

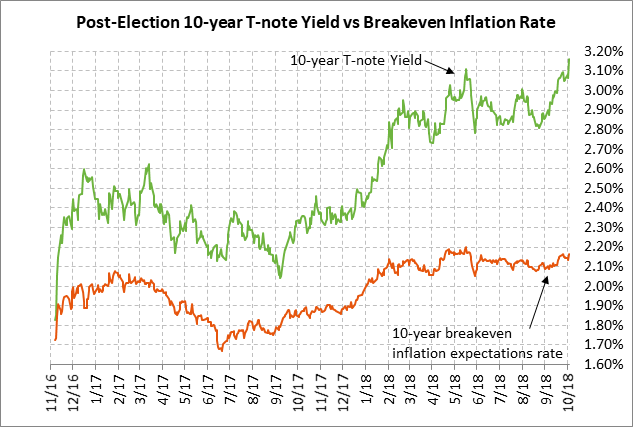

10-year T-note yield spikes to 7-1/4 year high on increased inflation and rate-hike expectations — The 10-year T-note yield on Wednesday moved sharply higher by +12 bp to a new 7-1/4 year high of 3.18%, easily taking out May’s previous high of 3.13%.

Factors behind the sharp rise in the 10-year yield included (1) Wednesday’s strong ADP report of +230,000 versus expectations of +184,000, (2) Wednesday’s +3.1 point rise in the ISM non-manufacturing index to a new 21-year high of 61.6, (3) stronger expectations for Fed rate hikes after Fed Chair Powell again expressed optimism about the economy, (4) the new 4-1/2 month high in inflation expectations, and (5) reduced safe-haven demand for T-notes after Italy agreed to slightly reduce its 2020/21 budget deficits and after this past weekend’s NAFTA 2.0 agreement.

The market’s expectation for further rate hikes through the end of 2019 rose to a new peak of 73.5 bp on Wednesday, which indicates that the market is expecting another 2.9 rate hikes through Dec 2019, according to the federal funds futures market. Expectations for a tighter Fed policy were driven by (1) Wednesday’s strong U.S. economic data, (2) increased inflation expectations, and (3) mildly hawkish comments by Fed Chair Powell.

Fed Chair. Powell on Wednesday again referred to the U.S. economy as “extraordinary” and said that the Fed may need to lift rates to levels that restrain growth. That would be a higher funds rate than market expectations since the market at present is expecting the Fed to stop tightening before the funds rate reaches the neutral rate of 3.0%.

Meanwhile, the 10-year breakeven inflation expectations rate on Wednesday posted a new 4-1/2 month high and closed the day up 3 bp at 2.17%. That was just 4 bp below May’s 4-year high of 2.21%. Factors behind the rise in inflation expectations include (1) Wednesday’s rally in crude oil prices to a new 4-year high, (2) wage-push inflation concerns after Amazon agreed to give its workers a $15/hr minimum wage, which will put pressure on other retailers and possibly fast-food outlets to boost wages, and (3) Wednesday’s strong economic data.

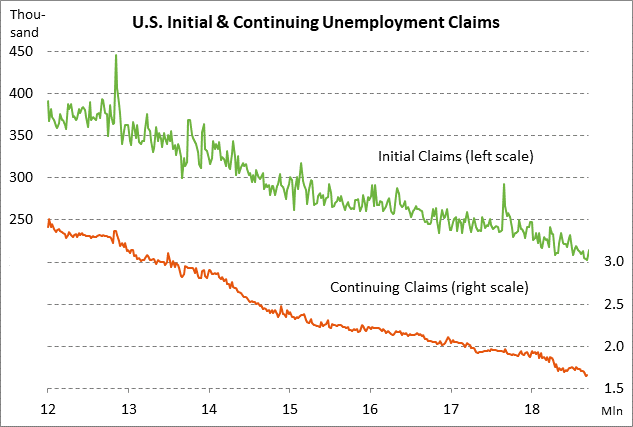

U.S. unemployment claims expected to remain favorable ahead of Friday’s unemployment report — The unemployment claims data remains in very favorable shape with layoffs near the lowest levels in nearly five decades. Initial unemployment claims are only +12,000 above the mid-Sep 49-year low of 202,000 and continuing claims are only +16,000 above the early-Sep 45-year low of 1.645 million.

The consensus is for today’s initial claims report to show a +1,000 increase to 215,000 (following last week’s +12,000 to 214,000). Continuing claims are expected to show an increase of +4,000 (following last week’s +16,000 to 1.661 million). Today’s report will show some continued distortions from Hurricane Florence, which hit North Carolina starting Sep 14.

On the labor front, the market is mainly looking ahead to Friday’s Sep unemployment report. Sep payrolls are expected to show a solid increase of +184,000, which would be just mildly below the 12-month trend average of +194,000. Expectations for Friday’s payroll report were bolstered by Wednesday’s news that Sep ADP jobs rose by +230,000, significantly stronger than expectations of +184,000. Job growth continues to hold up very well despite the difficulty that some businesses are having in finding qualified workers in the tight job market. Job growth also remains strong even though U.S. businesses have already hired a net 19.5 million new employees since the Great Recession ended.

The Sep unemployment rate on Friday is expected to fall by -0.1 point to 3.8%, thus matching May’s 48-year low. The consensus is for Sep average hourly earnings to ease slightly to +2.8% y/y from August’s 9-year high of +2.9%. If the earnings report does not ease a bit as expected, then the markets will become more concerned about wage-push inflation.

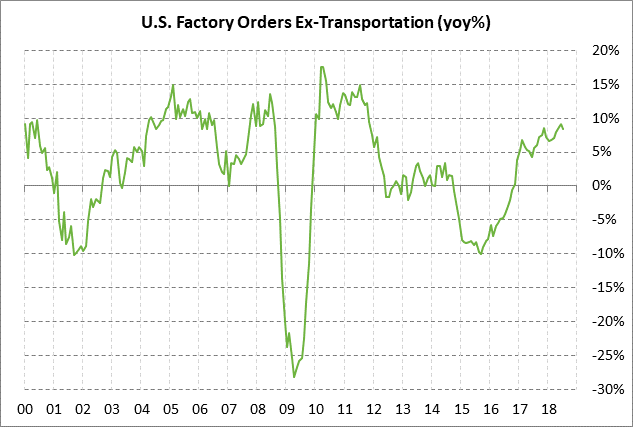

U.S. factory orders expected to remain strong — The market consensus is for today’s Aug factory orders report to show an increase of +2.1% following July’s report of -0.8% and +0.2% ex-transportation. On a year-on-year basis, factory orders remain very strong at +9.0% y/y and +8.4% y/y ex-transportation. Factory orders are seeing support from the generally strong global economy and from strong investment by U.S. businesses that are flush with tax-cut cash.

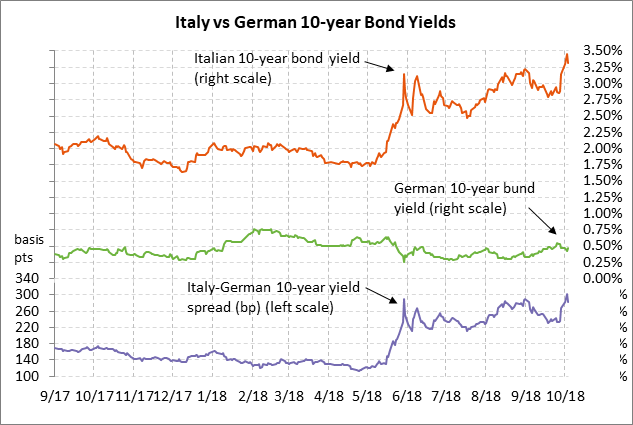

Italian stock and bond markets stabilize after government trims 2020-21 deficits — The Italian stock and bond markets on Wednesday recovered a bit after the Italian government threw the Eurozone and the markets a bone by cutting its deficit targets to 2.1% of GDP for 2020 and 1.8% in 2021, although it left the 2019 target unchanged at 2.4%. The 2019 deficit is three times larger than the previous government’s target of 0.8% of GDP. The new populist government also committed to reducing the national debt to 126.5% of GDP in 2021 from the current level near 132%. Italy’s budget must be forwarded to the European Commission by October 15 for its review. The European Commission can then demand changes in the budget to meet Eurozone fiscal commitments.

The iShares Italy ETF (EWI) on Wednesday recovered modestly by +0.7% after the 4-session plunge of -6.5%. Italy’s 10-year bond yield on Wednesday fell by -14 bp to 3.31% from Tuesday’s 4-1/2 year high of 3.45%, but remained up by a net +42 bp from last Thursday. The spread of the Italian 10-year bond yield over Germany fell by -19 bp on Wednesday to 284 bp from Tuesday’s 5-1/4 year high of 303 bp, but was still up by +48 bp from last Thursday’s level of 236 bp.