- Powell’s ruminations on the yield curve are potentially dovish

- U.S. housing starts expected to back off from 11-year high

- Italy’s 10-year yield spread eases to a 1-1/2 month low

- EIA weekly Petroleum Status Report

Powell’s ruminations on the yield curve are potentially dovish — Fed Chair Powell’s comments yesterday before the Senate Banking Committee were generally in line with market expectations. Mr. Powell will repeat his performance today before the House Financial Services Committee in the Fed’s semi-annual monetary policy report to Congress.

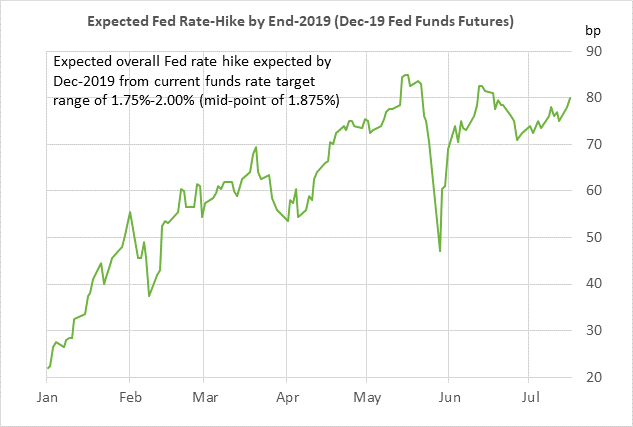

Mr. Powell’s appearance yesterday had only a minor impact on the markets since he mostly reiterated the Fed’s well-worn themes. The federal funds futures curve was unchanged for the rest of 2018 but tightened slightly by +2 bp for the 2019-2020 contracts.

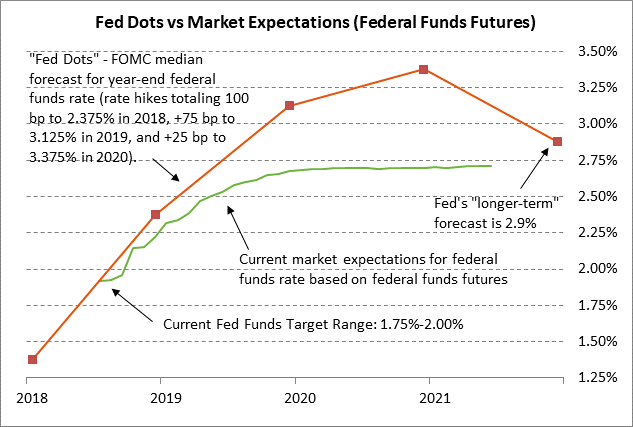

Nevertheless, Mr. Powell did make two comments that could be construed as dovish. First, he said that gradual interest rate hikes are the best option “for now.” That suggested that Mr. Powell is already thinking about the time when rate hikes are no longer the best option. Indeed, the market is expecting only another 75 bp of rate hikes by the end of 2019 to 2.50/2.75%. By contrast, the FOMC is much more hawkish with a forecast for another 125 bp of rate hikes to 3.25/3.50% by late 2020.

The market is not even expecting the Fed to be able to push the funds rate up to its neutral rate of 2.9% whereas the Fed thinks it will have to temporarily overshoot its neutral rate by pushing the funds rate up to 3.00/3.25% by late 2020. We believe that the market is likely to be closer to the truth than the Fed about the course of short-term rates. With the new worries about a slower Chinese economy and with increasing trade tensions, the chances are that U.S. economic growth will soften and the FOMC will eventually be forced to curtail its hawkish tightening forecasts.

Second, Mr. Powell made a potentially dovish comment by mentioning the flat yield curve. Mr. Powell said that, “If you raise short-term rates higher than long-term rates, then maybe your policy is tighter than you think. Or it’s tight, anyway.” That comment indicated that Mr. Powell and other Fed officials are at least thinking about whether short-term rates are tighter than they think.

In fact, the 10yr-2yr T-note yield spread yesterday fell to an 11-year low of 0.247%, indicating that the 10-year yield is now only 25 bp above the 2-year yield. If the Fed continues to push funds rate higher as expected, the yield curve would invert if the 10-year yield does not follow short-term rates higher. An inverted yield curve is typically a signal of a tight Fed policy and is often a precursor to a recession.

Mr. Powell said that in his view, “what really matters is what the neutral rate of interest is.” The Fed dots indicate that the Fed believes the neutral rate is around 2.9%. However, if the 10-year T-note yield does not climb much above 2.9% even as the Fed raises interest rates, then the implication is that the bond market believes that the Fed is raising rates too high and that the economy will eventually soften and perhaps even fall into a recession.

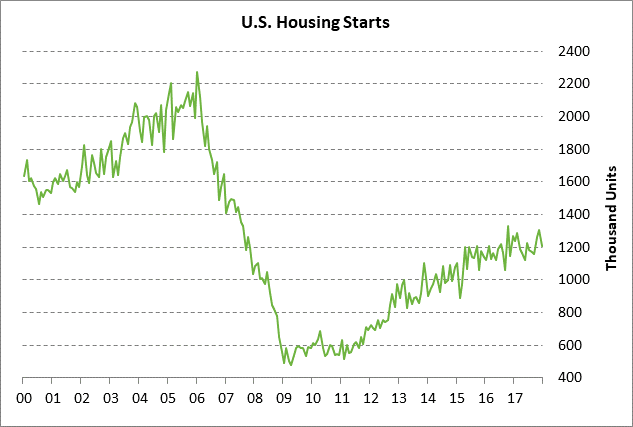

U.S. housing starts expected to back off from 11-year high — The market consensus is for today’s June housing starts report to show a -2.2% decline to 1.320 million, reversing about half of May’s +5.0% increase to an 11-year high of 1.350 million.

U.S. housing starts are in very strong shape due to (1) strong new home sales, (2) tight new home supplies, and (3) high new home prices. New home sales in May were strong at 689,000 units, just 3.2% below the 10-year high of 712,000 posted in Nov 2017. New home supplies were tight at 5.2 months in May, well below the long-term average of 6.1 months. New home prices were high at a median of $313,000 in May, only 9% below the record high of $343,400 posted in Nov 2017.

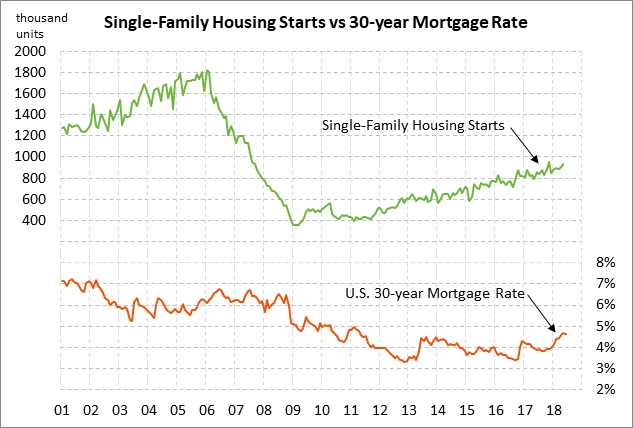

In addition, builder confidence remains strong. Yesterday’s July National Association of Home Builders (NAHB) housing market index was unchanged at 68, which was only 6 points below December’s 19-year high of 74. Home builder confidence remains strong due to the roaring economy, strong consumer confidence and spending, and strong home demand. However, mortgage rates are becoming more of a problem as the Fed pushes short-term rates higher. The 30-year mortgage rate in the past 10 months has risen by 75 bp to the current level of 4.53%.

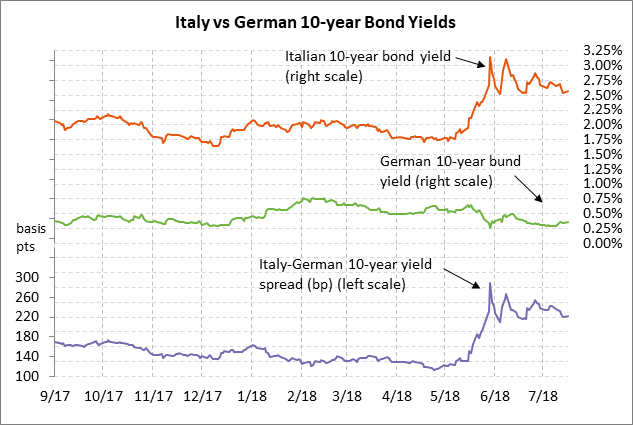

Italy’s 10-year yield spread eases to a 1-1/2 month low — The spread of the Italian 10-year bond yield over the 10-year German bund yesterday fell to a 1-1/2 month low of 212.3 bp. The spread in the past several weeks has fallen by -40 bp because the populist Italian government has not done anything lately to alarm the markets about their euro-skeptic tendencies. However, the Italian 10-year spread is still roughly 100 bp higher than it was three months ago, which indicates that the markets still remain very nervous about the trouble that Italy’s government is eventually expected to cause for the Eurozone with its budget-busting plan for a big tax cut and a big increase in social spending.

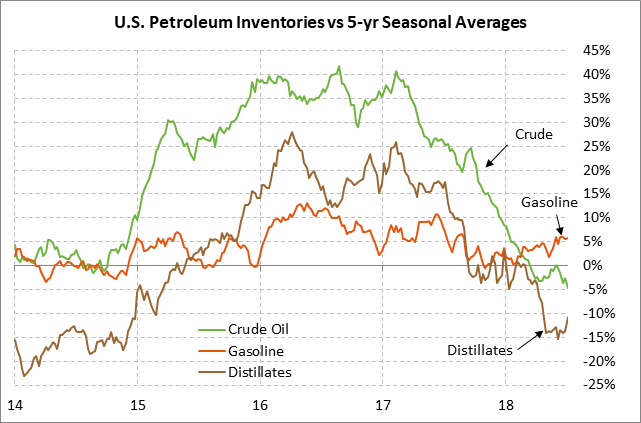

EIA weekly Petroleum Status Report — The market consensus is for today’s weekly EIA report to show a -3.1 mln bbl drop in U.S. crude oil inventories, a -900,000 bbl drop in gasoline inventories, a +1.1 mln bbl rise in distillate inventories, and a +0.3 point increase in the refinery utilization rate to 97.0%. Today’s expected -3.1 mln bbl drop in U.S. crude oil inventories would add to last week’s -12.6 mln bbl plunge to 405.248 mln bbls. Crude oil inventories last week fell to a 3-1/2 year low and were -4.7% below the 5-year seasonal average, the tightest such level in 10 years. Meanwhile, gasoline inventories are ample at +5.8% above the 5-year average while distillate inventories are tight at -10.8% below average. U.S. oil production in last week’s report was unchanged at a record high of 10.9 million bpd.