- Market raises Fed rate-hike expectations after mildly bearish FOMC meeting

- U.S. May retail sales expected to be solid

- Trump says China will be upset over trade in coming weeks

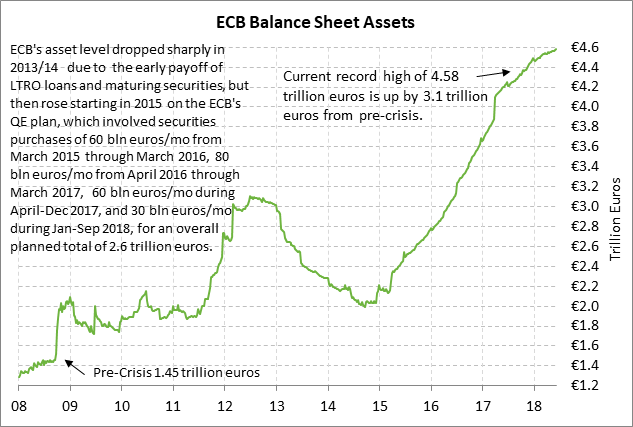

- ECB today may announce the end of its QE program

- BOJ policy expected unchanged

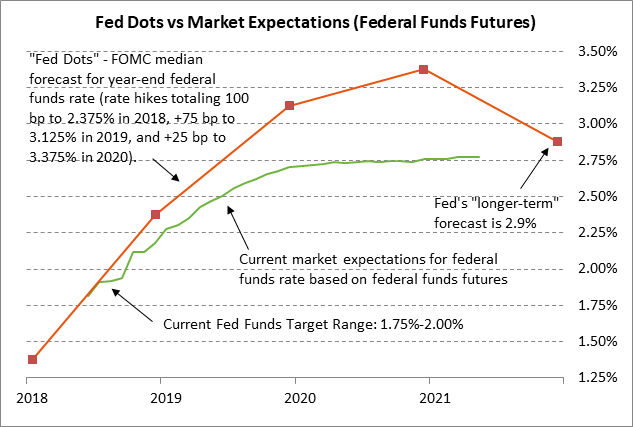

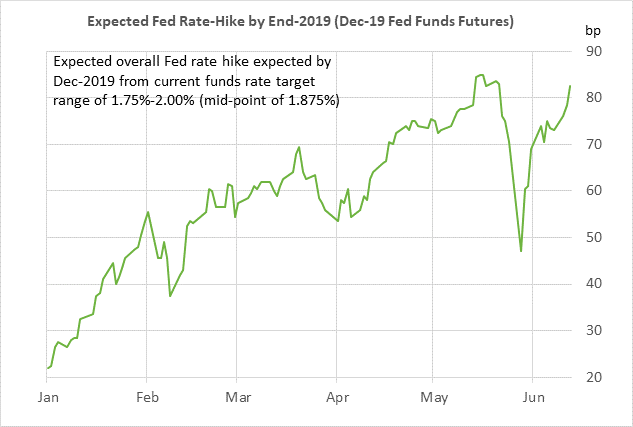

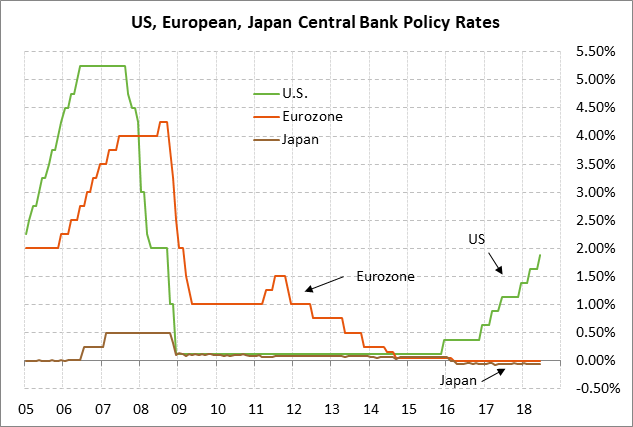

Market raises Fed rate-hike expectations after mildly bearish FOMC meeting — The market mildly raised Fed rate-hike expectations after yesterday’s FOMC meeting announcement, which featured an increase in the Fed dots. The federal funds futures curve (on a yield basis) showed little change for the 2018 contracts but tightened by 4-5 bp for the contracts from late 2019 through 2020. The market is now expecting an additional 82.5 bp of Fed rate hikes (after yesterday’s +25 bp rate hike) through the end of 2019, up by 4 bp from 78.5 bp from Tuesday.

The Fed-dot median forecast for the funds rate at end-2018 rose by +25 bp to 2.375%, which implies two more rate hikes in 2018 (i.e., in September and December). However, the market is discounting the odds at only 60% for the December rate hike (i.e., the fourth of the year), meaning the market isn’t completely sold on the Fed’s hawkish forecast. The higher Fed-dot forecast for 2018, however, really didn’t mean much because it resulted from the movement of a single FOMC member into the four rate-hike camp.

The Fed dots also rose by +25 bp to 3.125% for the end-2019 funds rate, meaning the Fed is now predicting three rate hikes in 2019 rather than two. However, the Fed dots were unchanged for the end-2020 at 2.375%, which means the Fed is now forecasting only one rate hike in 2020 versus the previous two hikes. The market is expecting the funds rate to be at only 2.76% by the end of 2020, which is 62 bp more dovish than the Fed’s forecast of 3.38%.

Fed Chair Powell also announced that starting in 2019 there will be a press conference at every FOMC meeting meaning that every meeting in 2019 will be “live” for a possible rate hike. The FOMC yesterday raised its IOER rate (interest on excess reserves) by only +20 bp to 1.95%, rather than the typical +25 bp hike, in order to encourage the funds rate to trade closer to the middle of the target range. That move was in line with market expectations.

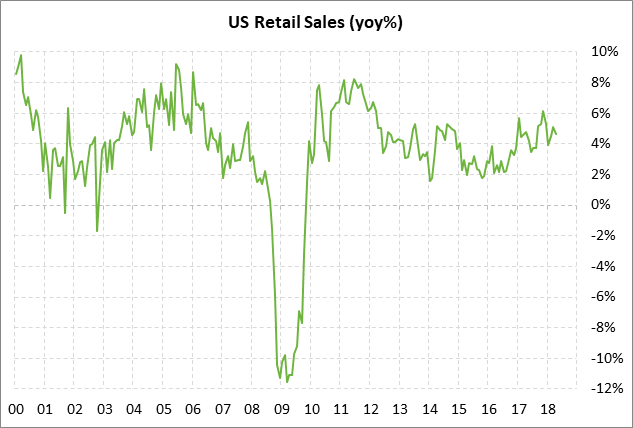

U.S. May retail sales expected to be solid — The market consensus is for today’s May U.S. retail sales report to show a solid increase of +0.4% and +0.5% ex-autos, strengthening a bit from April’s report of +0.3% and +0.3% ex-autos. Retail sales in April were strong on a year-on-year basis at +4.6% and +4.8% ex-autos. The Atlanta Fed’s GDPNow is forecasting Q2 GDP at a very strong +4.6% following the lackluster Q1 report of +2.2%. A key element of the expectations for a strong Q2 GDP report is GDPNow’s forecast that consumer spending will contribute a hefty 2.3 points to Q2 GDP, up sharply from only 0.7 points in Q1.

Trump says China will be upset over trade in coming weeks — President Trump on Wednesday said in an interview that, “China could be a little bit upset about trade because we are very strongly clamping down on trade.” He added, “You will see over the next couple of weeks. They understand what we are doing.”

The Trump administration recently said that it will release the final list of $50 billion worth of Chinese products subject to a 25% tariff this Friday (June 15), with the tariff to be implemented “shortly thereafter.” The markets therefore need to be prepared for the possibility of the tariff implementation any time starting on Friday. A possible outcome would be an announcement this weekend with the implementation taking effect on Monday. The Treasury at the end of June is also set to announce the details of the administration’s clamp-down on Chinese investment in the U.S.

Whenever the Trump administration announces the implementation of the 25% tariff, China can be expected to follow through with its promise of a reciprocal tariff on its list of $50 billion of U.S. products. Then the markets will find out if Mr. Trump was serious about his threat to slap tariffs on another $100 billion of Chinese products as punishment if China retaliates on the first $50 billion of products. China has not yet said what it would do if the U.S. slaps tariffs on another $100 billion of Chinese products but the implication would be that China would levy a reciprocal tariff on another $100 billion of U.S. products, effectively putting a tariff on all the products that the U.S. exports to China including all ag and energy products.

ECB today may announce the end of its QE program — The ECB at its meeting today will formally discuss the end of its QE program, which is currently scheduled to last only through September. A recent Bloomberg survey found that about a third of the respondents expect the ECB to announce an ending date for QE today, whereas about half of the respondents believe the ECB will wait until its July meeting to reveal the QE details.

Whenever the ECB does make its QE announcement, the market consensus is for the ECB to taper its QE program from its current level of 30 billion euros per month to 10 or 15 billion euros per month in Q4-2018 and then allow the program to end altogether at the end of 2018. The market is expecting the ECB to leave its interest rate guidance unchanged by reiterating that rates will remain unchanged “well past” the end of the QE program. The market consensus is that the ECB will raise its -0.40% deposit rate in Q2-2019 and its refinancing rate of zero in Q3-2019, according to a recent survey by Bloomberg.

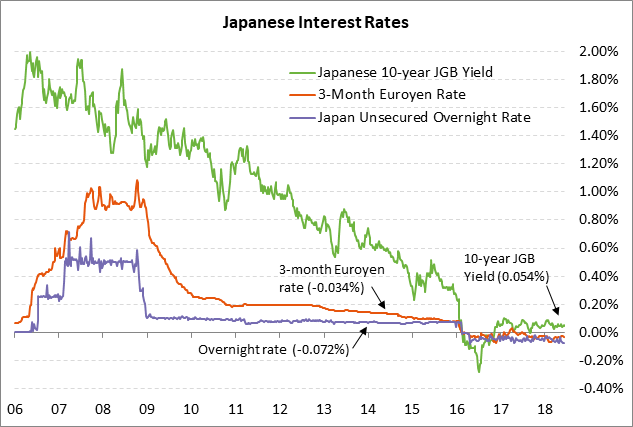

BOJ policy expected unchanged –– The market is unanimously expecting the BOJ at its Thursday/Friday meeting to leave its monetary policy unchanged with its QE program at 80 trillion yen per year and its 10-year JGB yield target at zero. The BOJ is keeping its foot on the gas even while the Fed tightens and the ECB is preparing to end its QE program since Japan’s economy remains lackluster and inflation remains far below the BOJ’s +2.0% target. Japan’s Q1 GDP fell -0.6% (q/q annualized) and Japan’s April CPI ex fresh food and energy was up by only +0.4% y/y.