- Washington dominates market attention with budget talks now adding to trade tensions

- U.S. trade deficit expected to expand to 5-month high

- Italian bond spread falls to 2-week low

Washington dominates market attention with budget talks now adding to trade tensions — Adding to the turmoil in Washington, Republican Congressional leaders will meet with President Trump today to discuss their autumn legislative agenda including how to avoid a government shutdown in just 3-1/2 weeks. President Trump has threatened to force a government shutdown on Sep 30 if he doesn’t get his border wall funding as part of the fiscal 2019 spending bill, which Democrats are refusing to provide.

A government shutdown on Sep 30 seems unlikely since neither the Republicans or Democrats will want to be blamed for a government shutdown just a month before the Nov 6 mid-term elections. Still, President Trump might make good on his threat to force a government shutdown over border wall funding and there are a host of other things that could go wrong that could still produce at least a short government shutdown.

Meanwhile on the trade front, U.S. and Canadian trade negotiators are due to resume negotiations today on a revised NAFTA agreement. The two main sticking points are U.S. demands for Canada to curb its dairy support system and to give up the independent dispute panels. The good news is that the U.S. and Canada have until Sep 30 to come up with an agreement since Congress does not have to be notified about the exact language of an agreement until Oct 1.

Despite all the tough talk, there appears to be a good chance for a US/Canada agreement since Canada needs to prevent an all-out trade war and since Congress is not likely to approve a NAFTA agreement that does not include Canada. The Trump administration over the weekend heard a great deal of political backlash from all sides about the idea of excluding Canada from a new NAFTA agreement and moving forward with just a US/Mexico bilateral agreement.

Nevertheless, there is still the possibility of a US/Canada deadlock that turns into an all-out trade war. President Trump at any time could simply (1) declare the end of US/Canadian trade talks, (2) provide notification that the U.S. is withdrawing from NAFTA, and (3) levy a 25% tariff on Canadian autos and any other penalty tariffs that the administration might come up with.

On the Chinese trade front, the markets seem to be mostly resigned to the likelihood that the Trump administration as soon as Thursday or Friday may announce the implementation of the tariffs on another $200 billion of Chinese goods. The Trump administration can implement those tariffs at any time after the public comment period ends this Thursday (Sep 6). The administration could announce the implementation of the tariffs effective immediately or it could announce a delayed implementation to allow some time for last-minute negotiations.

The markets certainly will not be happy if the Trump administration announces the implementation of tariffs on another $200 billion of Chinese goods and China proceeds with its plan to retaliate with tariffs on another $60 billion of U.S. goods. The markets will be even more upset, however, if President Trump at that point moves ahead with his idea to slap tariffs on another $250-275 billion of Chinese goods so that there are penalty tariffs on all $575 billion of Chinese goods that the U.S. imported over the last 12 months.

Mr. Trump may feel that he has no choice but to slap a tariff on all Chinese goods since his imminent move to slap tariffs on a total of $250 billion of goods hasn’t yet brought China to the bargaining table with sufficient concessions.

Aside from Canada and China, the markets also remain worried about the administration’s current review of its plan to slap a 25% tariff on all imported vehicles. In addition, there is the possibility that President Trump could end the US/European tariff truce if Europe is not providing enough concessions in talks. President Trump last week said that the European offer to cut reciprocal tariffs to zero on all industrial products and vehicles was “not good enough.” President Trump seems to also want concessions on non-tariff barriers to U.S. vehicles being sold in Europe and on European agriculture.

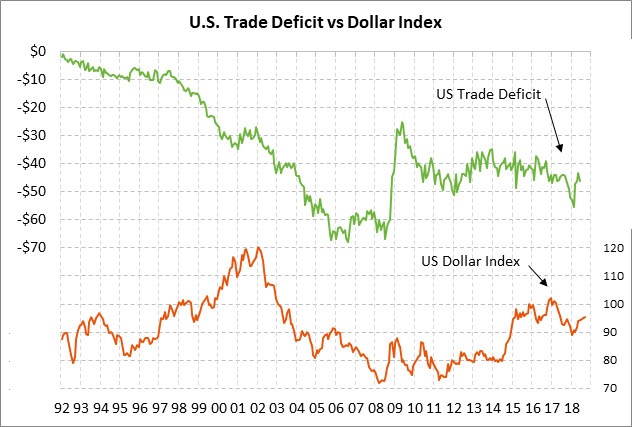

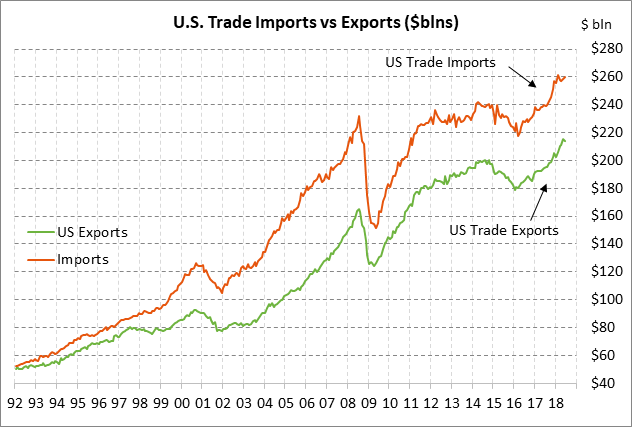

U.S. trade deficit expected to expand to 5-month high — The market consensus is for today’s July U.S. trade deficit to expand to a 5-month high of -$50.2 billion from June’s -$46.3 billion. The expected deficit of -$50.2 billion would be wider than the 12-month average of -$47.7 billion but would at least be narrower than February’s 10-year high of $55.5 billion.

A wider trade deficit today would certainly be unwelcome news at the White House. However, underlying trade trends are currently impossible to discern since there has been a surge of both import and export orders in recent months in an attempt to beat the implementation of tariffs. Indeed, both exports and imports in June were near record highs.

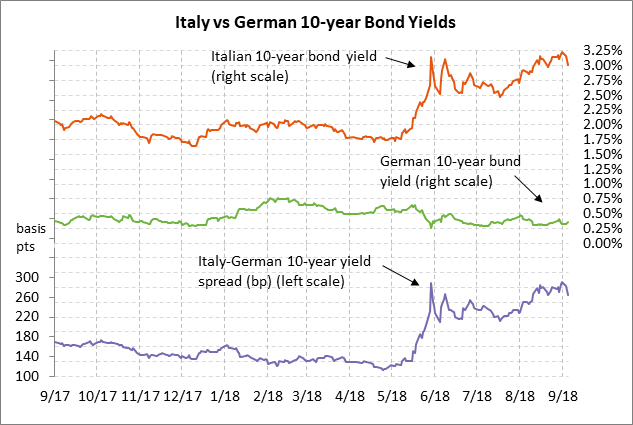

Italian bond spread falls to 2-week low — The spread of the 10-year Italian government bond yield over Germany fell sharply by 17 bp to a 2-week low of 266 bp on Tuesday. The spread has now fallen by a total of -25 bp from last Friday’s 5-1/4 year high of 291 bp. The Italian bond yield dropped sharply this week after League head Salvini said “all rules” will be respected and as media reports said the government is targeting a deficit below the EU ceiling of 3%. The iShares Italy stock ETF rallied by +1.48% on Tuesday, easily outperforming the weakness in European stocks week with the Eurostoxx 50 index rising by only +0.06% on Monday and then falling by -1.05% on Tuesday.