- Democrat’s Plan B on debt ceiling should emerge after the Senate today again fails to pass a debt ceiling suspension

- ADP report expected to show another ho-hum increase in jobs

Democrat’s Plan B on debt ceiling should emerge after the Senate today again fails to pass a debt ceiling suspension — The Senate today is scheduled to vote on the debt ceiling suspension bill that the House already passed. However, the bill is expected to fail because Republicans are expected to filibuster the cloture vote, meaning there won’t be the 60 votes necessary to advance the bill to the floor for an up-or-down majority vote.

Senate Majority Leader Schumer already knows the outcome of today’s vote and is only holding the vote to highlight once again that Republicans are blocking the debt ceiling suspension.

The only good news is that after today’s debt ceiling suspension vote fails, Mr. Schumer might give up on trying to get Republicans to help pass a debt ceiling suspension and move on to Plan B. The only Plan B available to Democrats is to pass a debt ceiling hike with the reconciliation process, assuming that Mr. Schumer can’t get all 50 Democratic Senators to vote to strip the Republican’s filibuster rights from the debt ceiling bill.

Mr. Schumer has insisted he won’t use reconciliation because it is a lengthy process that could be delayed to the point where the Treasury would default. Within the next few days, however, the markets should know whether Mr. Schumer will cave in and begin the reconciliation process. Some budget experts predict the reconciliation process could take two weeks, which means it might already be too late to meet Treasury Secretary Yellen’s drop-dead date of October 18.

The markets can only hope that Mr. Schumer has carefully timed out how long reconciliation will take and that he believes there is still enough time to get the debt ceiling raised by October 18. Mr. Schumer yesterday warned that the Senate is likely to skip next week’s recess. He said the Senate will remain in Washington until they get a debt ceiling hike completed.

Meanwhile, internal Democratic negotiations continue on the $550 billion infrastructure bill and the Democrat’s $3.5 trillion reconciliation bill. There may have been a little progress yesterday after Democratic Senator Manchin said he might be open to a spending deal in the range of $1.9-2.2 trillion, up from his previous ceiling of $1.5 trillion. Progressive Democrats might be convinced to move down from the current $3.5 trillion size by cutting the length of the deal to 5 or 7 years versus the current 10 years, thus preserving the spending programs they want.

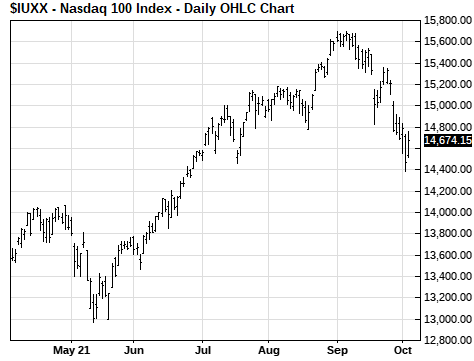

Congressional Democratic leaders are hoping to push the infrastructure and reconciliation bills through Congress by the end of October. The stock market would like to see those bills pass since the fiscal stimulus would boost the economy, although the stock market is clearly not happy about the corporate tax hike in the reconciliation bill.

ADP report expected to show another ho-hum increase in jobs — The consensus is for today’s Sep ADP employment report to show an increase of +430,000, improving a bit from August’s weak report of +374,000.

The days of job increases of more than +500,000 may be over. ADP jobs from March through June showed increases of more than +500,000 for four straight months (March +519,000, April +622,000, May +882,000, and June +741,000). However, ADP jobs then increased by only +326,000 in July and +374,000 in August.

Job growth this summer was negatively impacted by the resurgence of the pandemic caused by the delta variant. Businesses pulled back to see how long the pandemic resurgence would last and the extent to which the economy would be hurt. Also, vulnerable sectors were hurt, such as restaurants, travel, and entertainment.

Job gains were curbed in August as the Covid infection figures continued to climb through the month. The 7-day average of daily U.S. Covid infections rose steadily during August, beginning the month at 69,942 and ending the month at 162,273. The 7-day average didn’t peak until mid-September at 171,850.

The good news is that the 7-day average of daily U.S. Covid infections has steadily declined since the mid-September peak and fell to a 2-month low of 105,118 on Monday. The decline in the infection rate may have come too late to help job gains in September, but the fading pandemic seems likely to produce much better job figures in October.

On the job front, the markets are looking ahead to Friday’s Sep unemployment report. The consensus is for Sep nonfarm payrolls to show an increase of +488,000. The markets are hoping for an improvement in payroll growth after August’s disappointing report of +235,000, which was far below market expectations of +620,000.

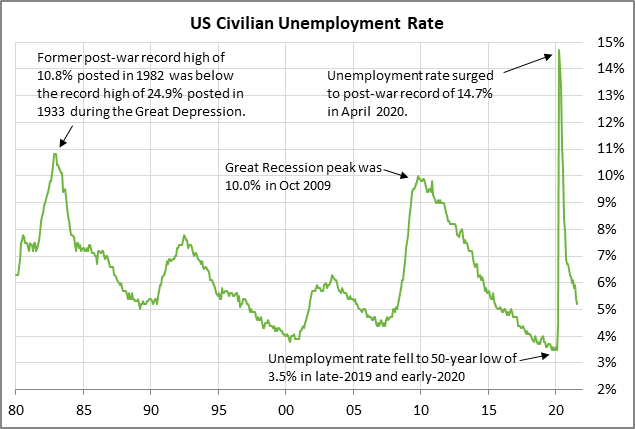

The consensus is for Friday’s Sep unemployment rate to fall by another -0.1 point to 5.1%, adding to August’s -0.2 point decline to a 1-1/2 year low of 5.2%. The current unemployment rate of 5.2% is still well above the record low of +3.5% seen prior to the pandemic.