- Weekly global market focus

- Markets wait for the next shoe to drop in the U.S. trade war

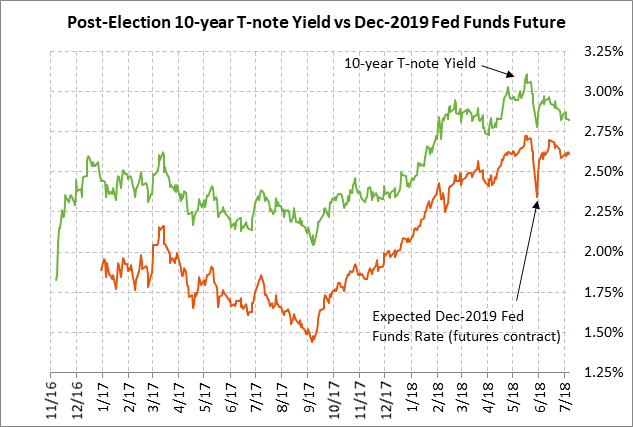

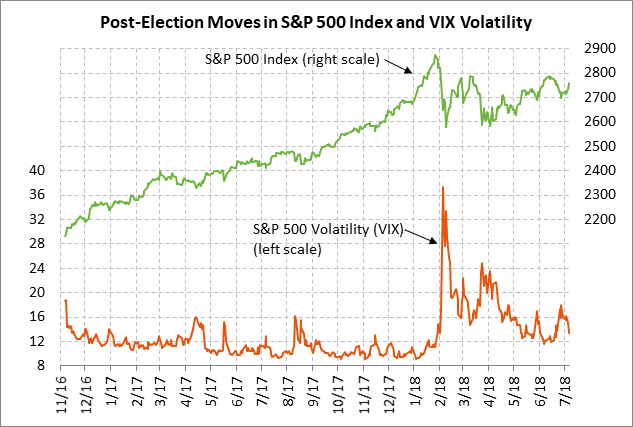

Weekly global market focus — The U.S. markets this week will focus on (1) whether any new trade threats emerge after the U.S. and China last Friday night exchanged tariffs on $36 billion worth of goods, (2) U.S. inflation expectations as U.S. tariff costs are starting to pile up for U.S. businesses and consumers and as Aug WTI crude oil last week posted a new 3-1/2 year nearest-futures high, (3) this week’s fairly busy U.S. economic schedule where Thursday’s June CPI report is expected to edge higher to +2.9% y/y headline and +2.3% y/y core (from May’s +2.8 and +2.2%, respectively), (4) the beginning of Q2 earnings season with seven of the S&P 500 companies reporting this week including JP Morgan Chase and Citigroup on Friday, and (5) the Treasury’s auction of $69 billion of 3, 10 and 30-year securities on Tuesday through Thursday.

President Trump on Monday evening is scheduled to announce his nomination for the new Supreme Court Justice to replace Justice Kennedy. Mr. Trump is then scheduled to attend the annual NATO Summit in Brussels on Wednesday and Thursday. Mr. Trump will then visit Britain on Friday through Saturday. Mr. Trump is then due to meet with Russian President Putin on Sunday in Helsinki.

The UK markets today will watch Prime Minister May’s address to Parliament on her Brexit plan to assess whether she can gather enough support to keep it going. At a key meeting last Friday, she managed to get most of her cabinet to support her version of a soft Brexit. However, Ms. May suffered a major blow on Sunday when David Davis resigned as Brexit Secretary, illustrating the difficulty that Ms. May is having in getting the harder-line Brexiteers to agree to her Brexit plan.

The UK on Tuesday for the first time will release its GDP estimates on a monthly basis. The consensus is for UK GDP growth in the three months through May to show annualized growth of about +1.6%.

In Europe, the markets will assess Thursday’s release of the minutes from the ECB’s last meeting on June 14 for any clues on when the ECB will implement its first rate hike. The market consensus is that the ECB will not implement its first rate hike until at least mid-2019. The market is discounting only a 35% chance of a rate hike by March 2019. The ECB’s QE program is scheduled to end at the end of 2018.

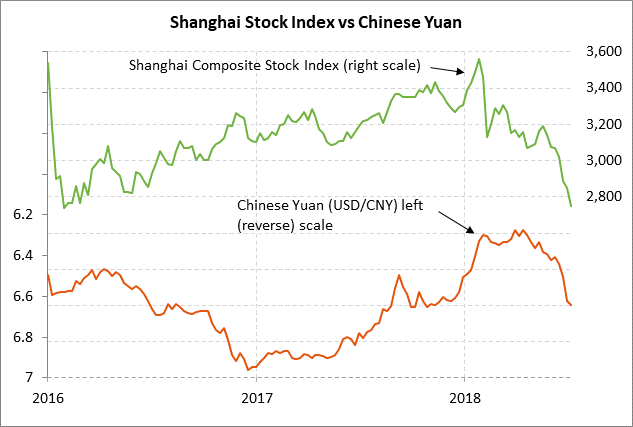

In Asia, the market focus will mainly be on U.S./Chinese trade tensions and the performance of the Chinese stock market. The Shanghai Composite index last Friday fell to a new 2-1/4 year low and closed the week down -3.52%.

The Chinese yuan last Friday consolidated mildly above last Tuesday’s 1-year low as the Chinese government tried to halt the yuan’s steep month-long -3.8% decline. The market continues to fear a downward spiral in China’s stock and currency markets, spurred on by capital flight.

In Chinese economic data, Monday night’s June CPI is expected to edge slightly higher to +1.9% y/y from May’s +1.8%. June new yuan loans are expected to strengthen to 1.52 trillion yuan from May’s 1.15 trillion yuan. Thursday night’s June Chinese trade surplus is expected to widen to $27.2 billion from May’s $24.9 billion. Chinese June export growth is expected to ease mildly to +10.4% y/y from May’s +12.6%.

Markets wait for the next shoe to drop in the U.S. trade war — The markets are waiting for the next shoe to drop after reciprocal U.S./Chinese tariffs on $34 billion worth of goods went into effect last Friday night. The U.S. will hold a hearing on June 24 for input on exactly which products should be included in the next $16 billion batch of Chinese goods subject to a 25% tariff. Chinese has already listed the $16 billion worth of U.S. products that will receive a retaliatory tariff, which include U.S. oil and coal.

The markets are waiting to see if President Trump delivers any fresh news on his intent to levy tariffs on at least another $200 billion of Chinese goods as punishment for China’s retaliation on the first $50 billion worth of products. Mr. Trump last Friday indicated that he may levy tariffs on all imports from China, which totaled $523 billion over the last twelve months.

China’s ability to retaliate with tariffs is limited since China imported only $134 billion worth of U.S goods over the last twelve months, which is much less than U.S. imports of $523 billion worth of Chinese goods. However, China has plenty of other ways to retaliate such as (1) clamping down on sales by U.S. companies within China, (2) organizing Chinese consumer boycotts against U.S. brands, (3) devaluing the yuan, and (4) lightening up its holdings of $1.2 trillion worth of U.S. Treasury securities.

The markets are also waiting to see if there is any news on Mr. Trump’s idea of levying a 20% tariff on European auto imports. German Chancellor Merkel now says she favors negotiations under the WTO process for reducing auto tariffs on a global basis.