- Democratic reconciliation bill seems close to an agreement

- U.S. Q3 GDP expected to take a hit from the pandemic’s resurgence

- Unemployment claims expected to show continued labor market strength

- 7-year T-note auction

Democratic reconciliation bill seems close to an agreement — Democrats seem close to announcing a “framework agreement” for the reconciliation bill, with some details to be filled in later. President Biden on Wednesday met at the White House with key moderate and progressive Democrats. Democrats are trying to produce a framework agreement before President Biden leaves today for his European trip for the G20 Summit and UN Climate talks.

House Speaker Pelosi is also desperately trying to get House progressives to agree to vote in favor of the $550 billion infrastructure bill either today or tomorrow. If the infrastructure bill doesn’t pass, then Congress will have to pass a stop-gap bill to extend highway funding that otherwise expires this Sunday (Oct 31).

Progressives are so far still refusing to vote for the infrastructure bill until a reconciliation bill is a done deal. It remains to be seen whether progressives will be satisfied with a framework agreement, or whether they will require final legislative text or final votes by the House and Senate.

Democrats are still scrambling for revenue raisers. Senator Wyden’s billionaire’s tax was reportedly shot down yesterday by Manchin and others. Democrats have turned to the idea of 3% income tax surcharge on those making more than $5 million, but it is not clear whether that would pass muster with Senators Sinema and Manchin.

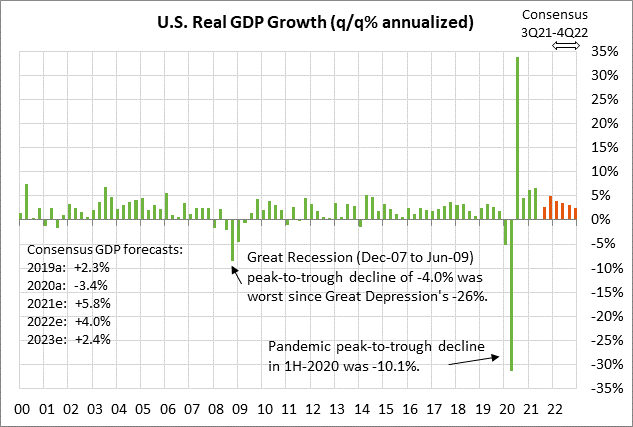

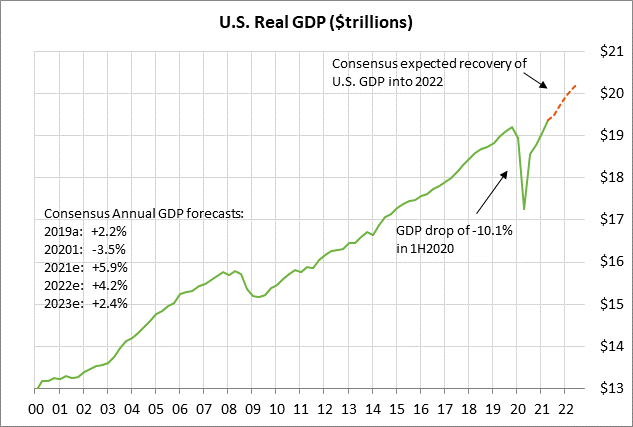

U.S. Q3 GDP expected to take a hit from the pandemic’s resurgence — The consensus is for today’s Q3 GDP to ease to +2.7% (q/q annualized) from +6.7% in Q2. Q3 personal consumption is expected to sink to +0.8% (q/q annualized) from Q2’s stellar pace of +12.0%.

Today’s weak Q3 GDP report is expected to be the result of the pandemic’s resurgence that started in July and lasted until mid-September. U.S. economic activity was negatively impacted by the pandemic’s resurgence as businesses trimmed their expansion plans and as some consumers stayed home. In addition, there were no stimulus checks in Q3 and many consumers already spent their stimulus checks in the first half of the year.

U.S. business activity in Q3 was also undercut by a range of obstacles, including supply-chain shortages, high input prices, the chip shortage, shipping delays, and labor market shortages.

The good news, however, is that GDP growth is expected to improve in Q4 since the pandemic’s resurgence peaked in mid-September and fell sharply through October. The falling Covid infection figures encouraged businesses to expand and consumers to get out and start spending again.

The consensus is for U.S. GDP growth in Q4 to improve to +4.9%, and then remain strong at +4.0% in Q1-2022 and +3.6% in Q2-2022. However, GDP growth is then expected to decelerate to more normal level near +3.0% in the second half of 2022, when the Fed is expected to start raising interest rates and the burst of growth from the pandemic reopening and fiscal stimulus will fade.

On a calendar year basis, the consensus is for GDP this year to show strong growth of +5.8%, easily overcoming the -3.4% decline seen in 2020. GDP growth is then expected to remain relatively strong at +4.0% in 2022, but then decelerate to a more normal +2.4% in 2023.

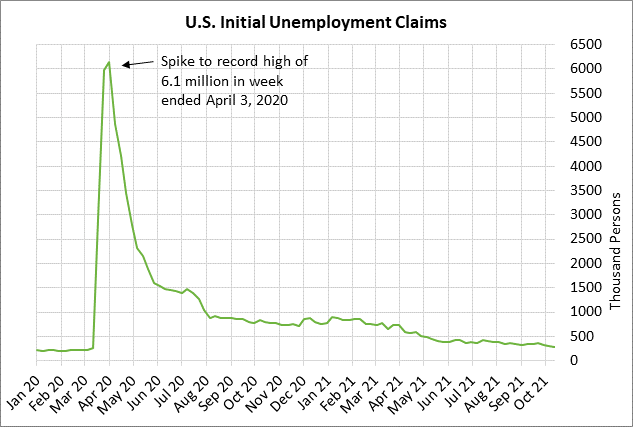

Unemployment claims expected to show continued labor market strength — The consensus is for today’s weekly initial unemployment claims report to show an increase of +2,000 to 292,000, following last week’s -6,000 decline to 290,000. Initial claims last week fell to a new 1-1/2 year low of 290,000 and were only 74,000 above the pre-pandemic level.

Today’s continuing claims report is expected to show a decline of -61,000 to 2.420 million, adding to last week’s decline of -122,000 to 2.481 million. Continuing claims are in strong shape as the series fell to a new 1-1/2 year low last week. The series is now elevated by only +773,000 from the pre-pandemic level.

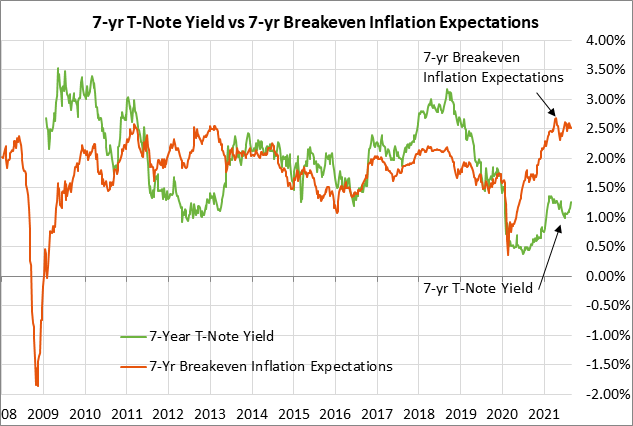

7-year T-note auction — The Treasury today will sell $62 billion of 7-year T-notes, concluding this week’s $211 billion T-note package.

The benchmark 7-year T-note yield yesterday closed -5 bp at 1.40%, down sharply from last Friday’s 1-3/4 year high of 1.54.%. Despite Wednesday’s decline, the 7-year yield is still up by about +30 bp over the past month due to accelerated expectations for Fed tightening. The market is now expecting a strong chance of two rate hikes by the end of 2022, versus expectations this summer that the Fed would not start raising rates until early 2023.

The 12-auction averages for the 7-year are as follows: 2.28 bid cover ratio, $17 million of non-competitive bids, 6.1 bp tail to the median yield, 52.4 bp tail to the low yield, and 45% taken at the high yield. The 7-year is moderately below average in popularity among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of only 58.5% of the last twelve 7-year T-note auctions, which is moderately below the median of 63.7% for all recent Treasury coupon auctions.