- Weekly global market focus

- Next few weeks are likely to be quiet for Fed policy

- Congressional recess means little near-term progress on infrastructure

- Q2 earnings season begins next weekÂ

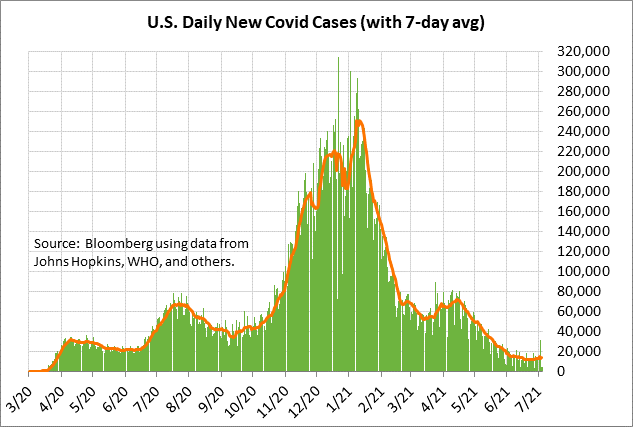

Weekly global market focus — The U.S. markets this week will focus on (1) oil prices after Monday’s rally of about +1.60% on the inability of OPEC+ to reach a production hike agreement, (2) tech stocks after China over the weekend cracked down on more Chinese tech stocks, (3) Fed policy after the markets viewed last Friday’s U.S. June unemployment report as neutral for Fed policy, (4) any developments in Washington on an infrastructure bill, although Congress is on recess this week, (5) anticipation of next week’s start of the Q2 earnings season, (6) the global pandemic statistics as the delta variant causes a new Covid infection surge in many parts of the world, and (7) the impact of the weekend news of a massive ransomware attack on thousands of businesses worldwide.

Oil prices on Monday rallied by around +1.6% after OPEC+ concluded its monthly meeting without an agreement to raise production. Oil prices are rallying since OPEC+ now plans to leave its production unchanged in August. The UAE wanted a higher production quota and refused to agree to the OPEC+ preliminary agreement, which involved a +400,000 bpd production hike in each month from August through December.

Next few weeks are likely to be quiet for Fed policy — The next FOMC meeting on July 27-28 is still another three weeks away. Fed officials over the next three weeks are not likely to shift their themes, simply reiterating their recent comments and waiting to engage in more discussion on QE tapering at its July 27-28 meeting. However, the market consensus is that the earning warning of QE tapering will not come until the August Jackson Hole conference or the following FOMC meeting on September 21-22.

In a survey taken by Bloomberg in early June, 33% of the respondents said they expect the formal announcement of QE tapering in September, 10% in October or November, and 33% in December.

The markets are expecting the Fed’s first +25 bp rate hike in late 2022, according to the federal funds futures market. The markets are then expecting two more +25 bp rate hikes in 2023.

Last Friday’s +0.1 point increase in the U.S. June unemployment rate to 5.9% was interpreted by the markets as a sign that the labor market is not yet strong enough for the Fed to officially announce QE tapering. Payrolls rose by +850,000, which was stronger than market expectations of +711,000. However, the +850,000 payroll report was not a blow-out number that caused the markets to believe that the Fed has concluded that the labor market has made “substantial further progress,” which is the benchmark the Fed is using for its policy decisions.

Rather, the labor market continues to just slowly improve as more people come back into the labor market and as the pandemic drags on in many parts of the country. The U.S. economy must still create another 6.7 million jobs before getting back to the pre-pandemic record high.

Congressional recess means little near-term progress on infrastructure — Congress is still on its Fourth of July recess this week, meaning little will get done this week on an infrastructure bill. The Senate is scheduled to return to session this coming Monday (July 12), while the House is scheduled return a week later on Monday, July 19. After the July 4th recession, Congress will only be in session for a few weeks and will then leave in early August for its August recess, returning in September after Labor Day.

The House moved the ball forward on the infrastructure process last Thursday by passing an infrastructure bill totaling more than $700 billion over 5 years. House leaders hope to use their bill as the basis for negotiations with the Senate on their $579 billion bipartisan infrastructure agreement since the Senate’s bipartisan legislation has yet to be written.

However, last week’s House infrastructure bill contained no pay-fors, meaning Washington is still at a loss about whether there is a bipartisan way to pay for an infrastructure bill without raising tax rates on corporations.

Democrats are still on a two-track infrastructure process, pursuing both the bipartisan infrastructure agreement in the Senate and a Democratic-only reconciliation infrastructure bill. Senate Majority Leader Schumer has said that he intends to hold votes in the Senate in July on both the bipartisan infrastructure plan as well as a budget resolution that would provide the basis for a Democratic-only infrastructure reconciliation bill.

Q2 earnings season begins next week — Vulcan Materials will release its earnings report today, but that it is the only S&P 500 company that is scheduled to release earnings this week. However, Q2 earnings season is near, with 24 of the S&P 500 companies releasing earnings next week, including most of the major Wall Street banks. Earnings season then kicks into high gear with 87 of the S&P 500 companies reporting during the week of July 19-23, 184 companies during the week of July 26-30, and 130 companies reporting during the week of Aug 2-6.

The consensus is for Q2 earnings growth of +65.4% y/y for the S&P 500 companies. The year-on-year figure is, of course, inflated by the fact that earnings dropped sharply in Q2-2020 during the height of the pandemic economic shutdowns, causing a very low year-earlier base. For all of 2021, the consensus is for earnings growth of +37.2%, more than recovering from the -12.2% decline seen in 2020.