- Stocks fall on concern about weaker economic growth and Delta variant

- FOMC policy in focus with Powell testifying next week

- Senate will get to work next week on infrastructure bill

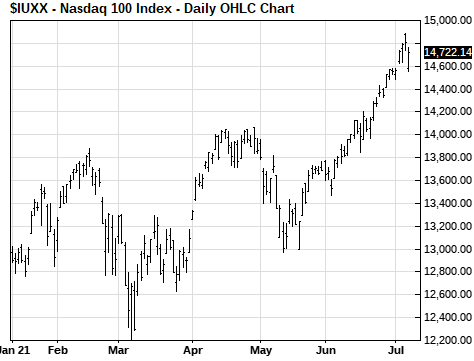

Stocks fall on concern about weaker economic growth and Delta variant — U.S. stocks fell on Thursday as concern grew about the economy due in part to the surge in the Delta variant in the U.S. and worldwide. The S&P 500 index on Thursday fell to a 1-week low and closed the day down -0.86%. The Nasdaq 100 index on Thursday fell back from Wednesday’s record high and closed the day down -0.60%.

The stock market finally acknowledged the doubts about the economy that the Treasury market seems to have flagged in the past week. The 10-year T-note yield hit the skids starting with last Friday’s +0.1 point rise in the unemployment rate and has fallen sharply by a total of -17 bp since last Thursday to yesterday’s 4-1/2 month low of 1.29%.

The spread of the delta Covid variant worldwide has forced renewed lockdowns across parts of Asia and Australia and has sparked concern about a slowdown in global growth. That has led to selling in economically sensitive stock sectors such as industrial and commodity stocks, consumer discretionary stocks, and energy stocks.

The Delta variant is also causing the pandemic to worsen in the U.S. The 7-day average of new U.S. Covid infections fell to a 15-month low of 11,351 on June 23, but has since been on the upswing and was at 15,063 on Wednesday. The 7-day average would probably be higher if it were not for the fact that Covid reporting seemed to be under-reported during the Fourth of July weekend.

The CDC has said the Delta variant accounted for more than 51% of new Covid cases in the U.S. during June 20 to July 3, according to reporting by Politico. Also, Politico reports that Covid hospitalizations are up more than 40% in the past two weeks in Arkansas, Iowa, and Nevada. ICU beds in Missouri are more than 80% filled.

FOMC policy in focus with Powell testifying next week — Fed Chair Powell will deliver his semi-annual testimony on monetary policy to Congressional committees next week, which will keep the market focused on Fed policy.

The Fed has so far managed to prevent a taper tantrum even though FOMC members at their last meeting on June 16-17 officially began discussions on when to taper QE. Mr. Powell, in his post meeting press conference, downplayed the talks by saying they were only “talking about talking.”

Nevertheless, QE tapering is coming. The minutes from the June 16-17 FOMC meeting said that the time is not yet ripe for QE tapering, with the comment that “The committee’s standard of ‘substantial further progress’ was generally seen as not having yet been met, though participants expected progress to continue.” However, the minutes also said that “Various participants mentioned that they expected the conditions for beginning to reduce the pace of asset purchases to be met somewhat earlier than they had anticipated at previous meetings.”

A survey taken by Bloomberg in June showed a consensus that the Fed’s early warning of QE tapering will come at either the August Jackson Hole conference or the following FOMC meeting on September 21-22. That survey showed that 33% of the respondents expect the formal announcement of QE tapering in September, 10% in October or November, and 33% in December.

While QE tapering is on the horizon, the market believes that the Fed’s first +25 bp rate hike is more than a year away in early 2023, according to the federal funds futures market. The market is now expecting two rate hikes in 2023.

Meanwhile, FOMC members have turned more hawkish about rate hikes. The new FOMC dot-plot from the June 16-17 meeting showed that 7 of the 18 FOMC members are now expecting at least one +25 bp rate hike in 2022, and 11 of the 18 members are expecting a total of at least two rate hikes by the end of 2023.

Senate will get to work next week on infrastructure bill — The Senate will return this coming Monday from its Fourth of July recess and will get to work on an infrastructure bill. The House, by contrast, has another week off and will not return to Washington until July 19. Congress will only be in session for a few weeks and will then leave in early August for its August recess, not returning to Washington until after Labor Day.

The Senate within the next several weeks is expected to vote on both the $579 billion bipartisan infrastructure bill and the budget resolution that would provide the framework for a Democratic-only infrastructure reconciliation bill. Both of those bills still need to be finalized next week so they are ready for a vote. Democrats are widely split on the proposed size of the reconciliation bill.

There continue to be doubts about whether the Senate will be able to pass a bipartisan infrastructure bill since ten Republicans will be needed to prevent a filibuster, assuming all Democratic Senators are on board with the bipartisan bill. The bipartisan bill has yet to prove it has the revenue-raising measures necessary to pay for the bill. Also, Republicans are not happy that Democrats are conditioning the bipartisan bill on the reconciliation bill.

If the bipartisan bill doesn’t pass the Senate, then Democrats will simply roll the provisions into their reconciliation bill. However, there are doubts about how large Democrats can go with the reconciliation bill because of the desire of moderate Democratic Senators Manchin and Sinema to minimize the size of the bill and keep things as bipartisan as possible. The Senate will not begin voting on the final reconciliation infrastructure bill until this autumn.