- U.S. unemployment report will be critical factor for QE tapering decision

- U.S. ISM services index expected to fall back from record high

- U.S. Covid infections keep climbing

U.S. unemployment report will be critical factor for QE tapering decision — Today’s unemployment report will be a critical factor in the FOMC’s decision at its next meeting in three weeks (Sep 21-22) on whether they will announce QE tapering.

Strong payroll data for August could convince the FOMC that it is safe to go ahead with QE tapering even though the pandemic is still raging. By contrast, if the August labor market data is weak, then the FOMC may decide to delay a tapering decision until its next meeting on Nov 2-3 as it waits to gauge the size of the hit to the U.S. economy from the pandemic’s resurgence.

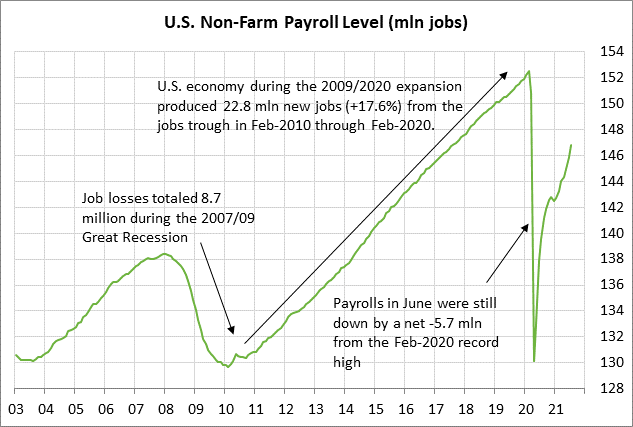

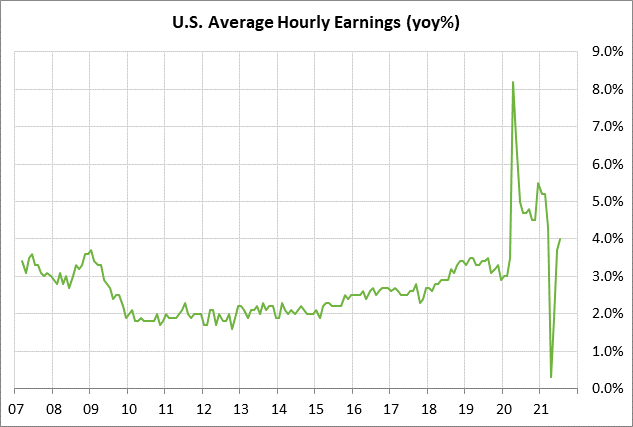

The consensus for today’s August payroll report is for a large increase of +750,000. Payrolls have been very strong in the past three months, with a monthly average of +832,000 (May +614,000, June +938,000, July +943,000). Expectations for today’s payroll report were undercut by Wednesday’s Aug ADP employment report, which rose by only +374,000, weaker than expectations of +625,000.

The markets are waiting to see whether businesses are pulling back on their hiring plans due to the pandemic’s resurgence, which has caused some businesses to delay plans to return to the office and institute mandatory vaccination rules. Increased pandemic restrictions are particularly damaging for the restaurant, travel, and entertainment industries.

A pull-back in hiring would disrupt the Fed’s plans since the U.S. labor market still has a long way to go before returning to health. The U.S. economy must produce another 5.7 million jobs to get the payroll job level back up to the pre-pandemic record high seen in February 2020.

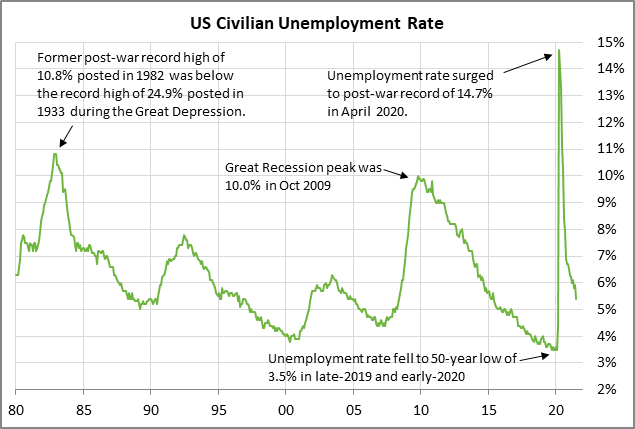

The consensus is for today’s Aug unemployment rate to show a -0.2 point decline to 5.2%, adding to July’s sharp -0.5 point decline to a 16-month low of 5.4%. July’s drop in the unemployment rate to 5.4% was a welcome development since the unemployment rate is now only 1.9 points above the pre-pandemic record low of 3.5%.

However, the Fed knows that the unemployment rate will be increasingly difficult to push lower since more people are likely to come back into the labor market as jobs increase. The increased pool of available workers will keep upward pressure on the unemployment rate.

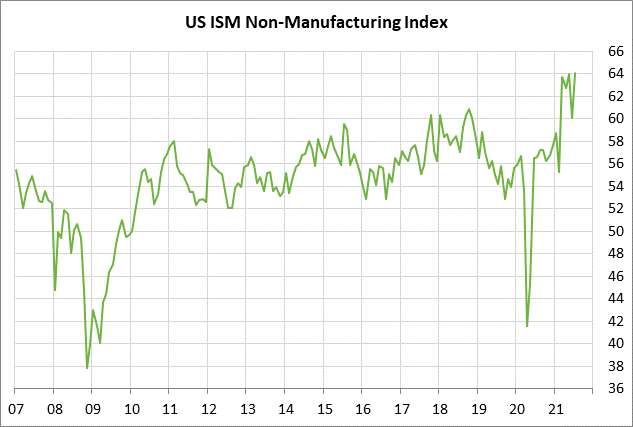

U.S. ISM services index expected to fall back from record high — The consensus is for today’s Aug ISM services index to show a -2.4 point decline to 61.7, reversing part of July’s +4.0 point increase to a record high of 64.1 (data since 1997).

The ISM services index in July hit a record high of 64.1 despite the resurgence in the pandemic. However, business confidence in August is expected to fall back as the pandemic worsened in August and showed no signs of fading. In addition, some business sectors such as restaurants and travel are being hurt as more people are being cautious about leaving their houses and as some areas have imposed new restrictions.

On the brighter side, the ISM manufacturing index for August, which was released earlier this week, showed an unexpected +0.4 point rise to 59.9 despite the pandemic’s resurgence.

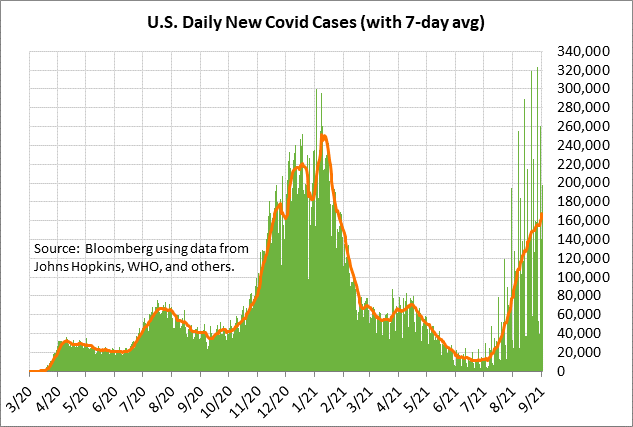

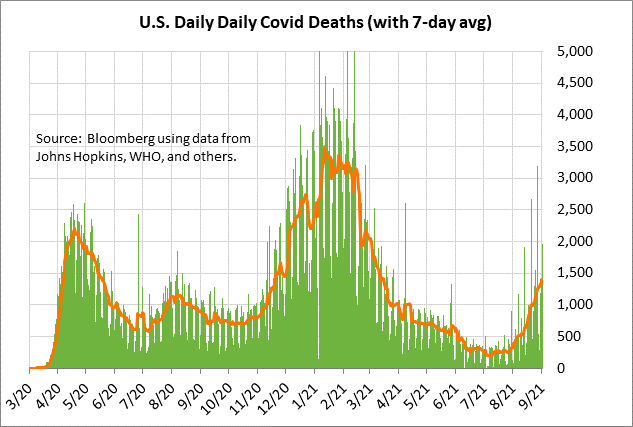

U.S. Covid infections keep climbing — The recent surge in Covid infections has yet to peak. The 7-day average of new U.S. Covid infections on Wednesday rose to a new 7-month high of 167,680. New daily U.S. Covid infections are now at two-thirds of the record high of 251,085 posted in January. The 7-day average of daily Covid deaths on Wednesday rose to a new 5-1/2 month high of 1,401.

On the brighter side, more people are gaining some immunity every day by getting vaccinations or by recovering from a Covid infection, thus bringing the U.S. closer to some semblance of herd immunity.

Bloomberg reports that a daily average of 910,432 vaccine doses have been administered over the past week, which is much higher than the pre-delta level in the 500,000 area. The CDC reports that 52.7% of the total U.S. population is now fully vaccinated, while 62.0% have received at least one dose.

The stock market continues to shake off the pandemic’s resurgence, apparently because investors believe that large U.S. businesses have learned to live with the pandemic and will be able to keep the earnings machine churning.

The Fed is cautious about the pandemic’s resurgence but is nevertheless making plans to announce QE tapering within the next 2-3 months. The Fed apparently thinks the U.S. economy will remain relatively strong despite the pandemic’s resurgence.