All the decision-making tools necessary to invest and open a managed futures account with CCS Futures.

At Capitol Commodity Hedging Services Futures we work with individual and institutional investors to define their ideal risk/reward profile and present clients the CTA(s) with the most potential to achieve their unique investment goals. By opening a managed futures account at Capitol Commodity Hedging Services you partner with the oldest and largest independent futures commission merchant in the world, R.J. O’Brien, with over $8 billion in client assets. Since founded in 1983 Capitol Commodity Hedging Services has built its reputation on value-added client service and risk management to assure the safety of its customers’ assets.

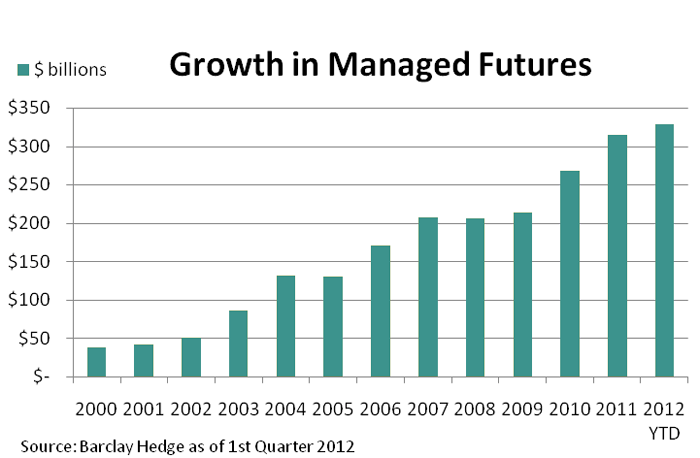

When added to a portfolio of traditional assets, managed futures can enhance return and lower overall risk through their positive diversification effects. Since they are actively managed by a professional with the opportunity to profit in different market conditions, the correlation between the stock market and CTA returns is near zero. Managed futures also allow investors to leverage a CTA’s expertise, experience, and resources in order to outperform traditional assets while limiting drawdowns through active risk management. The lower probability of serious damage in systemic crises and smoother positive returns are particularly appealing characteristics to institutional money managers and have contributed to the growing popularity of managed futures over the past decade.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Get In Touch

Our willingness to share over 40 plus years of our experience is the foundation of our business. Call Us Now : 1-317-848-8050Contact

Get In Touch

Capitol Commodity Hedging Services

3905 Vincennes Road Suite 303

Indianapolis

IN 46268

317-848-8050