- Market’s view of U.S. short-term interest rates has likely become overly dovish

- JOLTS job openings will be watched for any fresh labor market weakness

- 3-year T-note auction to yield near 0.84%

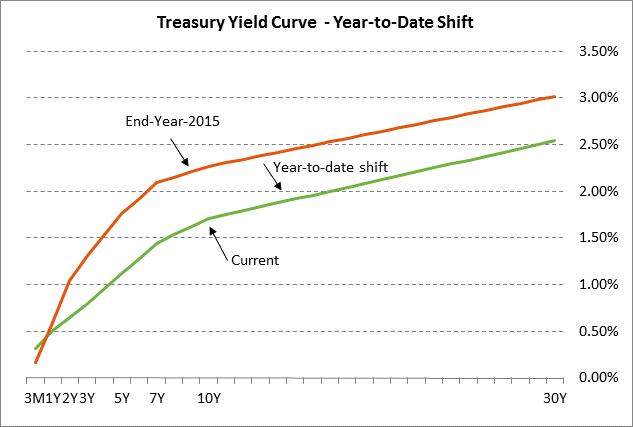

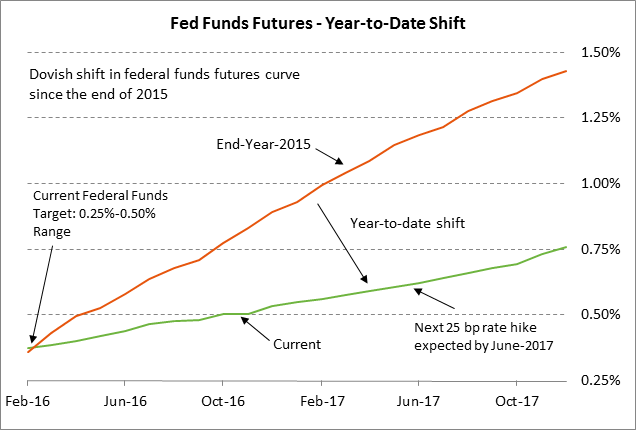

Market’s view of U.S. short-term interest rates has likely become overly dovish — The prospects for U.S. short-term interest rates have turned much more dovish since the beginning of the year. After the Fed implemented its +25 bp rate hike on Dec 16, the federal funds futures market was discounting two +25 bp rate hikes in 2016, the first by mid-year and the second by year end. FOMC members were much more hawkish than the market, forecasting four +25 bp rate hikes in 2016.

However, market expectations for Fed policy turned substantially more dovish in January. The Chinese government at the beginning of January forced a further -1.2% depreciation of the yuan, which caused a sharp sell-off in the Chinese stock market on fears of capital flight. The turmoil in China in turn helped to spark a sharp sell-off in the U.S. stock market on worries that China might be headed for a hard landing. The U.S. stock market also fell on expectations for an earnings recession with S&P 500 earnings growth expected to fall -4% y/y in Q4 and Q1.

The markets on Jan 29 then received the disappointing U.S. Q4 GDP report of only +0.7%, which reflected tepid consumer spending, non-existent business investment, and poor net exports. Last Friday, the markets then received the weak Jan payroll report of +151,000, which was substantially below the market consensus of +190,000 and thereby raised worries about whether companies are lightening up on hiring due to the recent turmoil.

Another negative factor for the U.S. markets is concern about credit quality caused by the weak economy and the recessions in the petroleum and mining sectors. The iShares iBoxx High Yield Corporate Bond ETF (HYG) sold off sharply in mid-December after the Third Avenue junk bond fund halted redemptions from its fund on Dec 10 due to heavy losses. Junk bond prices then took another dive in the first half of January when HYG fell sharply to a new 6-1/2 year low as the U.S. stock market correction sparked a heavy exit from risk trades.

The recent spate of bad news has caused the markets to turn dramatically more dovish on Fed policy. The federal funds futures market at present is not fully discounting the Fed’s next +25 bp rate hike until June 2017, meaning the markets are not fully expecting the Fed’s next rate hike for another 1-1/3 years. The market is then expecting only two +25 bp rate hikes in 2018.

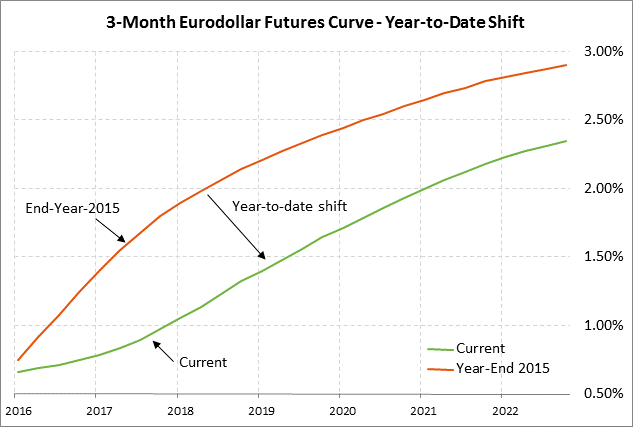

The dovish shift in market expectations for Fed policy has caused the Eurodollar futures curve on a yield basis to plunge by about -80 bp. Specifically, the Dec 2017 Eurodollar futures contract is currently trading at 0.975% (i.e., a price of 99.025), down by -80 bp from the end-2015 level of 1.775% (98.225). Meanwhile, the Dec 2018 Eurodollar futures contract fell by -79 bp to the current level of 1.32% (98.68) from 2.11% (97.89) at the end of 2015.

We believe that the pendulum has swung too far in the direction of expecting extraordinarily low short-term interest rates over the next several years. We believe that the markets are discounting an overly bearish view of the global economy. We suspect that the Fed will be forced to implement another +25 bp rate hike by the fourth quarter of this year, resulting in at least a modest upward shift in the federal funds and Eurodollar futures curves.

The main caveat to our base view is the outside possibility that China could fall into a hard landing or that the U.S. economy could sink into a recession, in which case the federal funds and Eurodollar futures curves on a yield basis would fall sharply from even their current levels. In the event of a U.S. recession, the Fed would likely be forced to retract its December 25 bp rate hike and might even be forced to join the ECB and BOJ with a new QE program and negative interest rates.

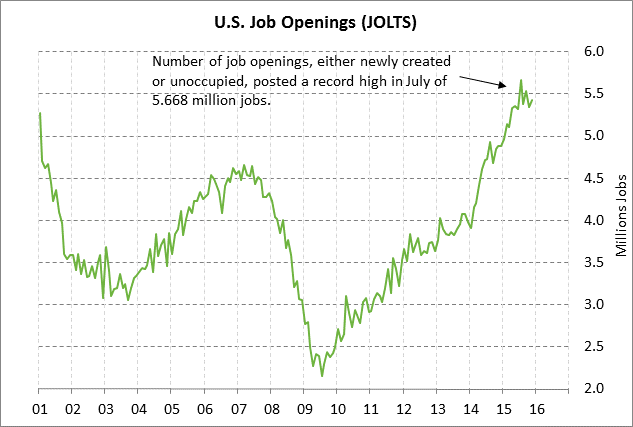

JOLTS job openings will be watched for any fresh labor market weakness — The market is expecting today’s Dec JOLTS job openings report to show a decline of -18,000 to 5.413 million, reversing part of the +82,000 gain to 5.431 million seen in November. The JOLTS report spiked higher to a record high of 5.668 million in July 2015 but then fell back quickly and was -237,000 below that record high in November. A weak JOLTS report today would fuel additional concerns that U.S. companies may be starting to lighten up on their workforce levels in response to the financial market turmoil.

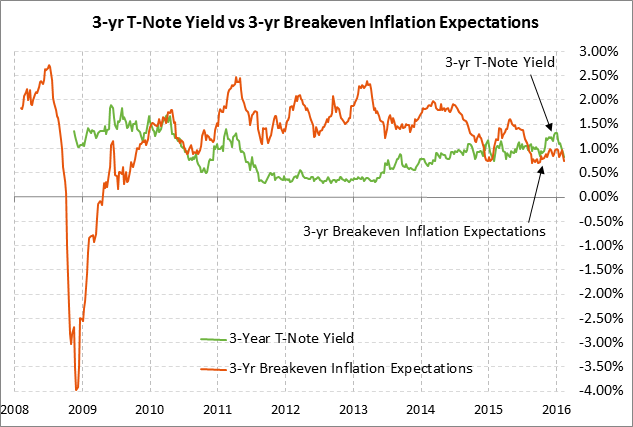

3-year T-note auction to yield near 0.84% — The Treasury today will sell $24 billion of 3-year T-notes. The Treasury will then continue this week’s $52 bln coupon package by selling $23 billion of 10-year T-notes on Wednesday and $15 billion of 30-year T-bonds on Thursday. The Treasury will sell new 10-year and 30-year securities this week as opposed to reopening a previous issue. The $23 billion size of Wednesday’s 10-year auction is $1 billion smaller than the $24 billion size seen since May 2010, reflecting the Treasury’s intent to boost T-bill sales. The $15 billion size of Thursday’s 30-year bond auction is $1 billion smaller than the $16 billion size since seen since Nov 2009.

Today’s 3-year T-note was trading at 0.84% in when-issued trading late yesterday afternoon. The 12-auction averages for the 3-year are as follows: 2.94 bid cover ratio, 3.6 bp tail to the median yield, 23.0 bp tail to the low yield, and 52% taken at the high yield. The 3-year is the second least popular security behind the 2-year among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of only 50.3% of the last twelve 3-year auctions, well below the average of 55.1% for all recent Treasury coupon auctions.