- Markets are waiting to see if the Fed’s preferred inflation measure will keep rising

- U.S. personal income and consumption expected to remain strong

- U.S. consumer sentiment expected to remain stellar

- U.S. federal government expected to be open for business on Monday

- Italy budget deficit of 2.4% is higher than the markets hoped but is at least under the 3% Eurozone limit

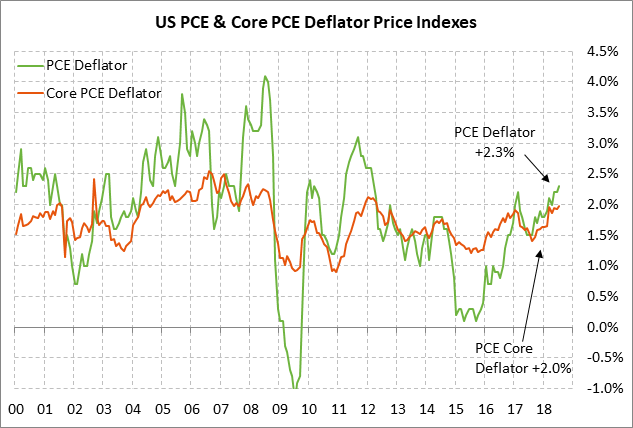

Markets are waiting to see if the Fed’s preferred inflation measure will keep rising — The markets will be carefully watching today’s PCE deflator, the Fed’s preferred inflation measure, for any indications about whether inflation is trending higher. The PCE deflator has risen from only +1.5% a year ago to a 6-year high of +2.3% y/y in the latest report for July. The core PCE deflator has also been on the rise and reached a 6-year high of +2.0% in May and July, thus matching the Fed’s 2.0% inflation target.

Indeed, the PCE deflator may show some upward pressure in coming months from the rally in oil prices to new highs and from higher prices caused by tariffs. However, the Fed can look through both those factors because they are not monetary-policy driven inflation events but are instead special one-time factors. Both can actually be considered anti-inflationary over the longer-term since higher prices from tariffs suggest reduced demand (i.e., reduced economic growth) and since the more money that consumers spend on gasoline, the less money they spend on other goods.

In any case, the Fed has explicitly said that it is willing to allow the PCE deflator to move somewhat above its 2.0% target since the inflation target is symmetrical. Indeed, the FOMC itself is forecasting that the headline and core PCE deflators will both move sideways at +2.1% during 2019 and 2020. The markets therefore will not panic if today’s PCE deflator report is a bit stronger than expected.

If the PCE deflator in coming months should begin to march higher to +2.5% or above, then the markets will begin to factor in a Fed response with accelerated rate hikes. However, there were actually hints of reduced inflation pressures in the recent Aug CPI report, which was weaker than expected. The Aug headline CPI eased to +2.7% from July’s 6-1/2 year high of +2.9% y/y and the core CPI eased to +2.2% from July’s 10-year high of +2.4%. On a 3-month annualized basis, the CPI looks weaker as the Aug headline CPI eased to +2.0% from July’s +2.3% and the core CPI was unchanged at +2.1%.

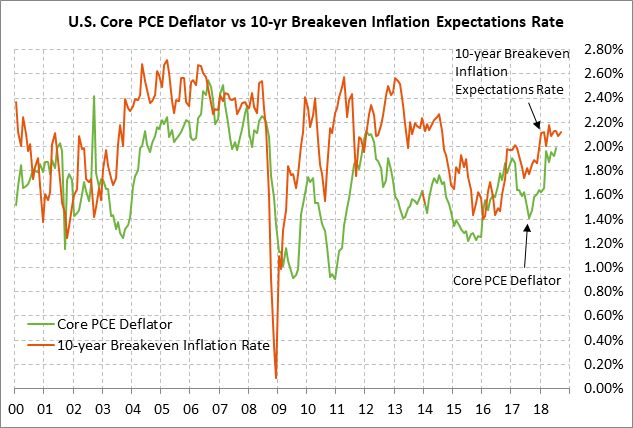

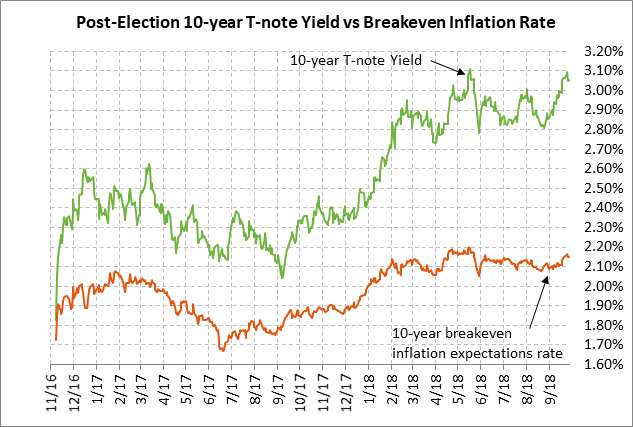

Regarding inflation expectations, the market currently believes that inflation will be mildly above the Fed’s +2.0% inflation target over the next ten years, but that inflation is not about to get out of hand. The 10-year breakeven rate is currently at 2.15%, which is at the upper end of the June-Sep range but is below May’s 4-year high of 2.21%.

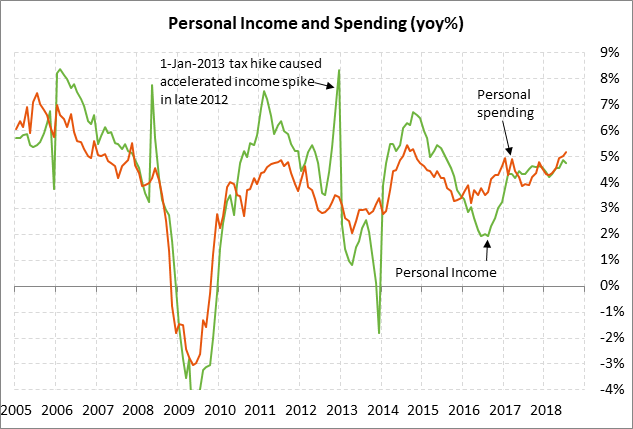

U.S. personal income and consumption expected to remain strong — The market consensus is for today’s Aug personal income and spending report to show respectable increases of +0.4% and +0.3%, respectively, following July’s report of +0.3% and +0.4%. Both personal income and consumption have been very strong on a year-on-year basis. July personal income was up by +4.7% y/y and personal spending was even stronger at +5.2% y/y.

U.S. consumers are in strong shape from an income and tax-cut stance and are spending their money freely, thus giving the economy a boost. Personal spending contributed a hefty 2.55 percentage points to the very strong Q2 GDP report of +4.2%. Consumer spending remained strong in Q3 with GDPNow expecting spending to contribute 2.54 points to their strong Q3 GDP forecast of +3.8%. The market consensus is for Q3 GDP growth of +3.0%.

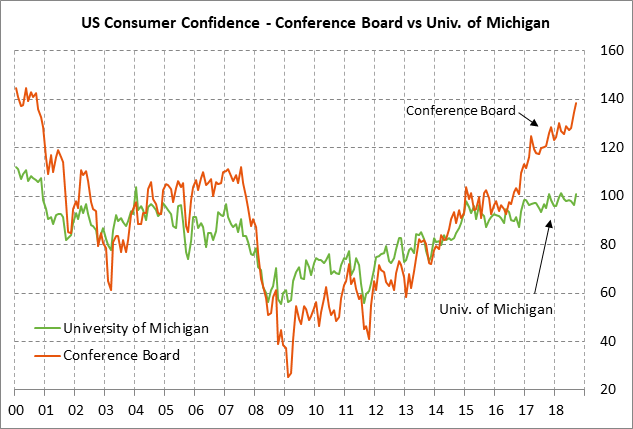

U.S. consumer sentiment expected to remain stellar — The market is expecting today’s U.S. consumer sentiment index from the University of Michigan to remain very strong with only a small -0.3 point downward revision from early-Sep’s 6-month high of 100.5. The index in early-Sep was only -0.9 points below March’s 14-1/2 year high of 101.4. The index in the prelim-Sep report rose sharply by +4.6 points to 100.8.

U.S. consumer confidence is being supported by (1) the very strong U.S. economy with Q2 GDP growth of +4.2%, (2) the strong labor market with the unemployment rate near a 5-decade low, (3) strong personal income with growth of +4.7% y/y in July, and (4) rising household wealth with the record highs in the stock market and the sharp post-recession rise in home prices. Negative factors for consumer confidence include (1) the Fed’s rate-hike regime and rising mortgage rates, (2) political uncertainty in Washington, and (3) high gasoline prices.

U.S. federal government expected to be open for business on Monday — Even though it is coming down to the wire as usual, a U.S. government shutdown on Sunday night when the new fiscal year begins appears to be unlikely. Congress is doing its job on the spending bills and President Trump on Wednesday said that he will sign the necessary spending bills to avert a government shutdown. President Trump will have his chance for a “good government shutdown” on Dec 7 to try to force his border-wall funding when the continuing resolution expires for part of U.S. government operations.

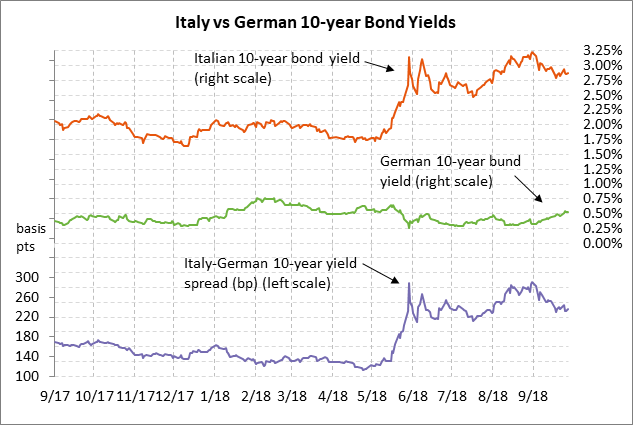

Italy budget deficit of 2.4% is higher than the markets hoped but is at least under the 3% Eurozone limit — Italy’s government earlier this week appeared to be moving towards a 2019 budget deficit of 1.9%-2.0% of GDP, which the markets would have considered as favorable under the circumstances. However, Five Star was able to prevail at the end in getting 10 billion euros for their promise for a minimum citizen’s income, which pushed the deficit up to 2.4% of GDP. The deficit of 2.4% is at least well below Eurozone’s 3% deficit rule even if it will cause the overall Italian national debt to rise. As long as the Italian parliament finalizes a 2019 budget with a 2.4% deficit by December, the markets will have gotten out this budget mess relatively unscathed.