- Weekly market focus

- Powell suggests QE tapering is a go for next week’s FOMC meeting

- Democrats continue to hash out reconciliation bill

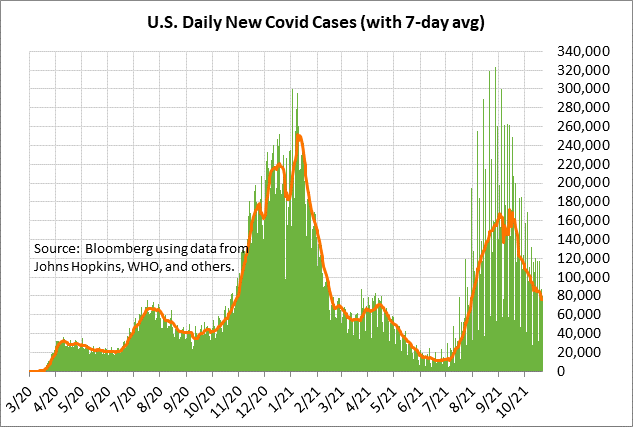

- U.S. Covid infections are now down by -57% from September’s high

- Q3 earnings season kicks into high gear

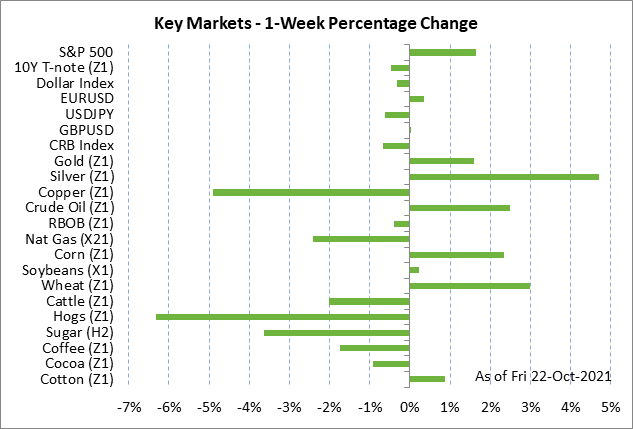

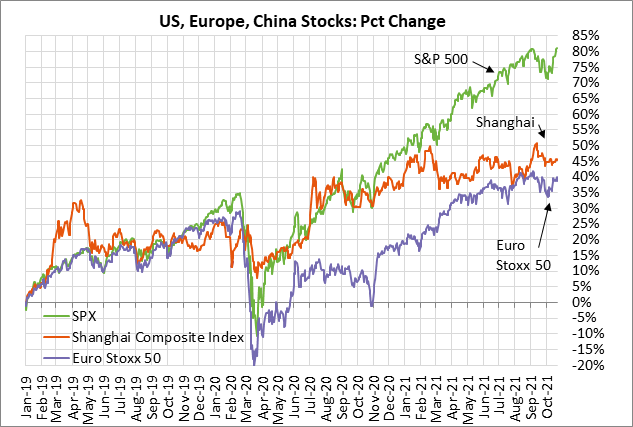

Weekly market focus — The markets this week will focus on (1) anticipation of next week’s FOMC meeting where the Fed is expected to announce QE tapering, (2) whether the Covid infection figures continue to decline, (3) Q3 earnings season with 165 of the S&P 500 companies reporting this week, (4) the Treasury’s sale of $211 billion of T-notes, (5) the ECB’s meeting on Thursday, which is not expected to produce any policy change but where ECB members may discuss whether to extend QE beyond early 2022, and (6) any carry-over from the ongoing debt crisis among Chinese property developers led by Evergrande.

Powell suggests QE tapering is a go for next week’s FOMC meeting — Fed Chair Powell last Friday suggested that the FOMC at next week’s meeting is likely to announce QE tapering, although he was careful to reiterate that the Fed is not close to raising interest rates. Mr. Powell said, “We are on track to begin a taper of our asset purchases, that, if the economy evolves broadly as expected, will be completed by the middle of next year.” He added, “I do think it is time to taper and I don’t think it is time to raise rates.”

Mr. Powell also said that supply-chain constraints that have led to elevated inflation “are likely to last longer than previously expected, likely well into next year.” However, he added that “it is still the most likely case” that as those constraints ease, as they eventually will — and as job gains move up — inflation will move back down closer to our 2% goal.”

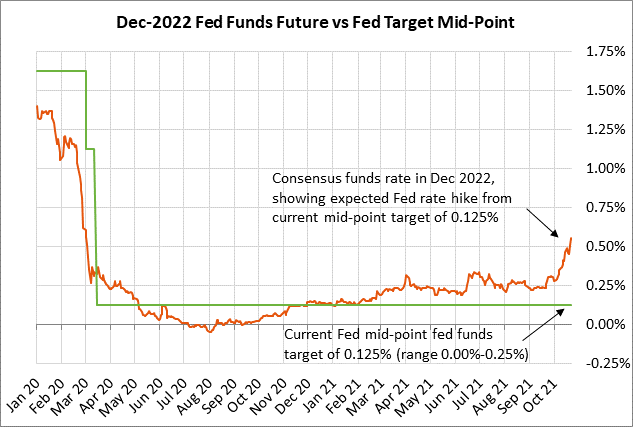

The markets seem to have already fully discounted a QE tapering announcement next week since Fed officials have been very clear about telegraphing that move. However, the markets are now concerned that the current surge in inflation might force the Fed into raising interest rates sooner than earlier expected.

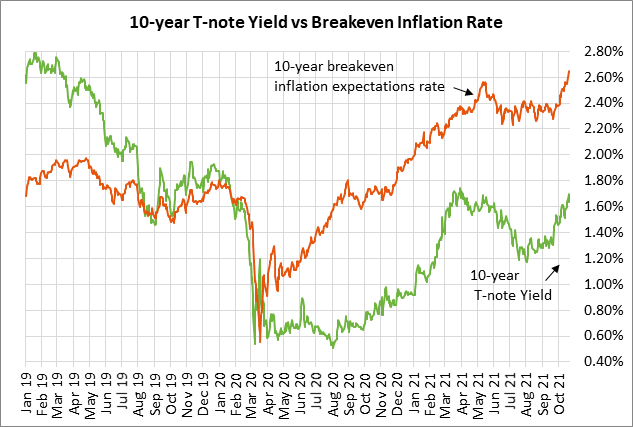

As of this past summer, the markets were not expecting the Fed’s first rate hike until early 2023. However, the inflation situation has since turned more alarming and the markets have quickly accelerated expectations for Fed rate hikes. The 10-year breakeven inflation expectations rate last Friday reached a new 9-year high of 2.69%, which was only 9 bp below the record high (data since 2002) of 2.78% posted in 2005.

The market is now discounting a 90% chance of two Fed rate hikes by the end of 2022. The December 2022 federal funds futures contract (on a yield basis) last Friday rose to a new 1-1/2 year high of 0.555%,. That indicates that the market is expecting an overall Fed rate hike of +47.5 bp by December 2022 from the current effective federal funds rate of 0.08%. That translates to 100% expectations for one Fed rate hike by December 2022, and a 90% chance of a second rate hike by December 2022.

Democrats continue to hash out reconciliation bill — Democrats last week engaged in furious negotiations to try to get a reconciliation bill done, but were unable to meet Senate Majority Leader Schumer’s deadline of last Friday. House Speaker Pelosi has her own target of getting the infrastructure bill and the reconciliation bill passed by the House by this Friday before highway spending programs expire on October 31.

Democrats continued to negotiate over the weekend. They are focused on trimming the size of the spending bill down to the $1.8-1.9 trillion area from the previous level of $3.5 trillion. Meanwhile, the revenue side of the bill was thrown into chaos last week after Democratic Arizona Senator Sinema said she does not want any increase in the corporate tax rate, or in income or capital gains taxes on high-income taxpayers. Giving up those tax increases would blow a $1.35 trillion revenue hole in the plan, which might force further cuts in spending levels.

The stock market, of course, would be very pleased if Ms. Sinema gets her way and there is a smaller-than-expected hike in the corporate tax rate, or no rate hike at all. A higher corporate tax rate takes a direct bite out of after-tax earnings and thus stock prices.

U.S. Covid infections are now down by -57% from September’s high — U.S. Covid infections have fallen sharply by -57% in the past month but are still about six times higher than June’s temporary trough. The 7-day average of new daily U.S. Covid infections on Sunday fell to a new 2-3/4 month low of 73,006.

The U.S. has administered a daily average of 851,581 vaccination doses over the past week, according to Bloomberg. That figure should rise in the coming weeks as booster shots ramp up after the FDA and CDC last week approved the Moderna and J&J vaccines for booster shots. Bloomberg reports that 57.4% of the total U.S. population has now been fully vaccinated.

Q3 earnings season kicks into high gear — Q3 earnings season kicks into high gear this week with 165 of the S&P 500 companies reporting. Notable reports include Facebook on Monday; Alphabet, Microsoft, Twitter, Visa, UPS, and Capital One on Tuesday; Apple, Ford, General Motors, and Ebay on Wednesday; Amazon.com, Caterpillar, and Mastercard on Thursday; and Exxon on Friday.

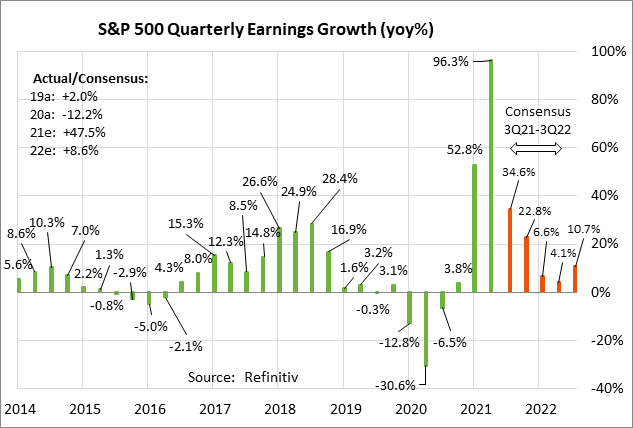

The consensus is for Q3 earnings growth of +34.6% y/y for the S&P 500 companies, according to Refinitiv. Earnings season has so far been positive, with 83.8% of reporting S&P companies having beaten the consensus, higher than the long-term average of 65.8% although below the 4-quarter average of 84.7%, according to Refinitiv. On a calendar year basis, S&P earnings growth in 2021 is expected to be stellar at +47.5%, but is then expected to fade to +8.6% in 2022.