- ECB will issue new forecasts at today’s meeting and may discuss QE plans

- U.S. weekly unemployment claims show continued labor market improvement

- 30-year T-bond auction

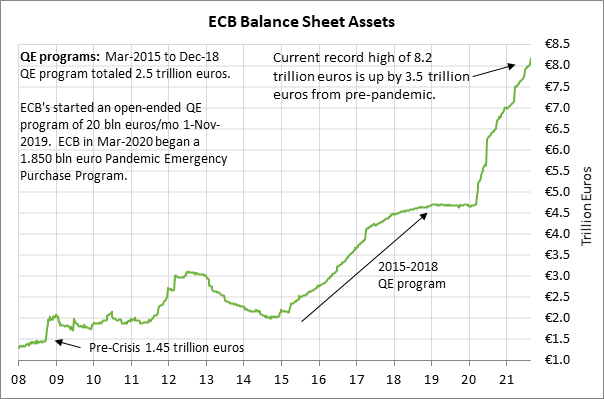

ECB will issue new forecasts at today’s meeting and may discuss QE plans — Today’s ECB meeting could be eventful because the ECB will release new economic projections and may give an update on its QE plans.

The ECB is already starting to think about whether it needs to make adjustments to its 1.85 trillion-euro Pandemic Emergency Purchase Program (PEPP), which is currently running at an elevated pace and is due to expire in March 2022.

By contrast, the ECB is expected to leave in place its older Asset Purchase Program (APP) of 20 billion euros/month, which is due to end shortly before interest rates start rising. That program is less controversial because it buys bonds on a proportional basis among the Eurozone countries and therefore has broader support on the ECB Council.

The markets had previously thought that the ECB would extend its PEPP program beyond March 2022. However, some ECB officials have recently called for reining in the ECB’s QE programs because the Eurozone economy is on more solid ground and Eurozone inflation is soaring.

ECB Council members Klass Knot said on August 31 that the inflation outlook has improved markedly by enough to consider ending the PEPP program in March 2022. He said the “PEPP has a clearly delineated objective — repairing the damage that the coronavirus has inflicted on the inflation outlook.” He said that inflation goal is now within reach.

ECB official Robert Holzmann last week also said that the improved inflation outlook warrants a reduction in bond buying.

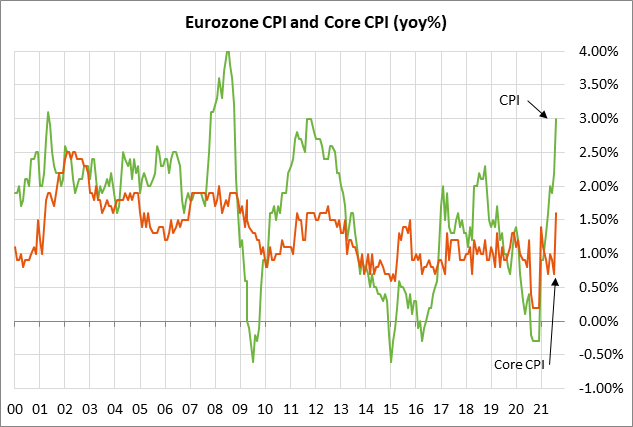

The comments by some ECB officials expressing support for curbing QE came after last week’s stronger-than-expected inflation data. The Eurozone Aug CPI rose by a 10-year high of +3.0% y/y from +2.2% in July, and was stronger than expectations of +2.7%. The Aug core CPI rose to a 9-year high of +1.6% y/y from July’s +0.7%, and was slightly stronger than expectations of +1.5%.

The ECB today is expected to raise its inflation forecast. However, the ECB is expected to continue to argue that the current inflation surge is temporary and does not require a policy response.

Echoing the ECB’s official theme, ECB Council member Yannis Stournaras last week said, “According to most estimates, the recent jump in inflation is due to temporary factors related to various supply-side bottlenecks caused by the pandemic.” He added, “Wage developments and unit labor costs which determine the core of inflation do not show the same volatility as headline inflation. On this evidence, I would advise caution regarding the course of inflation relative to our medium-term target.”

While the ECB is starting to think about adjustments in its PEPP program, there is no suggestion that the ECB will raise interest rates anytime soon. The ECB at its last meeting on July 22 adopted new guidance that was highly dovish and indicated that the ECB would allow inflation to move above its 2% inflation target without a policy response.

ECB President Lagarde at July’s ECB press conference suggested that the first interest rate hike is likely years away. She said the new guidance is “intended to avoid premature tightening that would be detrimental to the economy.”

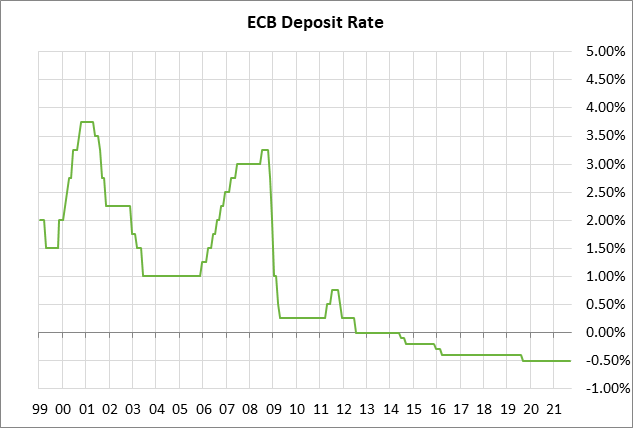

The ECB today is expected to leave its deposit rate unchanged at -0.50%, where that rate has been since September 2019. Before the pandemic emerged, the ECB in September 2019 cut the deposit rate by -10 bp to -0.50% due to the weak Eurozone economy and the weak inflation outlook.

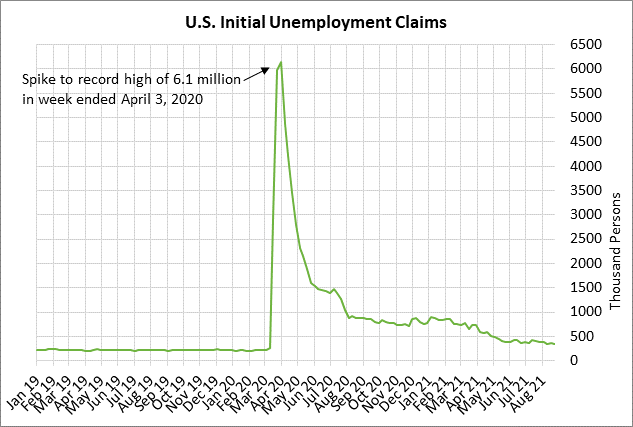

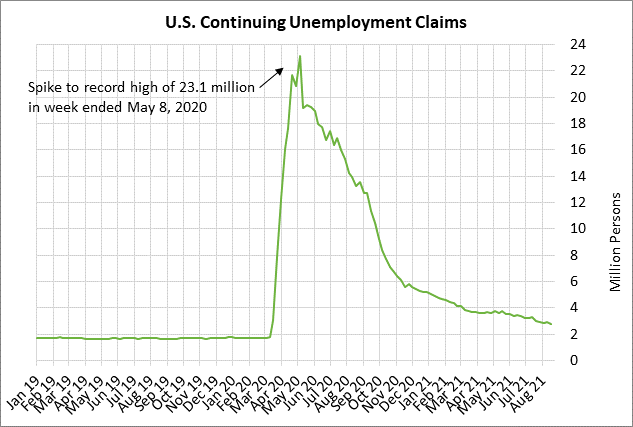

U.S. weekly unemployment claims show continued labor market improvement — The recent weekly unemployment claims data has shown a steady improvement in the U.S. labor market. The consensus is for today’s weekly initial unemployment claims to fall -5,000 to 335,000 following last week’s -14,000 decline to 340,000. The continuing claims series last week fell by -160,000 to a new 18-month low of 2.748 million.

Relative to the pre-pandemic level, initial claims are now elevated by only +124,000 and continuing claims are elevated by only 1.040 million.

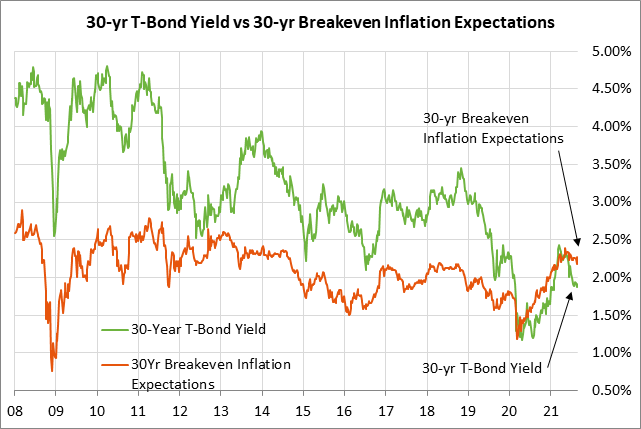

30-year T-bond auction — The Treasury today will sell $24 billion of 30-year bonds in the first of two reopenings of the Treasury’s 2% 30-year bond of August 2051 that the Treasury first sold last month.

The 12-auction averages for the 30-year are as follows: 2.31 bid cover ratio, $6 million in non-competitive bids, 6.4 bp tail to the median yield, 75.8 bp tail to the low yield, and 51% taken at th