- Aug U.S. JOLTS job openings expected to hit new record high

- House today expected to provide final approval of debt ceiling increase

- 10-year T-note yield rises to 4-1/4 month high

- 3-year and 10-year T-note auctions

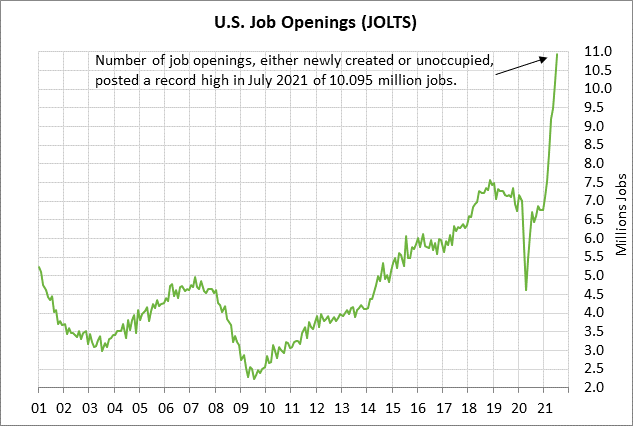

Aug U.S. JOLTS job openings expected to hit new record high — The consensus is for today’s Aug JOLTS job openings report to show a +16,000 increase to 10.950 million, adding to July’s +749,000 surge to a record high of 10.934 million. Since the beginning of the year, job openings have surged by +54%.

The record-high in job openings illustrates that there are plenty of jobs available. However, companies are having trouble filling those jobs with qualified persons due to a mismatch of skills with available jobs. There is also a labor shortage in some sectors. Many people are staying home and are avoiding taking a job because of worries about Covid exposure or perhaps to take care of children as the pandemic drags on. On the other hand, enhanced job benefits expired in early September, which should encourage some people to get back to work.

Last Friday’s Sep payroll report of +194,000 was much weaker than market expectations of +500,000. The weak job report was likely due to business concern about the pandemic’s resurgence since the Covid infection figures did not peak until mid-September. Some businesses have undoubtedly been delaying their hiring plans until the pandemic dies down. Also, some vulnerable sectors such as restaurants, travel, and entertainment continued to be hurt by the pandemic’s resurgence.

However, job gains are likely to improve substantially in October due to the sharp drop in the Covid infection figures seen since mid-September, which is likely to lead businesses to conclude that the pandemic’s resurgence on the delta variant is over and that it is safe to resume hiring and bring people back to work.

House today expected to provide final approval of debt ceiling increase — The House today is expected to approve the debt ceiling hike that the Senate passed last Thursday. The House vote would finalize the debt ceiling hike about a week ahead of next Monday’s (Oct 18) drop-dead date for a debt ceiling hike voiced by Treasury Secretary Yellen. House Speaker Pelosi had to call House members back from their recess for Tuesday’s debt ceiling vote.

The debt ceiling is only being raised through December 3, which sets up the possibility of a twin crisis for early December since the continuing resolution also expires on December 3.

Senate Majority Leader Schumer seems to want a combined spending bill and debt ceiling suspension passed by December 3. However, that is a recipe for further bipartisan conflict since Senate Minority Leader McConnell has insisted that Republicans will filibuster any debt ceiling suspension. Yet, Mr. McConnell may allow Democrats to pass a dollar-value debt ceiling hike, which Republicans would then use to pummel Democrats with campaign ads ahead of the November 2022 mid-term elections.

The debt ceiling fix through early-December gives Democrats more time to focus on trying to pass their $3.5 trillion spending bill and the $550 billion infrastructure bill. However, there may not be much near-term progress on those bills since the Senate is on recess this week for the Columbus Day holiday and the House will return to its recess shortly after today’s debt ceiling vote. The Senate and House are both scheduled to be back in session early next week.

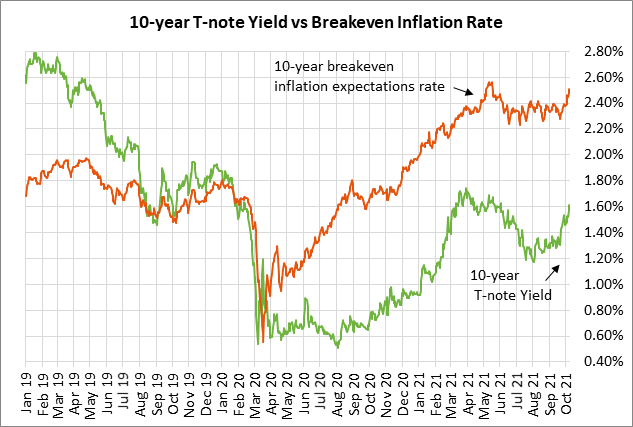

10-year T-note yield rises to 4-1/4 month high — The 10-year T-note yield last Friday rose to a new 4-1/4 month high of 1.62%. The 10-year T-note yield has risen sharply by about +30 bp since mid-September when the Covid infection figures peaked. The steady decline in Covid infections suggests that the pandemic’s resurgence is over, thus improving the prospects for the economy and forcing the Fed to turn more hawkish.

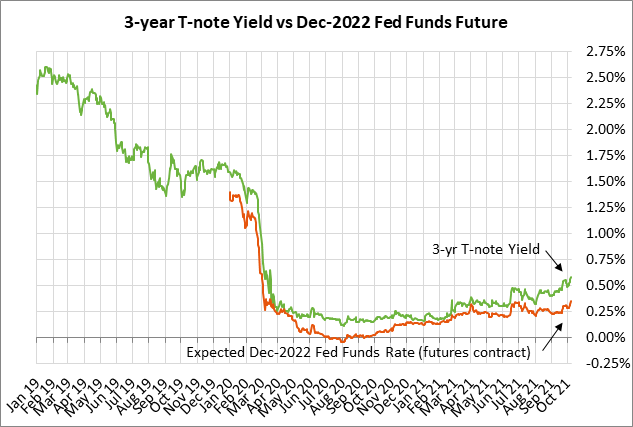

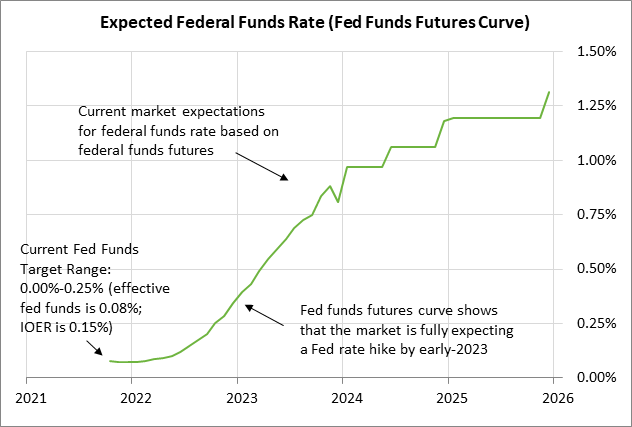

Indeed, the market is expecting the Fed to announce QE tapering at either its next meeting on November 2-3 or at its following meeting on Dec 14-15. The market is then discounting a 50% chance of the Fed’s first rate hike by late 2022 and a full chance of that rate hike by early 2023.

The T-note yield has also been pushed higher by increased inflation expectations. The 10-year breakeven inflation expectations rate last week broke out to a 4-3/4 month high of 2.52%, which is a half-percentage-point above the Fed’s 2.0% inflation target. Inflation expectations have been pushed higher by supply chain disruptions and strong commodity demand, factors that are likely to cause the recent inflation surge to extend at least into next year. The price of aluminum soared to a 13-year high Monday, while crude oil and gasoline prices surged to 7-year highs.

3-year and 10-year T-note auctions — The Treasury today will sell $58 billion of 3-year T-notes and $38 billion of 10-year T-notes. The Treasury will then conclude this week’s coupon package by selling $24 billion of 30-year T-bonds on Wednesday. Today’s 10-year auction will be the second and final reopening of the 1-1/4% 10-year T-note of August 2031.

The 12-auction averages for the 3-year are: 2.44 bid cover ratio, $36 million in non-competitive bids, 3.2 bp tail to the median yield, 20.3 bp tail to the low yield, 45% taken at the high, and 51.4% taken by indirect bidders (mildly below the median of 63.0% for all recent coupon auctions).

The 12-auction averages for the 10-year are: 2.45 bid cover ratio, $17 million of non-competitive bids, 4.9 bp tail to the median yield, 68.3 bp tail to the low yield, 53% taken at the high yield, and 63.3% taken by indirect bidders (slightly above the median of 63.0% for all recent coupon auctions).