- Markets await key trade developments over the next week

- Weekend OPEC meeting is only a Monitoring Committee meeting but will nevertheless divvy up production through year-end

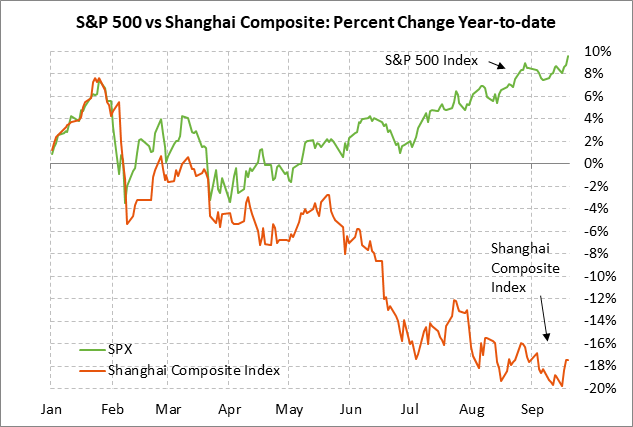

Markets await key trade developments over the next week –– The markets are waiting for key trade developments on Canada and China over the next few days and are waiting to see how US/Japanese and US/EU trade talks go next week. US Trade Representative Lighthizer will meet with the EU Trade Commission Malmstrom this coming Tuesday (Sep 25) in New York and they have another meeting tentatively scheduled for November. The U.S. and EU are negotiating trade terms for industrial goods and autos in an attempt to stave off President Trump’s threat of a 25% tariff on U.S. imports of European autos. The U.S. has agreed to hold off on any new tariff threats while those negotiations proceed.

Regarding Japan, USTR Lighthizer is due to meet later next week with Japanese Economy Minister Motegi. That meeting was originally scheduled for Monday (Sep 24) but was postponed for a few days. Japan continues to be a primary target for President Trump’s ire since Japan has so far refused to engage in bilateral trade negotiations. President Trump has threatened to slap a 25% tariff on U.S. imports of Japanese autos if Japan doesn’t start offering trade concessions to reduce its trade surplus with the U.S.

Regarding Canada, time is growing very short for a US/Canadian agreement on NAFTA 2.0 since the Trump administration must deliver the final language of a new NAFTA agreement to Congress by next Sunday (Sep 30), which can take up to a week to draft. If there is no final US/Canadian NAFTA written agreement by Sep 30, then President Trump may simply announce the U.S. withdrawal from NAFTA and move ahead with the bilateral US/Mexican trade deal that has already been agreed upon. In that case, Mr. Trump may also announce new penalty tariffs on Canada including a 25% tariff on Canadian autos.

Alternatively, the U.S. and Canada could keep talking and miss the deadline, but any new NAFTA agreement would then have to be signed by Mexican President-elect Obrador, who takes power on Dec 1. It remains unclear whether Mr. Obrador would demand any changes to the current US/Mexican trade agreement.

Regarding China, the Trump administration at any time could formally announce that procedures are being started for tariffs on another $267 billion of Chinese goods, as President Trump has threatened. If that new round of tariffs occurs, then the U.S. would have penalty tariffs on virtually all U.S. imports from China. Meanwhile, the U.S. 10% tariff on $200 billion of Chinese goods and China’s retaliatory tariff on $60 billion of U.S. goods both go into effect this Monday (Sep 24).

Weekend OPEC meeting is only a Monitoring Committee meeting but will nevertheless divvy up production through year-end — This weekend’s OPEC+ Joint Ministerial Monitoring Committee meeting in Algiers will essentially decide how production should be allocated through year-end. Iran has noted that no new production agreement can be reached at only a Monitoring Committee meeting, which is true. However, the Monitoring Committee is not trying to produce a new agreement but is just deciding how to comply with the existing agreement through year-end.

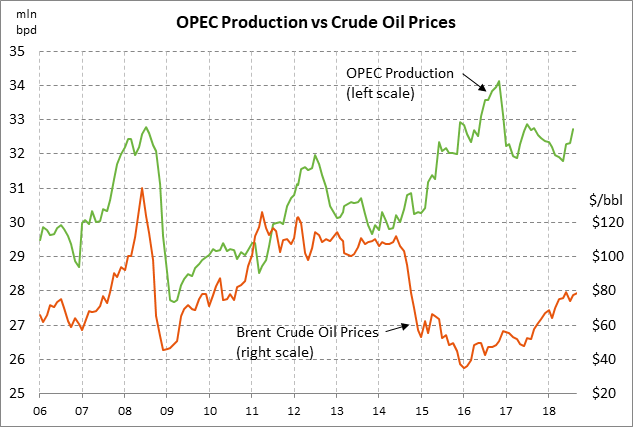

The problem is that there is not much left of the original OPEC+ production-cutting agreement. OPEC+ in late 2016 reached an agreement to cut production by 1.8 million bpd. However, the actual production cut turned out to be much larger because some OPEC members such as Venezuela and Libya saw their production fall due to domestic crises.

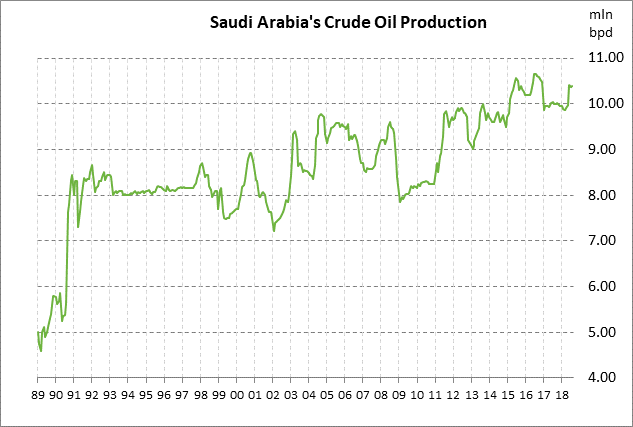

As a result, OPEC this past June reached an agreement to boost their production by about 700,000-800,000 bpd to reach the original intended production level. However, that side agreement contained no per-country allocations and most OPEC countries had no spare capacity to raise production. That meant that Saudi Arabia and Russia were the main parties to raise their production levels. Russian oil production has since jumped to a record high of 11.3 million bpd, edging above the previous record posted in Oct 2016. Saudi Arabia’s production in August of 13.39 million bpd was just slightly below June’s 1-3/4 year high of 10.42 million.

The current OPEC+ agreement ends in December. OPEC+ at its regular meeting in December will decide whether to maintain a production cut agreement of some kind for 2019 or whether to return to a pump-at-will policy.

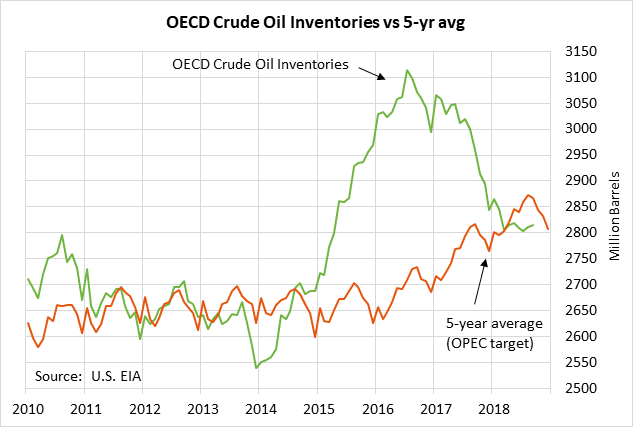

Brent crude oil prices in the past month have rallied by about $9 to the current level of $78.61 per barrel, where the market is knocking on May’s 3-3/4 year high of $80.50. That rally has been prompted by the one-third fall in Iranian oil exports and by OPEC’s success in working off the massive oil glut seen in 2015-16. In fact, OECD oil inventories in the past two years have plunged by -10% from 2016’s peak and are currently 1.8% below the 5-year seasonal average. In another supportive factor for oil prices, Venezuela’s oil production has plunged by 45% in the past 2-1/2 years to 1.33 million bpd.

OPEC members at their upcoming meetings can reach whatever fig-leaf agreements they wish, but the reality is that Saudi Arabia and Russia are the only countries with enough spare capacity to substantially raise production and offset the loss of Iranian oil exports. Saudi Arabia and Russia are therefore the world’s current swing producers and their production decisions will be the main driving factor for oil prices in coming months as Iranian oil exports fall farther ahead of full U.S. sanctions in November.