- U.S. housing affordability is at a 10-year low

- U.S. housing starts expected to remain strong

- Merkel gets 2-week reprieve on migrant policy

- Oil prices stabilize as OPEC+ considers a smaller-than-expected production hike

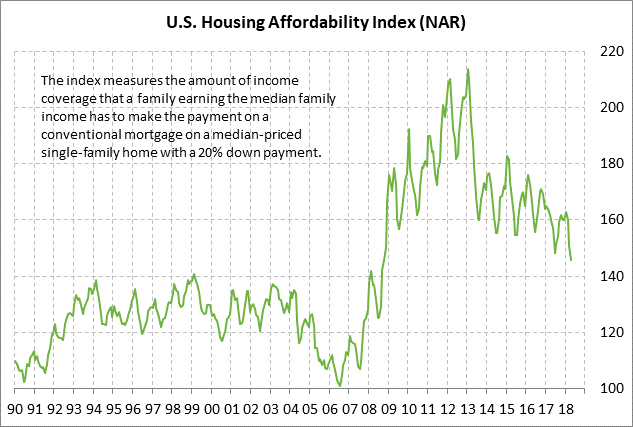

U.S. housing affordability is at a 10-year low — The U.S. Homebuyer Affordability index in April fell to a 10-year low of 145.8, indicating that financial conditions for buying a home are the worst since 2008. However, the good news is that home affordability is still moderately better than it was before the Great Recession during the period of 1990-2005.

The current index level of 145.8 means that a family earning the median family income has 145.8% of the income necessary to qualify for a conventional loan with a 20% down-payment on a median-priced existing single-family home. Among the variables in the index, median income is on the rise but that has been outweighed by the negative factors of rising mortgage rates and the sharp rise in home prices.

Regarding home prices, the FHFA home price index has soared by 46% to a record high from the housing-bust low posted in 2011. The median price of an existing home has steadily risen over the past six years and is currently near a record high at $257,900.

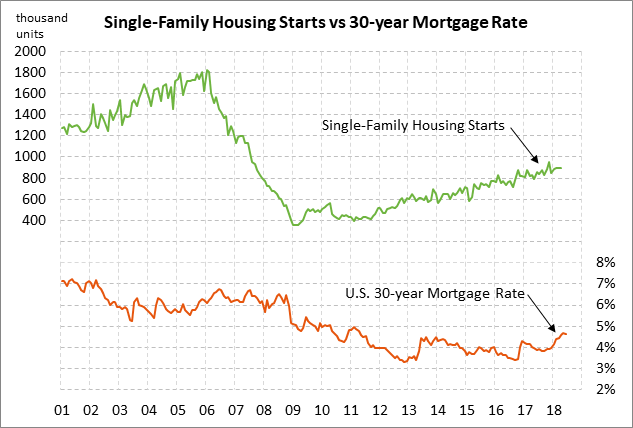

Meanwhile, the 30-year mortgage rate has risen sharply by 100 bp in the last nine months and is currently at 4.62%, which is only 4 bp below the late-May 7-year high of 4.66%. Mortgage rates will almost certainly rise further in coming months as the Fed continues to raise short-term interest rates.

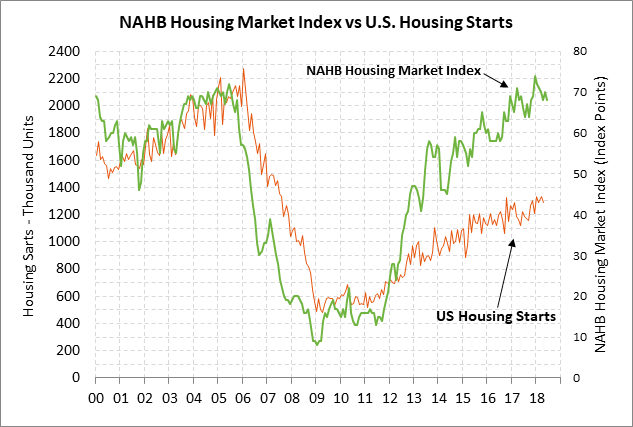

U.S. housing starts expected to remain strong — The consensus is for today’s May housing starts report to show a +1.9% increase to 1.312 million, recovering part of April’s -3.7% decline to 1.287 million. U.S. housing starts have been stuck in a sideways range for the past 1-1/2 years but remain in strong shape. In fact, the April level of 1.287 million units was only 3.7% below March’s 11-year high of 1.336 million units.

U.S. homebuilders remain in a good mood and are plowing ahead with aggressive building plans. The NAHB Housing Market index of 68 in June was only 6 points below the 19-year high of 74 posted in Dec 2017, illustrating that home builder confidence is near the highest level since 1999. U.S. home builders are seeing positive signals such as strong home demand, tight home supplies, and high new home prices.

Merkel gets 2-week reprieve on migrant policy — German Chancellor Merkel has two weeks to try to work out a revised EU migrant policy in order to satisfy her Interior Minister Horst Seehofer, who also happens to be the leader of the Bavarian-based CSU (Christian Social Union). Ms. Merkel last week vetoed Mr. Seehofer’s order to start turning away migrants that have already applied for asylum in another country.

There is an outside possibility that without some sort of compromise, Ms. Merkel might be forced to fire Mr. Seehofer, which could result in the CSU leaving the CDU-led governing coalition and forcing new elections. The CSU is the CDU’s sister party in Bavaria and has no desire to bring down Ms. Merkel’s fragile government that is also supported by the Social Democrats. However, Mr. Seehofer is adopting a harder line against migrants as he tries to prevent voters from switching to the anti-immigrant AfD party in regional elections in October.

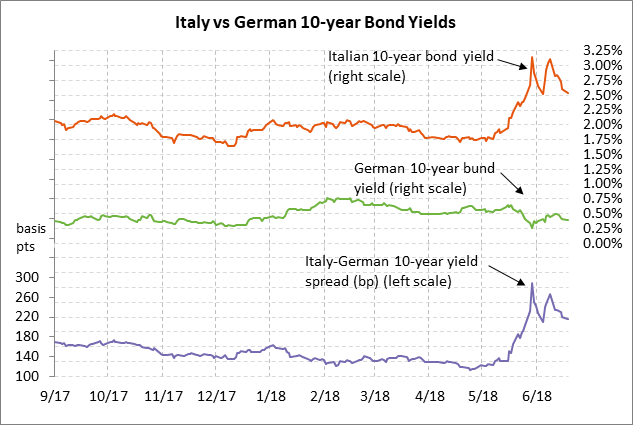

The markets are certainly not happy about the new political drama in Germany, which adds to the already-existing Eurozone political problems in Italy and Spain. Still, the 2-week reprieve for Ms. Merkel was welcomed by the markets on Monday. The Italian 10-year bond yield on Monday fell by 5 bp to 2.55%, where it was down by 60 bp from the late-May 4-year high. EUR/USD closed the day slightly higher by+0.11%.

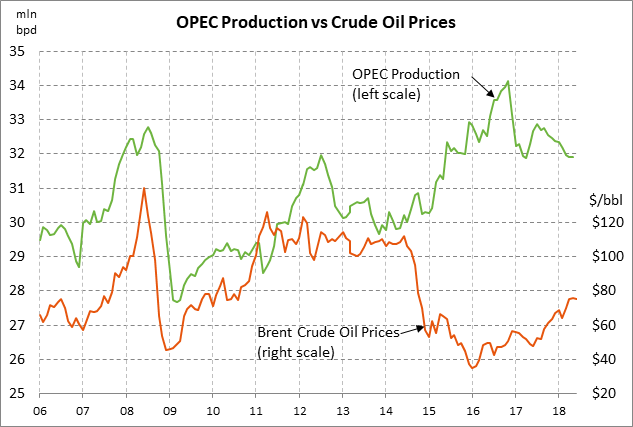

Oil prices stabilize as OPEC+ considers a smaller-than-expected production hike — July crude oil prices yesterday fell to a new 2-month low but then rebounded higher and closed the day up +0.79 (1.21%) at $65.85. July Brent crude showed a larger gain of +1.90 (+2.59%) at $75.34.

Bullish factors for crude oil prices on Monday included (1) short-covering after the steep $8 sell-off seen since late May, and (2) some relief that OPEC+ is now considering a smaller-than-expected production hike at its 2-day meeting this Friday and Saturday in Vienna.

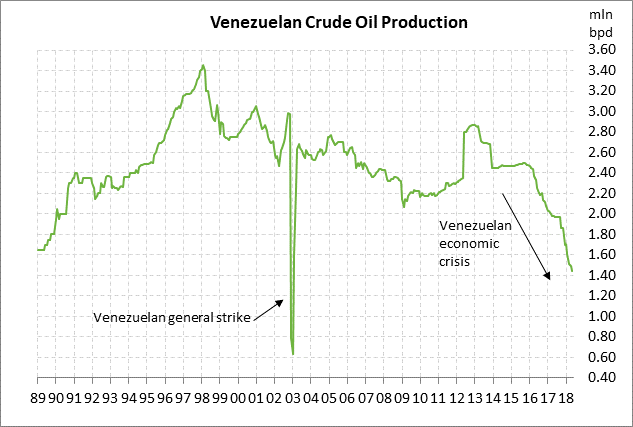

Russia has been pushing for a big production hike of 1.5 million bpd that would largely reverse the current 1.8 million bpd production cut. However, reports are now emerging that OPEC+ is considering a smaller production hike of 300,000-600,000 bpd. The smaller production hike is being considered since Iran, Iraq and Venezuela have threatened to veto any new production hike agreement at the meeting later this week since they cannot increase production and would rather see higher oil prices.

The OPEC+ production cut agreement has been successful in bringing global crude oil inventories closer to its goal of the 5-year seasonal average. However, OPEC+ production has actually fallen by more than the amount specified by the production cut agreement mainly because of a sharp drop in Venezuelan production due to the country’s economic collapse. Moreover, Iranian oil production and exports later this year will take a sharp hit of as much as 1 million bpd as U.S. sanctions take effect.