- Chinese stocks and yuan extend plunge on trade worries

- U.S. factory orders expected unchanged

- U.S. vehicle sales expected to mildly improve

Chinese stocks and yuan extend plunge on trade worries — Chinese stocks extended their plunge on Monday with a -2.52% sell-off in the Shanghai Composite index to a new 2-1/4 year low. Meanwhile, the Chinese yuan posted a new 9-month low against the dollar and closed the day -0.71% lower on continued concern about capital flight and an easier PBOC policy to support the Chinese stock market.

The latest trade worry was the weekend warning by the EU Commission that U.S. auto tariffs would risk global retaliation on $300 billion of U.S. products. The markets are worried that the Trump administration could announce tariffs on at least European auto imports at any time since President Trump said last Tuesday that the tariffs are almost ready. Separately, the U.S. and China appear to be doing little to avert the 25% reciprocal tariffs on $34 billion worth of U.S. and Chinese goods that are due to go into effect this Friday (July 6).

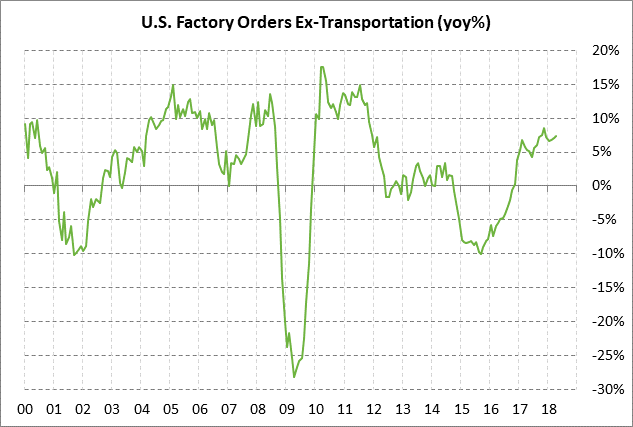

U.S. factory orders expected unchanged — The market consensus is for today’s May U.S. factory orders report to be unchanged after April’s mixed report of -0.8% and +0.4% ex-transportation. The factory orders series remains in strong shape with both the headline and ex-transportation series up +7.4% y/y in March. However, the durable goods series showed a little weakness in May with small declines of -0.6% m/m and -0.3% ex-transportation, which did not bode well for today’s May factory orders report.

The manufacturing sector so far remains strong due to the strong U.S. economy and increased capex spending following the Jan 1 tax cuts. The decline in the dollar index in 2017 was also helpful for manufacturing exports, although the dollar in recent months has recovered to a 1-year high.

However, there is some trepidation emerging in the U.S. manufacturing sector due to the trade war. The U.S. is in the process of being hit with retaliatory tariffs on more than $25 billion worth of U.S. goods due to the U.S. steel and aluminum tariffs. Those U.S. metals tariffs themselves raised the material input costs for many U.S. manufacturers, also leading to reduced manufacturing confidence.

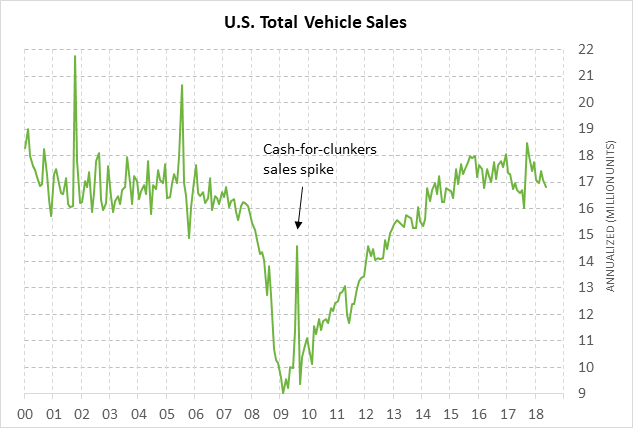

U.S. vehicle sales expected to mildly improve — The market consensus is for today’s June total vehicle sales to improve mildly to 17.00 million units from 16.81 million units in May. Today’s expected report of 17.00 million units would be just below the 12-month trend average of 17.1 million units.