- U.S. tariffs on China and retaliation

- U.S. consumer sentiment expected to remain strong

- U.S. industrial production expected to fall back after April’s strong report

- ECB meeting outcome is dovish since there will be no rate hike until at least summer 2019

June S&P 500 E-minis this morning are down -0.4% on a Reuters report that the Trump administration is close to finalizing the list of $100 billion worth of Chinese products that will be subject to a 25% tariff as punishment if China follows through with its threat to retaliate for the U.S. tariff on first $50 billion batch of products. President Trump reportedly signed off last night on the first $50 billion batch of products for a tariff, with an official announcement due today. The Euro Stoxx 50 index is down -0.2% this morning. The Chinese Shanghai Composite today fell by -0.7% on the imminent U.S. tariff announcement.

There was no amplification of what constitutes “shortly thereafter.” The administration could announce the implementation as soon as today, or over the weekend, for the tariffs to take effect on Monday. Alternatively, the administration might delay the implementation to use as a lever to see if China is willing to make any last-minute trade concessions.

President Trump on Wednesday said in an interview that, “China could be a little bit upset about trade because we are very strongly clamping down on trade.” He added, “You will see over the next couple of weeks. They understand what we are doing.” Mr. Trump’s comments suggested that the tariffs are coming within the “next couple of weeks.”

In addition to today’s final list of tariffed products, the administration is expected to release the details of its plan to clamp down on Chinese investment in the U.S. by the end of June.

Whenever the Trump administration does announce the implementation of the 25% tariff, China can be expected to follow through with its promise for a reciprocal tariff on its list of $50 billion of U.S. products. Then the markets will find out if Mr. Trump was serious about his threat to slap tariffs on an extra $100 billion of Chinese products as punishment if China retaliates on the first $50 billion of products.

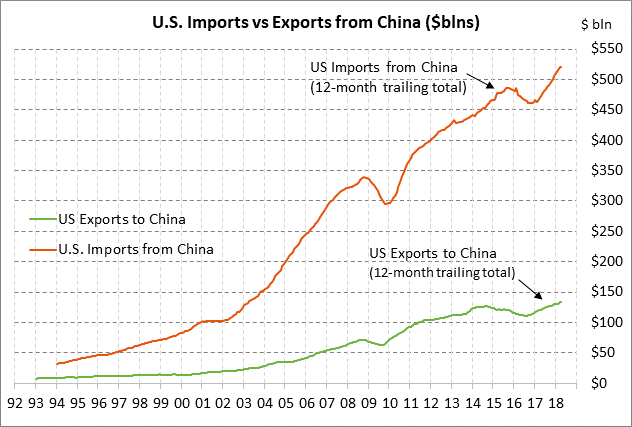

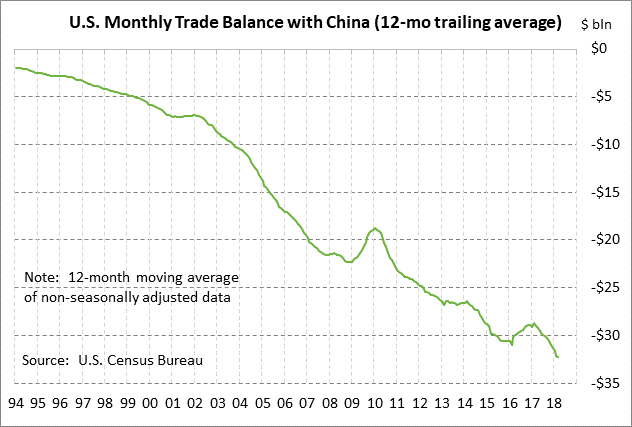

China has not yet said what it would do if the U.S. slaps tariffs on another $100 billion of Chinese products but it would be reasonable to assume that China would levy a reciprocal tariff on another $100 billion of U.S. products. That would put an extra 25% tariff on all the products that the U.S. exports to China since the U.S. over the last 12 months has exported only $133 billion worth of goods to China, according to the U.S. Census Bureau.

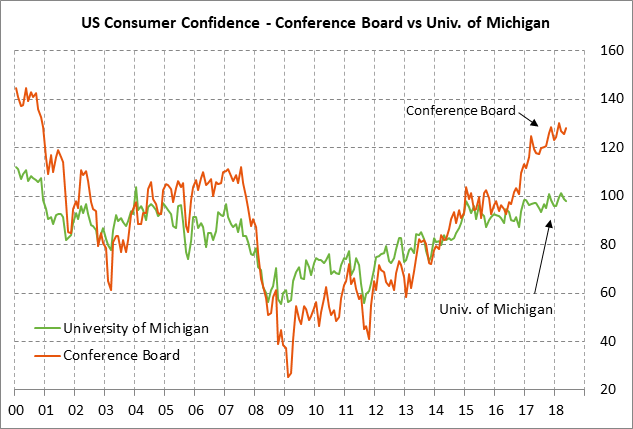

U.S. consumer sentiment expected to remain strong — The market consensus is for today’s University of Michigan preliminary-June U.S. consumer sentiment index to show a +0.5 point increase to 98.5, recovering part of May’s -0.8 point decline to 98.0. The index in May was in strong shape at only 3.4 points below March’s 14-year high of 101.4.

U.S. consumer confidence is seeing support from (1) the strong U.S. labor market, (2) rising wages and salaries, (3) rising household wealth with the steady increase in home prices and the generally strong stock market, and (4) the Jan 1 tax cut that boosted after-tax paychecks. Negative factors for consumer confidence include (1) high gasoline prices, (2) trade tensions and tariffs, (3) Washington political uncertainty, and (4) geopolitical risks.

The good news for the U.S. economy is that strong consumer sentiment is translating into actual spending. Yesterday’s May retail sales report was very strong at +0.8% m/m and +5.9% y/y, capping off a strong 3-month period of spending during March-May. The Atlanta Fed’s GDPNow is forecasting Q2 GDP at a very strong +4.6% following the lackluster Q1 report of +2.2%. A key element of the expectations for a strong Q2 GDP report is GDPNow’s forecast that consumer spending will contribute a hefty 2.3 points to Q2 GDP, up sharply from only 0.7 points in Q1.

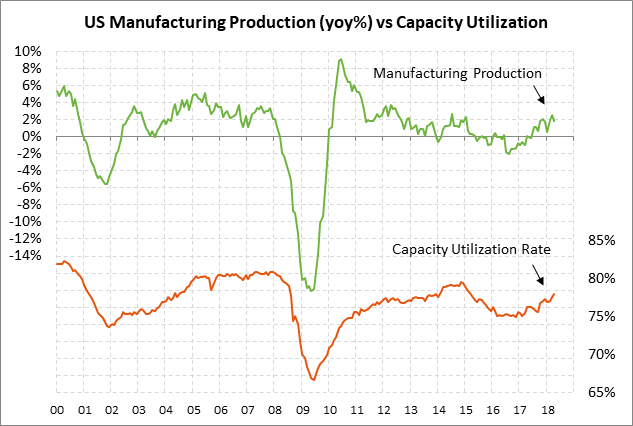

U.S. industrial production expected to fall back after April’s strong report — The market consensus is for today’s May industrial production report to show a modest increase of +0.2% m/m following April’s strong report of +0.7% m/m. Looking at just the manufacturing sector, today’s May manufacturing production report is expected to eke out a small +0.1% gain following April’s solid increase of +0.5%. The U.S. manufacturing sector is in solid shape with the ISM manufacturing index in May at 58.7, which was only 1.2 points below February’s 14-year high of 60.8.

ECB meeting outcome is dovish since there will be no rate hike until at least summer 2019 — Thursday’s ECB meeting outcome was dovish since the ECB explicitly said it will not raise interest rates until summer 2019 at the earliest. The market had previously suspected that the ECB could begin to raise interest rates as soon as spring 2019.

Central banks are usually vague in their guidance in order to keep their options open and give them room to react to new developments as they unfold. It was unusual that the ECB attached an actual date to its promise for unchanged rates. The ECB apparently wanted to prevent speculation that a rate hike could come in early 2019, which could push short-term interest rates higher now in anticipation of that hike. The markets reacted to the ECB’s statement by sharply reducing the chances for an ECB rate hike by June 2019 to 29% from 77% before Thursday’s meeting.

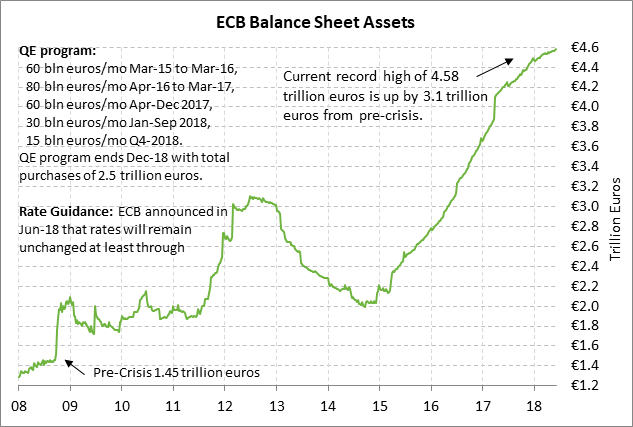

Regarding its QE program, the ECB met market expectations by announcing that it would taper its QE program to 15 billion euros per month in Q4 (from 30 billion euros/month through September) and then end the program altogether at the end of 2018. On the dovish side, the ECB said it will reinvest maturing principle and keep its balance sheet constant “for an extended period of time after the end of net asset purchases,” or longer if necessary to meet its policy goals. The markets can therefore be assured that the ECB is not likely to allow its balance sheet to start falling (thus tightening monetary policy) until at least 2020.