- Markets brace for acrimonious G-7 summit

- Markets brace for next Tuesday’s high-wire U.S./North Korea summit

- Hawkish Fed and ECB meetings expected next week while BOJ policy is expected unchanged

Markets brace for acrimonious G-7 summit — The markets are braced for a potentially acrimonious G-7 summit to be held today and Saturday in Quebec. French President Macron has reportedly said he will not sign a G-7 communique unless there is some progress on tariffs, the Iran nuclear agreement, and climate. German Chancellor Merkel has said she will challenge President Trump on tariffs and other issues.

The Trump administration angered all six of the other G-7 members by slapping tariffs on their steel and aluminum exports to the U.S. The U.S. steel-aluminum tariffs are being challenged by multiple countries at the WTO as illegal and there have already been some retaliatory tariffs slapped on U.S. products. There is even more concern about President Trump’s announcement of an investigation into the possibility of slapping a tariff on U.S. auto imports.

The market is already well aware of the factors behind what is likely to be a contentious G-7 meeting, which means that the meeting in theory should be a non-event for the markets. In all likelihood, G-7 leaders in the end will try to put the best face on the meeting in order to preserve global business and consumer confidence and avoid causing a stock market sell-off. Nevertheless, global stocks could suffer on Monday on the outside chance that the meeting devolves into a shouting match with the promise of more strife and tariffs ahead.

Markets brace for next Tuesday’s high-wire U.S./North Korea summit — The markets over the next few days will be handicapping the outcome of the planned summit this coming Tuesday (June 12) in Singapore between President Trump and North Korean leader Kim Jong Un. Global stocks should see some support if the meeting happens at all since that would imply reduced military tensions on the Korean peninsula. Both the U.S. and North Korea have every reason to bill the meeting as a success regardless of whether or not there is substantive progress on the underlying issues.

However, there is the outside chance that the meeting might not go well if the two sides meet and find out that there is no path towards denuclearization. President Trump has already said that he would walk out of the meeting if he doesn’t think Kim is serious about denuclearization. That would obviously have negative consequences for the markets next week on renewed Korea geopolitical tensions.

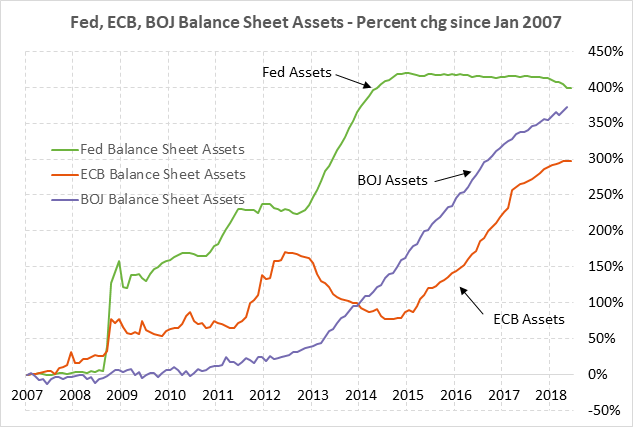

Hawkish Fed and ECB meetings expected next week while BOJ policy is expected unchanged — The Fed at its 2-day meeting next Tue/Wed is unanimously expected to implement its second +25 bp rate hike of the year, while the ECB may announce a decision to end its QE program by December. The BOJ at its meeting next Thursday/Friday is expected to leave its key policy indicators unchanged but there is a chance of less dovish guidance.

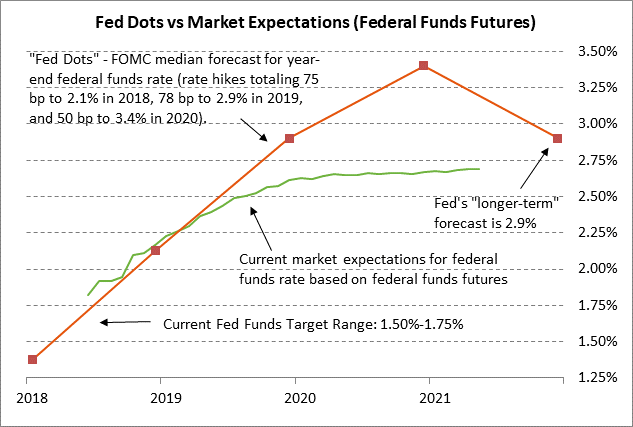

For next week’s FOMC meeting, the markets are discounting the odds at 100% for a +25 bp hike in the federal funds target range to 1.75%/2.00% from its current target of 1.50%/1.75%, based on federal funds futures pricing. That would be the Fed’s second rate hike of 2018. The Fed’s first rate hike of the year occurred two meetings ago on March 20-21. Next week’s FOMC meeting will feature new Fed macroeconomic forecasts, new Fed-dot forecasts for the funds rate, and a press conference from Fed Chair Powell.

After next week’s expected rate hike, the market is discounting the odds for the Fed’s third rate hike of the year at 90% by September the odds for a fourth rate hike by December at 40%. The market’s rate hike expectations temporarily dipped last week during the Italian and Eurozone turmoil but have since mostly recovered to previous levels.

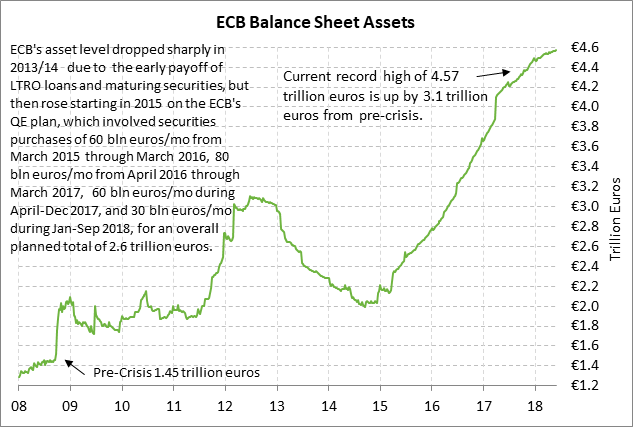

For Thursday’s ECB meeting, the markets are on edge since ECB chief economist Peter Praet said earlier this week that “it’s clear that next week the Governing Council will have to make this assessment” on when to end QE. The ECB next week could therefore announce that it will taper QE to 10 billion or 15 billion euros in Q4 and then end QE altogether in December 2018, which would be in line with the market consensus. Alternatively, the ECB could simply discuss the matter internally and defer an announcement until its next meeting in July. The markets would receive a hawkish shock in the unlikely event that the ECB decides to end its QE program altogether at the end of September.

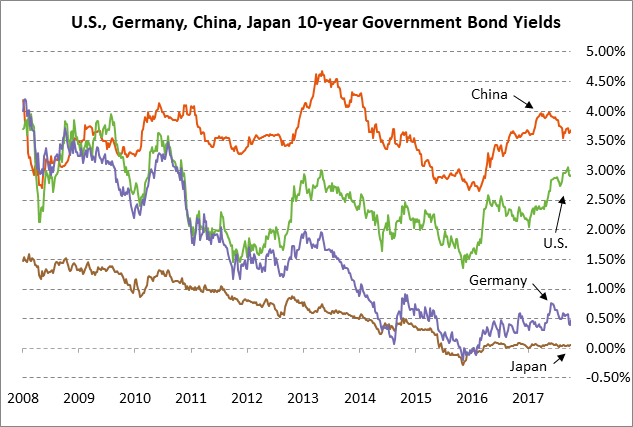

This week’s news reports that the ECB is close to a decision on ending QE caused a sharp sell-off in bund prices. The 10-year German bund yield rose sharply this week by +29 bp to 0.48% from last week’s 1-1/4 year low of 0.19% that was posted on the Italian political strife. The markets this week were not particularly surprised to hear that the ECB is nearing a decision to end QE, but the early timing of the decision did cause the market to bring forward expectations for the ECB’s first hike in the deposit rate to spring 2019 from previous expectations of autumn 2019.

The Bank of Japan at its 2-day policy next Thursday/Friday (June 14-15) is expected to leave its key policy variables unchanged with the 10-year JGB yield at zero and the nominal annual QE target unchanged at 80 trillion yen. However, there is the chance that BOJ officials could start to signal an eventual end to its QE program and a rise in its 10-year JGB yield target. The BOJ earlier this week created a stir by reducing the size of its 5-year and 10-year JGB purchases. The market suspects that the smaller JGB purchases were due to technical factors, but the move nevertheless sparked some talk that the BOJ might be starting to consider a tighter policy. The 10-year JGB yield this week rose by +3 bp to 0.055% from last week’s 2-1/2 month low of 0.025%.