- Jackson Hole conference could provide new Fed policy hints

Jackson Hole conference could provide new Fed policy hints — The 3-day Fed symposium that begins this Thursday in Jackson Hole will be watched carefully for any clues about the Fed’s policy inclinations. The headline event will be Fed Chair Powell’s speech on Friday titled “Monetary Policy in a Changing Economy.”

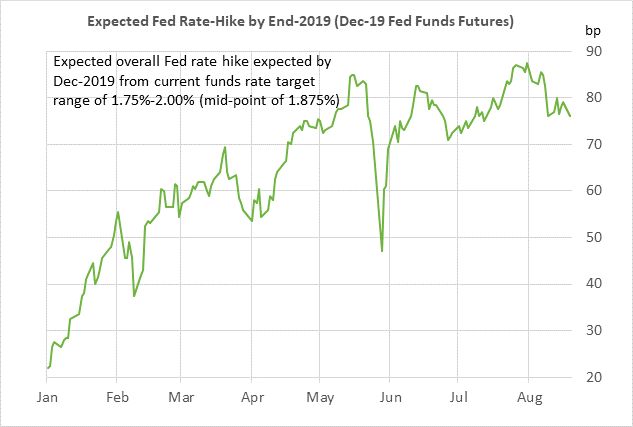

The market is currently discounting the odds at 100% for another rate hike at the next FOMC meeting in about five weeks on Sep 25-26. The market is then looking for an unchanged policy at the following meeting on Nov 7-8 and a 76% chance of the fourth rate hike of the year at the Dec 18-19 meeting.

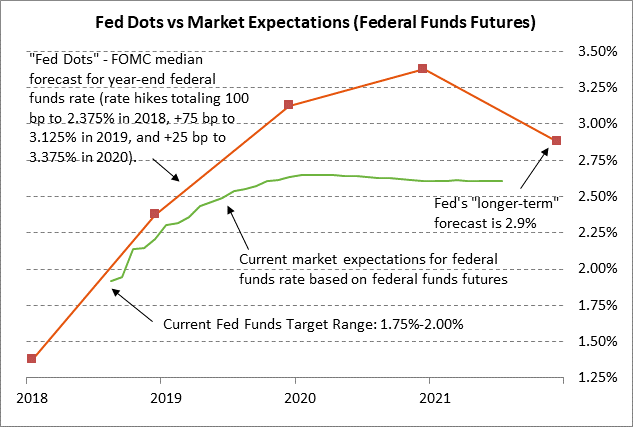

If the Fed goes ahead with the next two rate hikes in September and December, then the Fed will have pushed the funds rate up to 2.25%-2.50% from the current level of 1.75%-2.00%. The market is then looking for only one more rate hike in 2019, leaving the funds rate at a terminal level near 2.67% through 2020-2021.

That means that the market believes the Fed is nearing the end of its rate-hike regime. The Fed has so far raised the funds rate by +175 bp from the crisis level of 0.00%-0.25% and the market is expecting only about another 75 bp of rate hikes, meaning the market believes the Fed is 70% done with its rate-hike regime.

The Fed may already be starting to hint at how it will change its guidance language when it nears the end of its rate-hike regime. Indeed, the markets took notice when Fed Chair Powell at his mid-July testimony to Congress said that the FOMC “believes that — for now — the best way forward is to keep gradually raising the federal funds rate.”

The phrase “for now” suggested that the Fed is already thinking about how it will shift it guidance language as it nears the end of its rate-hike regime. The phrase “for now” suggested that the Fed plans to move to a more data-dependent decision framework, as opposed to the current framework which is basically a time-based policy of raising interest rates every other FOMC meeting.

A more data-dependent decision framework would be particularly appropriate given the recent uncertainties such as (1) trade tensions, (2) a slower Chinese economy, (3) Italy’s potential threat to Eurozone stability, (4) the Turkish financial crisis (with its threat to some European banks), and (5) general stress on the emerging market countries from the strong dollar.

None of those trouble spots is presently bad enough to deter the Fed from its rate-hike regime since (1) inflation is now essentially on-target, (2) the U.S. labor market is very tight, and (3) U.S. GDP growth was overheated at +4.1% in Q2 due to tax cuts and fiscal stimulus. Still, if those hot spots become more of a problem, then the Fed would have some flexibility to hold rates steady for a number of months to allow the situation to stabilize if it moves to a more data-dependent decision framework.

We believe that the odds for the Fed’s fourth rate hike of the year in December are higher than the market’s current odds of 76%. We believe the Fed will want to squeeze in it its fourth rate hike of the year to get the funds rate to 2.25-2.50%, i.e., decisively above the Fed’s +2.0% inflation target. That would put the real federal funds target mid-point at 0.38% versus the Fed’s +2.0% inflation target and at 0.29% versus the current 10-year breakeven inflation expectations rate of 2.09%.

The real funds rate has been in negative territory for the past decade and we believe the Fed is chomping at the bit to get the real funds rate decisively into positive territory to address the fact that its policy targets have been met and the U.S. economy is showing strong growth. There is no longer any excuse for the real funds rate to be negative. The Fed needs to get monetary policy normalized to avoid any further unintended effects such as encouraging bubbles and excessive risk-taking. The Fed also wants to get the funds rate up to a more normal level so it has room to cut rates when the next recession arrives.

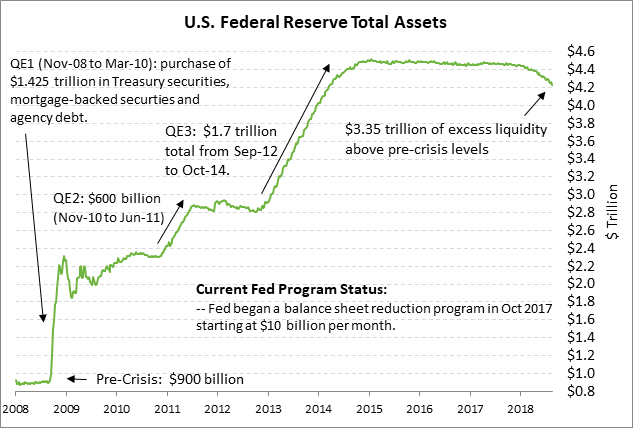

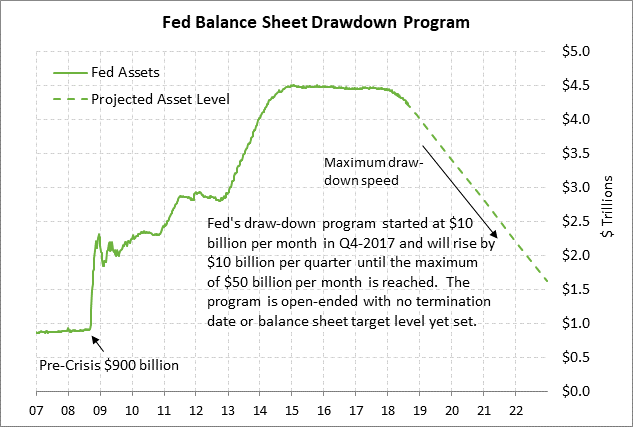

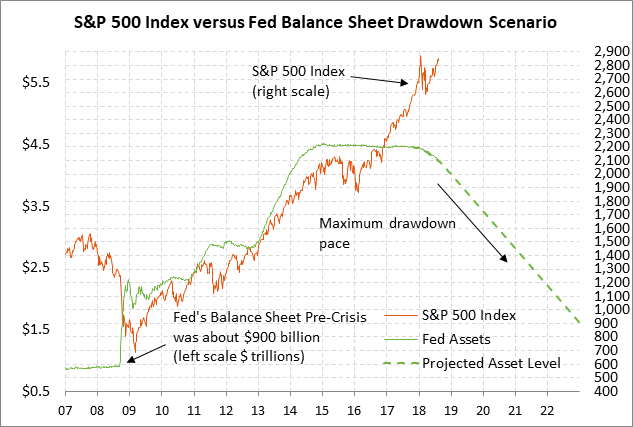

The markets at the Jackson Hole conference will also be watching to see if the Fed sends any signals regarding its balance sheet plans. The Fed’s balance sheet reduction plan is currently on autopilot. The Fed started its balance sheet reduction plan in Q4-2017 with a maximum monthly reduction of $10 billion per month and then stepped up the maximum drawdown to $20 billion per month in Q1-2018 and $30 billion per month in Q2. The maximum drawdown in the current third quarter is at $40 billion and will top out at $50 billion per month in Q4.

The Fed’s balance sheet has fallen by only -$227 billion (-5%) since the program began on October 1, 2017. The Fed still has a massive $3.35 trillion worth of excess liquidity in the banking system relative to the pre-crisis level and the balance sheet reduction program still has a number of years to run. The Fed’s reduction program has so far been like “watching paint dry” as some Fed officials predicted. However, the reduction program will step up another notch in Q4 to its maximum pace, meaning it will bite a little harder.

The Fed has not yet announced how long the drawdown program will last or where the Fed eventually wants the balance sheet to settle. The final target for the balance sheet depends on what type of a monetary policy system the Fed plans to run in the future. If the Fed plans to return to the pre-crisis corridor-type system, then the final balance sheet level will be smaller than if the Fed retains its current floor-type system. The Fed in any case will eventually have to start talking about its ultimate policy framework and its final balance sheet target.