- House expected to vote Friday on Build Back Better bill

- U.S. unemployment claims expected to show continued labor market improvement

- LEI expected to show continued strength

- 10-year TIPS auction

House expected to vote Friday on Build Back Better bill — The Hill on Wednesday reported that the House is likely to vote on the Democrat’s $1.75 trillion Build Back Better social spending bill on Friday. House leaders previously hoped to vote today, but the House was tied up on Wednesday with a vote censoring House member Gosar. Also, House Democratic moderates are still waiting for more CBO scoring information on the spending bill, which may not come out until Friday.

After the House approves the bill, it will move to the Senate for consideration in December. The fate of the bill in the Senate continues to be up in the air mainly because of the theatrics by moderate Senators Manchin and Sinema.

Elsewhere on the Washington front, the markets are waiting for President Biden’s decision on the next Fed Chair, which he said he would announce by this Saturday. Jerome Powell’s term as Fed Chair expires in February 2022 and the Senate needs time to approve the nomination.

Bloomberg reported Tuesday that Mr. Biden has narrowed down his choice to reappointing Jerome Powell as Fed Chair, or nominating current Fed Governor Lael Brainard. The White House is in the process of gauging support for each nominee in the Senate to make sure there is enough support to easily confirm whomever Mr. Biden chooses. More Senators are openly supporting Mr. Powell but there also appears to be sufficient support for Ms. Brainard.

Mr. Biden may soon announce his picks for other Fed positions since there is one Fed Governor position open now and Vice Chair Clarida’s term is up in January. Mr. Biden also needs to appoint someone to serve as the Vice Chair for bank supervision since Randal Quarles’ term expired last month.

The betting odds at PredictIt.org are 69% for Mr. Powell and 32% for Ms. Brainard as the new Fed Chair. Long-shots are Atlanta Fed President Raphael Bostic at 3%, former Fed Vice Chair Roger Ferguson at 1%, and former Fed Governor Sarah Bloom Raskin at 1%.

Meanwhile, Democrats face two major deadlines over the next few weeks. The continuing resolution expires in just 2-1/2 weeks on December 3. If there is no new spending bill by then, the federal government will be partially shut down starting on December 4. Politico reported yesterday that Democrats are floating another short-term CR that would likely last only through December 17. There is also the possibility of a CR that lasts into January. Another CR is necessary because Democrats and Republicans have still not begun to seriously negotiate an omnibus spending bill for the remainder of the fiscal year (which lasts until Sep 30, 2022).

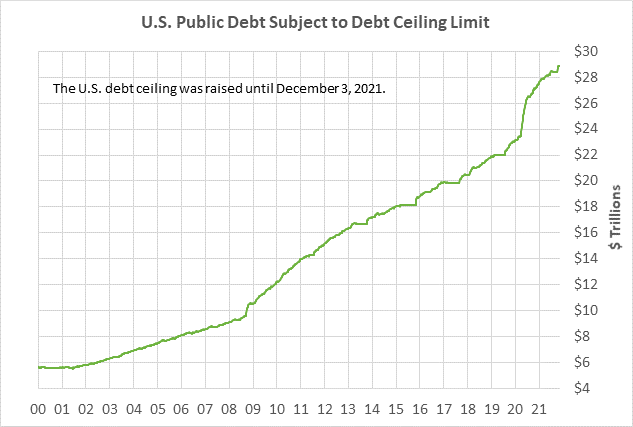

Democrats also face a deadline of December 15 for a debt ceiling hike, as specified Tuesday by Treasury Secretary Yellen. Democrats still seem to think that they can strong-arm Republicans into supporting another debt ceiling hike. However, Senate Minority Leader McConnell received serious flak from his party the last time around for helping Democrats pass a temporary debt ceiling hike into December and he seems much less likely to help Democrats out this time around. Without Republican support, Democrats will be forced to use up legislative time passing a debt ceiling hike through the cumbersome budget reconciliation process.

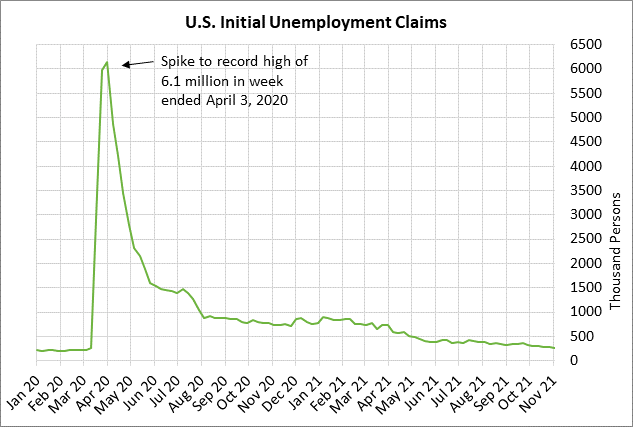

U.S. unemployment claims expected to show continued labor market improvement — The consensus is for today’s weekly initial unemployment claims report to show a -7,000 decline to 260,000, adding to last week’s -4,000 decline to 267,000. Meanwhile, today’s continuing claims report is expected to show a decline of -40,000 to 2.120 million, reversing part of last week’s +59,000 increase to 2.160 million.

The initial unemployment claims series last week fell to a new 1-1/2 year low and is now only 51,000 above the pre-pandemic level. The continuing claims series posted a 1-1/2 year low in the week of Oct 22 and is currently up by only +452,000 from the pre-pandemic level.

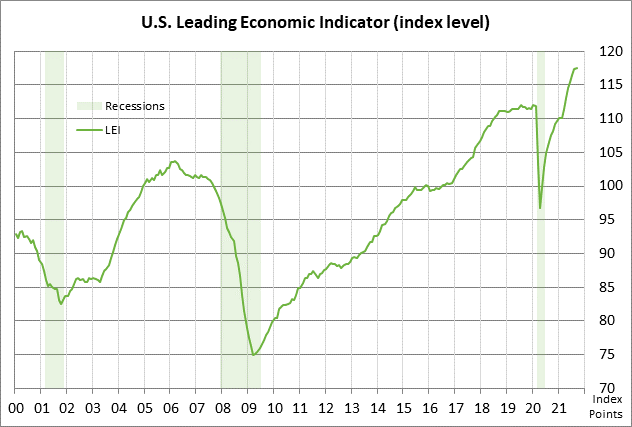

LEI expected to show continued strength — The consensus is for today’s Oct leading indicators report to show a strong increase of +0.8% m/m, adding to September’s smaller +0.2% gain. The LEI remains in strong shape and is up +7.2% on the year.

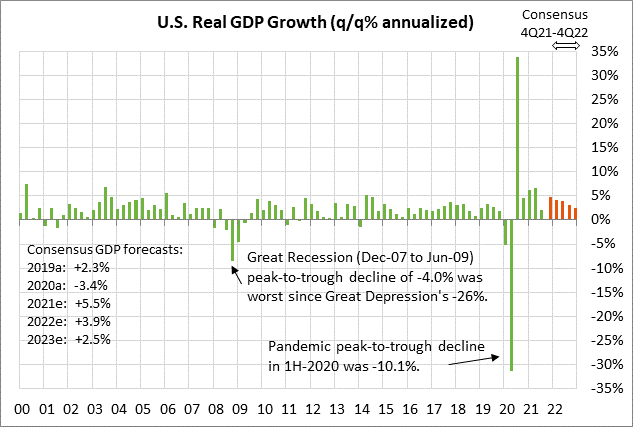

The consensus is for Q4 GDP to be strong at +4.8%, rebounding from Q3’s weak report of +2.0%. GDP is then expected to remain relatively strong at +4.2% in Q1-2022 and +3.9% in Q2-2022. On a calendar year basis, the consensus is for GDP this year to show a sharp rise of +5.5%, more than recovering last 2020’s -3.4% decline. U.S. GDP is then expected to ease to +3.9% in 2022 and +2.5% in 2023.

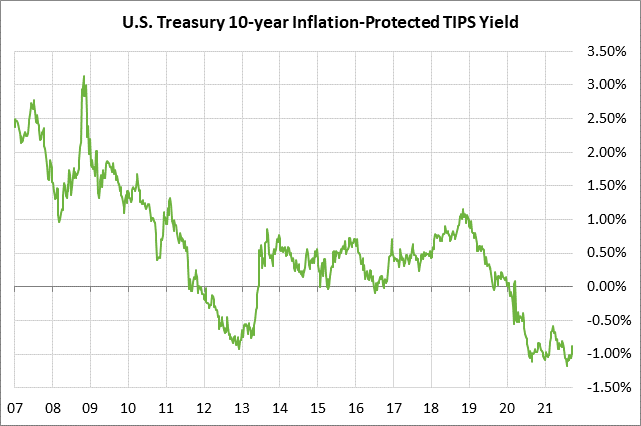

10-year TIPS auction — The Treasury today will sell $14 billion of 10-year TIPS in the second and final reopening of the 1/8% 10-year TIPS of July 2031, which the Treasury first sold last July. The benchmark 10-year TIPS yield yesterday closed at -1.14%.

The 12-auction averages for the 10-year TIPS are as follows: 2.47 bid cover average, $26 million in non-competitive bids, 7.1 bp tail to the median yield, 31.7 bp tail to the low yield, and 48% taken at the high yield. The 10-year TIPS is the third most popular coupon security among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of 67.9% of the last twelve 10-year TIPS auctions, which is well above the median of 63.9% for all recent Treasury coupon auctions.