- FANG and EM stocks drag U.S. stocks lower

- Canadian trade decision could come this week

- ADP employment expected to show a solid increase

- U.S. unemployment claims expected to remain favorable

- Weekly EIA report

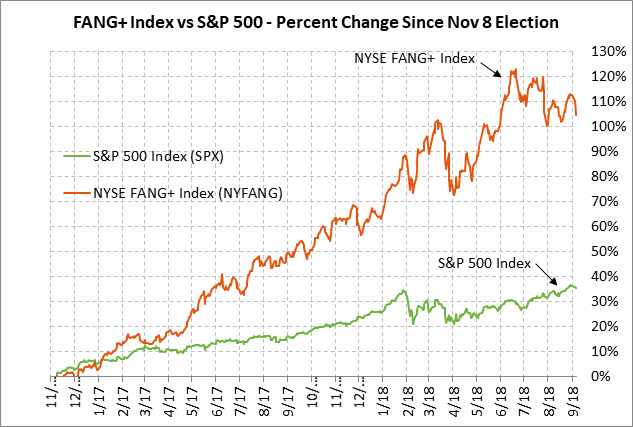

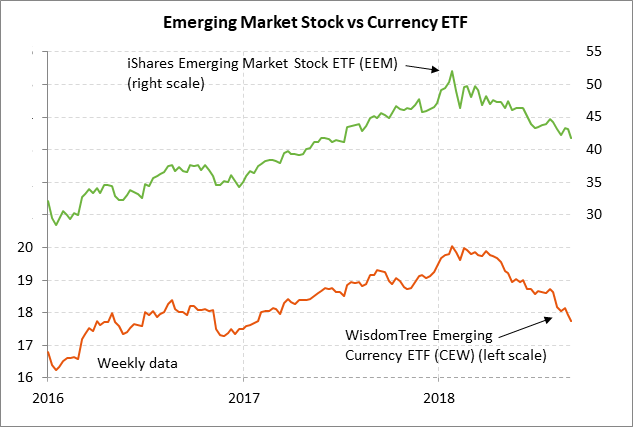

FANG and EM stocks drag U.S. stocks lower — The S&P 500 index on Wednesday fell by -0.38% and was dragged lower by weakness in FANG and emerging market stocks. The Nymex FANG+ index on Wednesday fell sharply by -2.76% due to fears of increased tech regulation after Facebook and Twitter leaders were grilled on Capitol Hill. Meanwhile, emerging market stocks continued to show weakness with the iShares Emerging Market stock ETF on Wednesday closing -1.44% lower, adding to Tuesday’s plunge of -1.95%. The WisdomTree Emerging Currency ETF has fallen by -1.03% so far this week to a 1-1/2 year low. European stocks have also helped drag U.S. stocks lower with the overall -2.35% plunge in the EuroStoxx 50 index on Tue/Wed to a new 5-month low.

U.S. tariffs on China could be announced as soon as today, along with the threat of even more tariffs — White House Press Secretary Sarah Sanders on Wednesday said that it is “certainly a possibility” that President Trump will announce the implementation of tariffs on China after the public comment period ends today. If the U.S. imposes sanctions on another $200 billion of Chinese products, then China has promised retaliatory tariffs on another $60 billion of U.S. products. President Trump could announce the implementation of the tariffs effectively immediately or he could delay the implementation in order to provide some time for last-minute negotiations.

The markets seem to be largely prepared for the implementation of tariffs on another $200 billion of Chinese tariffs, meaning the market reaction may not be particularly severe. However, there would likely be a much more bearish reaction if Mr. Trump pairs the announcement with a new initiative to slap tariffs on the remaining $275 billion of Chinese goods not covered by penalty tariffs. The U.S. imported about $575 billion of goods from China over the last 12 months. Mr. Trump may feel that he has no choice but to slap a tariff on all Chinese goods since his tariff moves thus far have not brought China to the bargaining table with nearly enough concessions to meet U.S. demands.

Canadian trade decision could come this week — President Trump on Wednesday said that it may become clear over the next two or three days whether the U.S. will reach a new NAFTA agreement with Canada. However, the two sides appear to have several weeks until the deadline of Sep 30 when the Trump administration must deliver the text of a revised NAFTA agreement to Congress.

Canadian Foreign Minister Freeland on Wednesday said that talks remain “constructive.” Canadian Prime Minister Trudeau said that he is willing to compromise on dairy but that he has red lines on the dispute panels and on cultural carve-outs for certain industries such as media.

If there is a breakdown in the talks, then President Trump could move quickly to announce the official U.S. withdrawal from NAFTA and to impose retaliatory tariffs on Canada including a 25% tariff on Canadian autos, an event that would likely hit the markets hard.

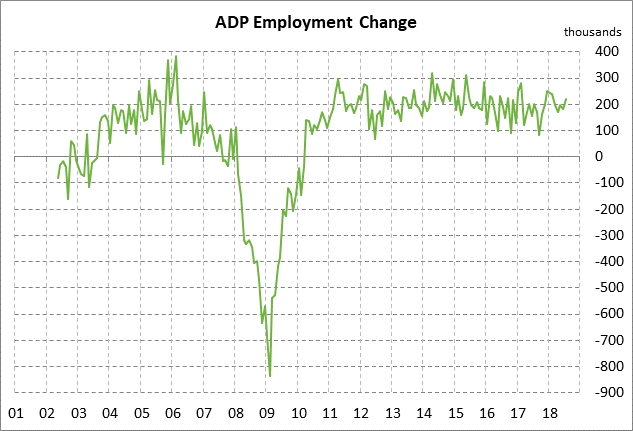

ADP employment expected to show a solid increase — The market consensus is for today’s Aug ADP report to show a solid increase of +200,000, which would be mildly above the 12-month trend average of +191,000. U.S. job growth continues at a strong pace despite the fact that qualified employees are hard to find in certain industries and that U.S. businesses have already hired 19 million new employees since the Great Recession.

On the labor front, the markets are mainly looking ahead to Friday’s August employment report. The consensus is for Friday’s Aug payroll report to show an increase of +195,000, recovering to trend after July’s weak report of +157,000. The Aug unemployment rate is expected to show a -0.1 point decline to 3.8%, matching May’s 48-year low. Despite the low unemployment rate, the consensus is for Aug average hourly earnings to remain unchanged at +2.7% y/y.

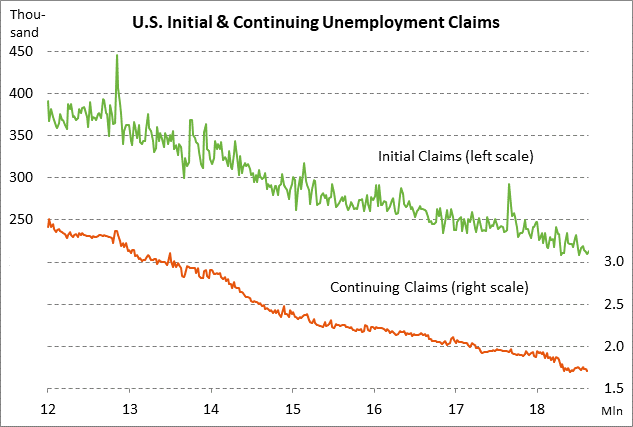

U.S. unemployment claims expected to remain favorable — The consensus is for today’s weekly initial unemployment claims report to be unchanged at 213,000 (following last week’s small +3,000 increase to 213,000) and for continuing claims to show a +12,000 increase to 1.720 million (after last week’s -19,000 decline to 1.708 million). Both of the series remain in very strong shape with the initial claims series only 5,000 above July’s 49-year low of 208,000 and the continuing claims series only 7,000 above June’s 45-year low of 1.701 million.

U.S. ISM non-manufacturing index expected to show continued strength in business confidence — The consensus is for today’s Aug ISM non-manufacturing index to show a +1.1 point increase to 56.8, recovering part of July’s fairly sharp -3.4 point drop to 55.7. Despite July’s decline, the index remains at a relatively strong level, illustrating that business confidence is relatively strong in the non-manufacturing sectors of the U.S. economy. In a positive indicator for today’s report, Tuesday’s ISM manufacturing index showed an unexpected +3.2 point increase to a new 14-year high of 61.3. Separately on the manufacturing front, today’s July factory orders report is expected to show a decline of -0.6% m/m following June’s increase of +0.7% and +0.4% ex-transportation.

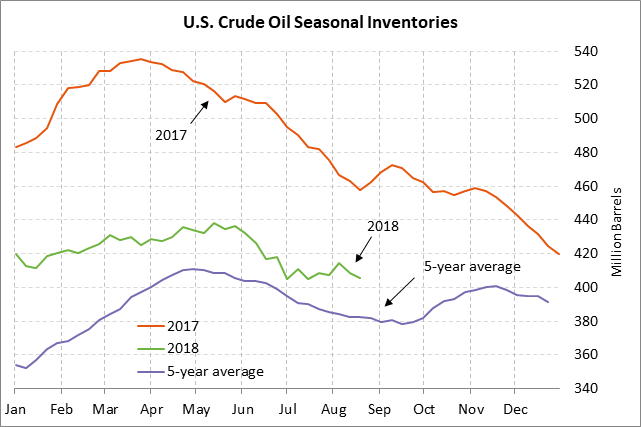

Weekly EIA report — The consensus for today’s weekly EIA report is for a -3.0 mln bbl drop in U.S. crude oil inventories, a -2.0 mln bbl drop in gasoline inventories, and an unchanged level of distillate inventories. U.S. crude oil inventories are currently -0.4% below the 5-year seasonal average, gasoline inventories are +5.1% above average, and distillates are -7.6% below average. U.S. oil production in last week’s report was at a record high of 11.0 million bpd.