- Today’s soft deadline arrives for Canadian’s NAFTA agreement

- New U.S. tariff round on China could be announced at any time

- U.S. existing home sales expected to recover modestly from 2-1/2 year low

- U.S. leading indicators expected to remain strong

- 10-year TIPS yield is near a 7-1/2 year high ahead of today’s auction

Today’s soft deadline arrives for Canadian’s NAFTA agreement — Canada considers today as the deadline for a US/Canadian agreement on NAFTA 2.0 since a week is necessary to draft the final language and present it to the U.S. Congress by the deadline of Sep 30. If the Sep 30 deadline is missed, then President Trump may simply declare that the U.S. is withdrawing from NAFTA and that the U.S. is moving forward with the already agreed-upon bilateral trade agreement with Mexico. In that case, Mr. Trump might also announce punitive tariffs on Canada such as a 25% tariff on Canadian autos, an event that would obviously be bearish for the U.S. and Canadian stock markets.

Alternatively, the US/Canadian negotiations could drag on for days or even weeks and simply blow through another deadline. If the Trump administration misses the deadline of getting the NAFTA language to Congress by Sep 30, then the US/Mexican deal isn’t dead but it will have to be signed by Mexican president-elect Obrador, who takes power on Dec 1. Mr. Obrador isn’t necessarily opposed to the current US/Mexican trade agreement but wants the agreement to be the political responsibility of the previous government.

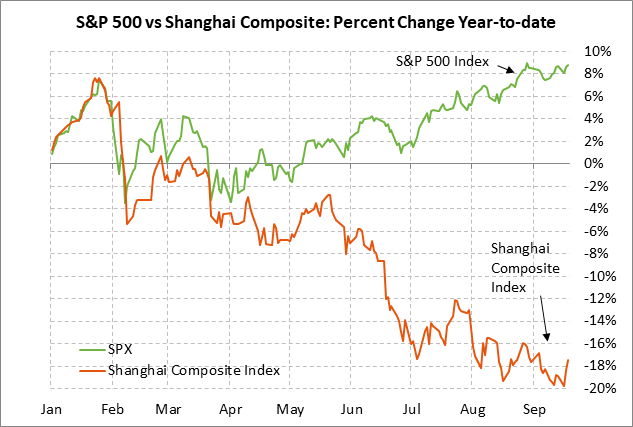

New U.S. tariff round on China could be announced at any time — The Trump administration at any time could formally announce that procedures are being started for tariffs on another $267 billion of Chinese goods. President Trump said he would go ahead with that new round of tariffs if China retaliated for the last U.S. tariff round, which in what happened earlier this week. It therefore appears to be only a matter of time before the Trump administration announces the new $267 billion round of tariffs, which after taking effect in 2-3 months, would mean that the U.S. would have penalty tariffs on virtually all its imports from China. Monday’s U.S. 10% tariff on $200 billion of Chinese goods and China’s retaliation on $60 billion of U.S. goods goes into effect this coming Monday (Sep 26).

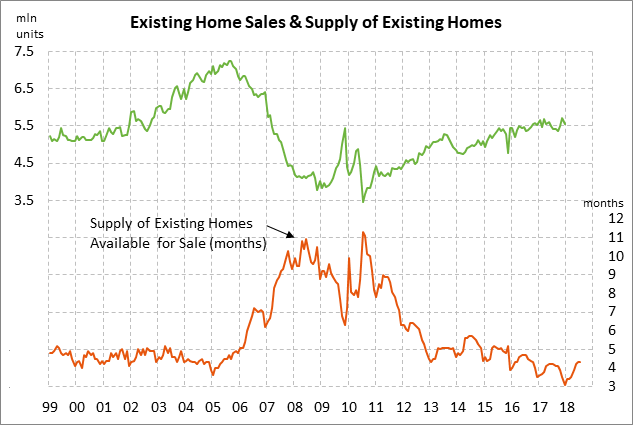

U.S. existing home sales expected to recover modestly from 2-1/2 year low — The consensus is for today’s Aug existing home sales report to show a +0.4% increase to 5.36 million, reversing part of July’s -0.7% decline to 5.34 million. U.S. home sales have fallen for four straight months by a total of -4.7% and are now 6.6% below November’s 11-1/2 year high of 5.72 million units.

U.S. home sales have fallen mainly because of weakening demand brought on by high home prices and rising mortgage rates. The National Association of Realtors’ Housing Affordability Index in June fell to a 10-year low of 134.8, which means that homes are at their least affordable level since 2008. The current index level indicates that a family earning the median family income has only 134.8% of the income necessary to qualify for a conventional loan with a 20% down-payment on a median-priced existing single-family home.

The median price of an existing home in July of $269,600 was just 2.6% below June’s record high of $276,900, which means that some potential home buyers are being discouraged by high home prices. Meanwhile, the 30-year mortgage rate is on the rise again. The 30-year mortgage rate has risen by about 10 bp in the past two weeks to 4.60%, which is only 6 bp below May’s 7-1/2 year high of 4.66%.

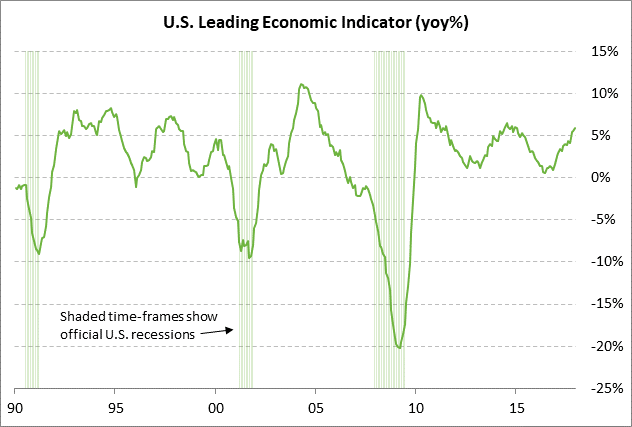

U.S. leading indicators expected to remain strong — The consensus is for today’s Aug leading indicators index to show another strong increase of +0.5%, adding to July’s increase of +0.6%. July’s year-on-year growth rate of +6.3% matched a 4-year high, illustrating that the key indicators for economic growth remain very positive.

The consensus is for Q3 GDP growth to remain strong at +3.0% following Q2’s stellar pace of +4.2%. The market is then expecting GDP to ease to +2.8% in Q4. On a calendar year basis, the consensus is for U.S. GDP growth in 2018 to match 2015’s 12-year high of +2.9% but then ease to +2.5% in 2019 and +1.9% in 2020 as the stimulative effects of the Jan 1 tax cuts wear off.

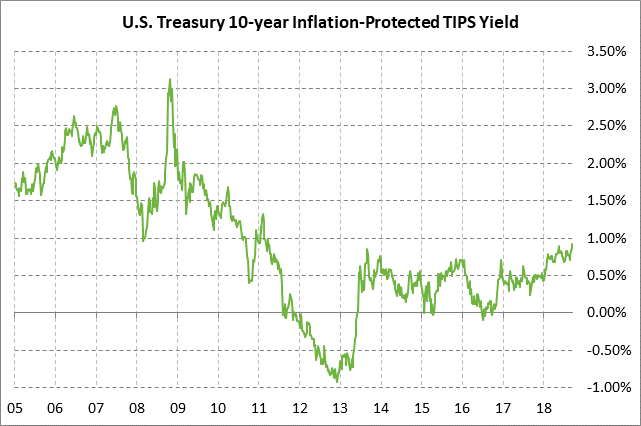

10-year TIPS yield is near a 7-1/2 year high ahead of today’s auction — The Treasury today will sell $11 billion of 10-year TIPS in the first reopening of the 3/4% 10-year TIPS note of July 2028, which was first sold in July. The size of today’s reopened auction is unchanged from the $11 billion size seen over the past 2-1/2 years.

The 10-year TIPS yield has risen sharply by 20 bp in the past three weeks to post a new 4-month high of 0.944%, which is just 0.5 bp below May’s 7-1/2 year high of 0.949. The 10-year TIPS yield yesterday closed at 0.91%. The 10-year TIPS yield has been driven higher in the past three weeks by increased expectations for Fed rate hikes and by the +4 bp rise in the 10-year breakeven inflation expectations rate to a 2-1/2 month high of 2.15%.

The 12-auction averages for the 10-year TIPS are as follows: 2.40 bid cover ratio, $23 million in non-competitive bids, 5.7 bp tail to the median yield, 11.9 bp tail to the low yield, and 53% taken at the high yield. The 10-year TIPS is the second most popular security behind the 30-year TIPS among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of 68.5% of the last twelve 10-year TIPS auctions, which is well above the median of 63.5% for all recent coupon auctions.