- Peso falls as Mexico follows through with tariff retaliation on U.S. ag and steel products

- Italian bonds show renewed weakness after PM Conte reiterates the populists’ radical fiscal plans

- ECB could announce a QE exit decision next week

- April U.S. trade deficit expected to remain at a 6-month low

Peso falls as Mexico follows through with tariff retaliation on U.S. ag and steel products — The Mexican government on Tuesday announced the list of U.S. products that will be hit with increased tariffs as retaliation for President Trump’s move last week to implement steel and aluminum tariffs on Mexico and Canada. Mexico will slap tariffs on U.S. metal products and ag products such as pork, cheese, apples and potatoes. The list excludes more important U.S. products such as corn and soybeans which Mexico needs to keep its consumer food costs low and provide feed for its livestock producers.

The Mexican peso on Tuesday plunged by -2% to a new 15-month low and extended the overall sell-off seen in the past 6-weeks to -11%. In addition to the Mexican tariff retaliation for U.S. steel and aluminum tariffs, the markets remain nervous that President Trump may yet make good on his threat to withdraw from NAFTA. The NAFTA talks are going slowly and will now bleed into 2019 since there is no longer enough time for Congress to approve a new NAFTA treaty before the new Congress takes over in January after the November elections. In addition, President Trump in the past several days has been floating the idea of dumping the 3-country NAFTA framework altogether and instead negotiating bilateral trade deals with U.S./Mexico and U.S./Canada.

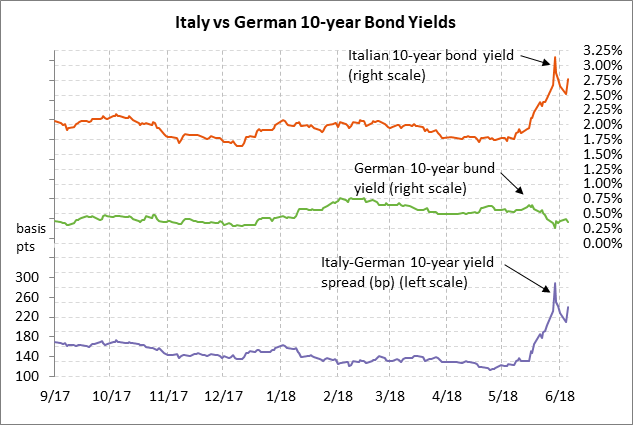

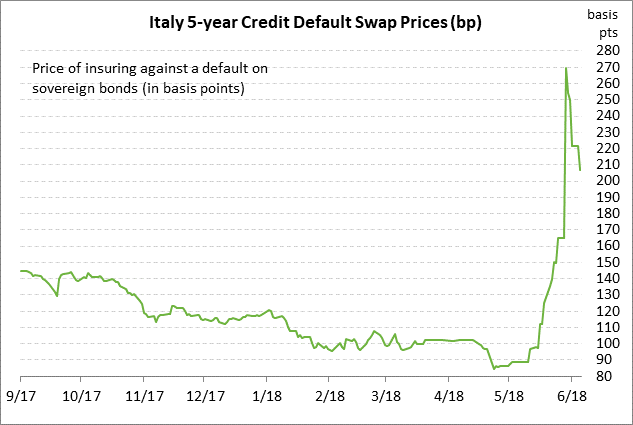

Italian bonds show renewed weakness after PM Conte reiterates the populists’ radical fiscal plans — Italy’s new government, led by Prime Minister Conte, received a vote of confidence in parliament on Tuesday, thus finalizing the process of taking power. However, the Italian bond market fell sharply on Tuesday after Mr. Conte in his maiden speeches reiterated that the government plans to make good on its platform promises for a guaranteed minimum income, sharp tax cuts, and higher health spending. Those fiscal moves will cost some 120 billion euros and boost Italy’s debt above the already alarming 130% of GDP. Mr. Conte at least did not stress the government’s intent to reduce the retirement age, thus boosting retirement costs.

Market concern about a worsening Italian debt outlook helped push Italy’s 10-year bond yield on Tuesday sharply higher by +26 bp to 2.78%, which was only 37 bp below from last Tuesday’s 4-year high of 3.15% and far above the 1.80% level seen just three weeks ago. The 10-year Italy-German bond yield spread on Tuesday rose sharply by +30 bp to 242 bp, which was -48 bp below last Tuesday’s 3-3/4 year high of 290 bp.

On a more positive note, Mr. Conte in one of his speeches on Tuesday said that a euro exit “has never been discussed” and isn’t a goal of the government. However, he reiterated that Italy wants to renegotiate Eurozone fiscal rules and radically change the EU’s immigration policy, which ensures that there will be plenty of alarming Italy-Eurozone headlines in coming weeks and months. PM Conte plans to hold a bilateral meeting with German Chancellor Merkel on the sidelines of the Friday/Saturday G-7 summit in Quebec.

ECB could announce a QE exit decision next week — The ECB at its meeting next Thursday (June 14) expects to discuss whether to issue a statement on the fate of its QE program, according to a Bloomberg report on Tuesday. However, the report also said that ECB members may decide to delay an announcement until the July meeting.

The ECB’s QE program of 30 billion euros/month is currently scheduled to last only through September. The market consensus is that the ECB will taper the program to 10 or 15 billion euros per month in Q4 and then end the program altogether at the end of 2018. The ECB has already said that it anticipates reinvesting the principal from maturing securities after it ends Q3, ensuring that the ECB’s balance sheet does not start falling and tighten monetary policy after the QE program ends. The ECB’s guidance also states that it will not start raising interest rates until “well after” the QE program ends. The market is not expecting an ECB rate hike until at least mid-2019.

The euro continues to see weakness due to (1) the political threats to the Eurozone from Italy’s new populist government, (2) the recent soft Eurozone economic data, and (3) continued soft Eurozone CPI data that will keep the ECB on the dovish side in coming months. However, an ECB announcement on the ending of QE at the end of 2018 should provide some underlying support for the euro.

April U.S. trade deficit expected to remain at a 6-month low — The market consensus is for today’s April U.S. trade deficit o be unchanged from March’s 6-month low of -$49.0 billion. The U.S. trade deficit in March fell sharply to a 6-month low from Feb’s 9-year high of -$57.7 billion mainly because of a +2.0% m/m surge in U.S. exports to a new record high of $208.5 billion.

However, April’s surge in U.S. exports may be unsustainable since it was likely due in part to overseas customers trying to order U.S. products before retaliatory tariffs are imposed. The various tariffs that have already been imposed will have a mixed impact on the U.S. trade deficit since U.S. tariffs will reduce imports but overseas retaliatory tariffs will have an offsetting effect by reducing U.S. exports.

In some good news for the U.S./Chinese trade relations, the U.S/Chinese trade deficit in March fell to a 1-year low of -$25.9 billion from January’s 2-1/2 year high of -$35.95 billion. That decline in the deficit was due to both a big increase in U.S. exports to China and a decrease in U.S. imports from China. However, trade flows may simply be getting disrupted by the new tariffs and by the threat of even more tariffs, still leaving the underlying U.S./Chinese trade deficit at high levels that will cause the Trump administration to keep up its pressure on China for trade concessions.

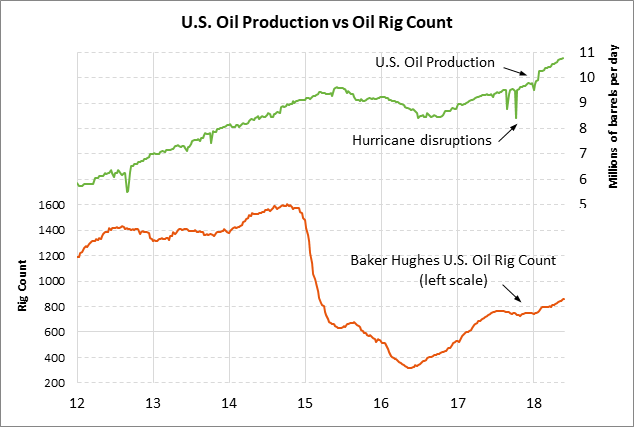

— The market consensus for today’s weekly EIA report is for a -3.0 million bbl drop in U.S. crude oil inventories, a +500,000 bbl rise in gasoline inventories, and a +1.1 million bbl rise in distillate inventories. U.S. crude oil inventories are currently -1.2% below the 5-year seasonal average. Meanwhile, gasoline inventories are ample at +3.6% above average while distillate inventories are tight at -13.5% below average. U.S. crude oil production in last week’s report rose by +0.4% w/w to a new record high of 10.769 million bpd.

— The market consensus for today’s weekly EIA report is for a -3.0 million bbl drop in U.S. crude oil inventories, a +500,000 bbl rise in gasoline inventories, and a +1.1 million bbl rise in distillate inventories. U.S. crude oil inventories are currently -1.2% below the 5-year seasonal average. Meanwhile, gasoline inventories are ample at +3.6% above average while distillate inventories are tight at -13.5% below average. U.S. crude oil production in last week’s report rose by +0.4% w/w to a new record high of 10.769 million bpd.