- U.S. CPI expected to remain strong and provide evidence against the transitory inflation theme

- FOMC minutes likely to underline the likelihood of QE tapering “soon”

- Debt ceiling raised through December

- 30-year T-bond auction

U.S. CPI expected to remain strong and provide evidence against the transitory inflation theme — Today’s CPI report is expected to show continued inflation pressures, fueling the idea that the current inflation surge is more than transitory and is likely to stretch well into 2022.

Atlanta Fed President Raphael Bostic yesterday made a strident argument that the inflation surge is not transitory, rejecting Fed Chair Powell’s usual theme that inflation is transitory and nothing to worry about. Mr. Bostic said, “It is becoming increasingly clear that the feature of this episode that has animated price pressures — mainly the intense and widespread supply-chain disruptions — will not be brief. By this definition, the forces are not transitory.”

Mr. Bostic added that “I believe evidence is mounting that price pressures have broadened beyond the handful of items most directly connected to supply-chain issues or the reopening of the services sector.”

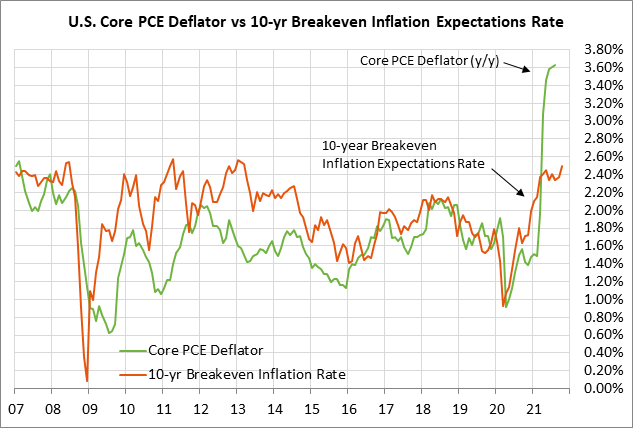

The markets have sharply boosted their inflation expectations over the past several weeks as oil and natural gas prices surge and as supply chain disruptions boost prices across the board for many different types of products. The 10-year breakeven inflation expectations rate on Tuesday edged to a new 4-3/4 month high of 2.53% before falling back to close the day at 2.49%. The breakeven rate is currently one-half percentage point above the Fed’s +2.0% inflation target.

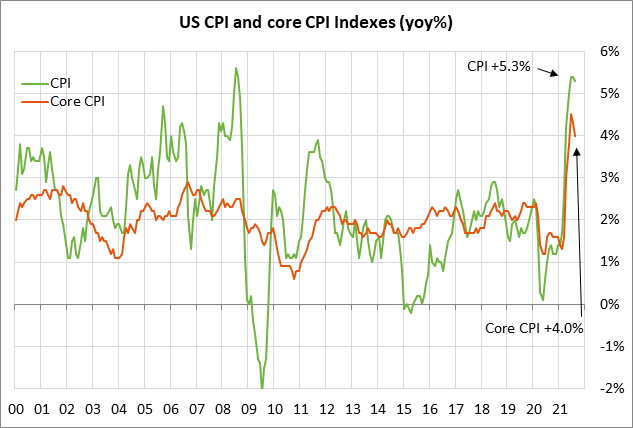

The consensus is for today’s Sep CPI report to show increases of +0.3% m/m and +5.3% y/y, which would exactly match August’s report. The Sep core CPI is expected to show increases of +0.3% m/m and +4.0% y/y, a bit stronger on balance than August’s report of +0.1% m/m and +4.0% y/y.

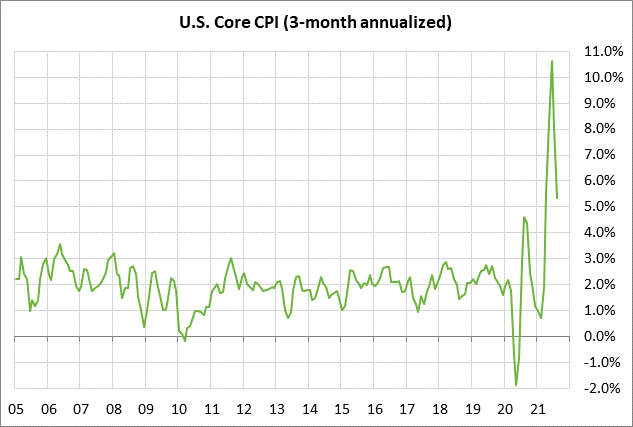

The year-on-year inflation figures continue to be of little use due to last year’s low base during the pandemic shutdowns. The markets are therefore more closely watching shorter-term inflation measures, which are actually in worse shape than the year-on-year figures. On a 3-month annualized basis, the headline CPI in August was at +6.8%, which was at least lower than the peak of +9.7% seen in June. The core CPI on a 3-month annualized basis was at +5.4% in August, down from June’s peak of +10.6%.

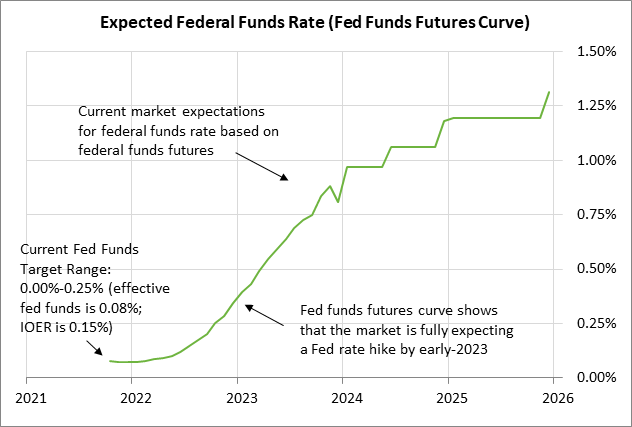

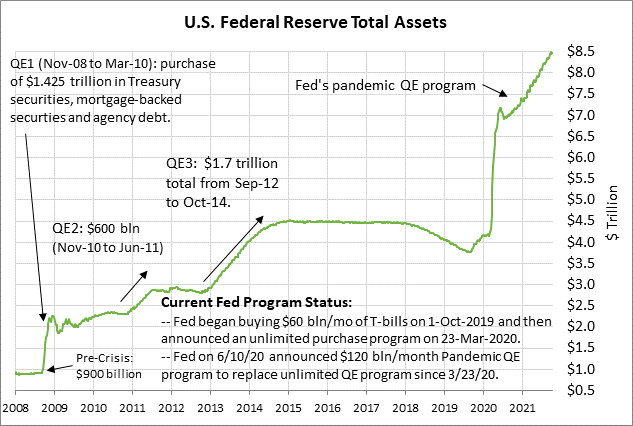

FOMC minutes likely to underline the likelihood of QE tapering “soon” — The Fed today will release the minutes from the last FOMC meeting on Sep 21-22. The FOMC at that meeting said that QE tapering “may soon be warranted” if progress continues as the Fed expects towards meeting its policy goals. The markets are now expecting the QE tapering announcement to come at the next meeting on November 2-3, or possibly at the following meeting on December 14-15.

The likelihood of QE tapering at the next meeting on November 2-3 has increased due to the sharp drop in the Covid infection figures seen since mid-September. However, the Fed might want to wait for better employment figures since Aug payrolls rose by only +194,000.

The market is discounting a 50% chance of the Fed’s first rate hike by late 2022 and a full chance of that rate hike by early 2023.

Debt ceiling raised into December — The House yesterday evening approved the debt ceiling hike that the Senate passed last Thursday, sending the bill to President Biden for his signature. The debt ceiling has therefore been raised before this coming Monday’s (Oct 18) drop-dead date, as specified by Treasury Secretary Yellen.

However, the debt ceiling was only raised through December 3, which sets up the possibility of twin crises in early December since the continuing resolution also expires on December 3. Congress will have to pass a spending bill to keep the government open after December 3. Congress also needs to pass a debt ceiling suspension or hike by December 3, or the threat will arise again of a Treasury default. The only sure-fire way to raise the debt ceiling is for the Democrats to pass that hike through the budget reconciliation process, even though Democrats are opposed to that method. Senate Minority Leader McConnell continues to insist that Republicans will not help in any way to suspend or raise the debt ceiling and that Democrats will have to do it through reconciliation.

The debt ceiling fix through early-December gives Democrats more time to focus on trying to pass their $3.5 trillion spending bill and the $550 billion infrastructure bill. House Speaker Pelosi is in the process of trimming the reconciliation bill down to the $2 trillion area in order to pass a bill that has a chance of being accepted by moderate Democratic Senators Manchin and Sinema. Ms. Pelosi wants to get the infrastructure and reconciliation bills passed by the end of October.

30-year T-bond auction — The Treasury today will sell $24 billion of 30-year T-bonds, concluding this week’s package of $120 billion of 3, 10, and 30 year securities. Today’s 30-year bond auction will be the second and final reopening of the 2% 30-year bond of August 2031, which the Treasury first sold back in August. The benchmark 30-year yield yesterday closed at 2.09%.

The 12-auction averages for the 30-year are as follows: 2.32 bid cover ratio, $6 million in non-competitive bids, 6.3 bp tail to the median yield, 79.6 bp tail to the low yield, and 50% taken at the high yield. The 30-year T-bond is of average popularity among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of 63.0% of the last twelve 30-year bond auctions, which exactly matches the median of 63.0% for all recent Treasury coupon auctions.