- Veterans Day

- Low Interest Rates and Taxes Contribute to “Superstar†Companies

Veterans Day – Today is the Veterans Day holiday. The U.S. stock market is open during regular hours. However, the cash Treasury market is closed. The Federal Reserve is also closed during today’s banking holiday.

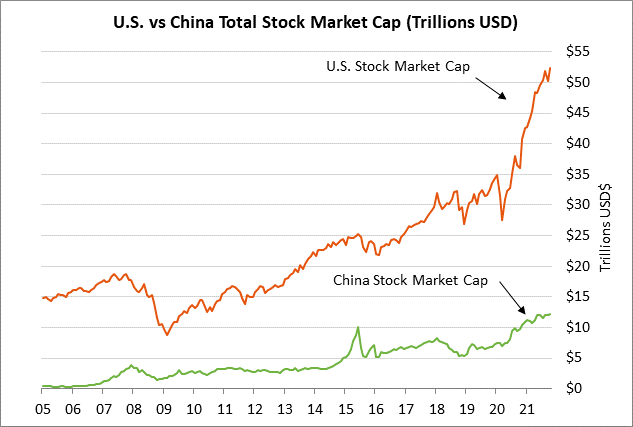

Low Interest Rates and Taxes Contribute to “Superstar†Companies — According to recent research from the National Bureau of Economic Research (NBER), the Fed’s ultra-easy monetary policy has disproportionately benefited industry-leading companies. Using data from as far back as 1962, the research shows that industry-leading companies are more able to take advantage of record-low interest rates than smaller companies can.

The NBER study shows that large companies use record-low interest rates to raise more debt, increase leverage, and buy back more of their own stock, while being better able to commit to capital investment and acquisitions. The study shows that these effects snowball as the interest rate approaches zero, and “the findings provide empirical support to the idea that extremely low-interest rates and the rise of superstar companies are connected.â€

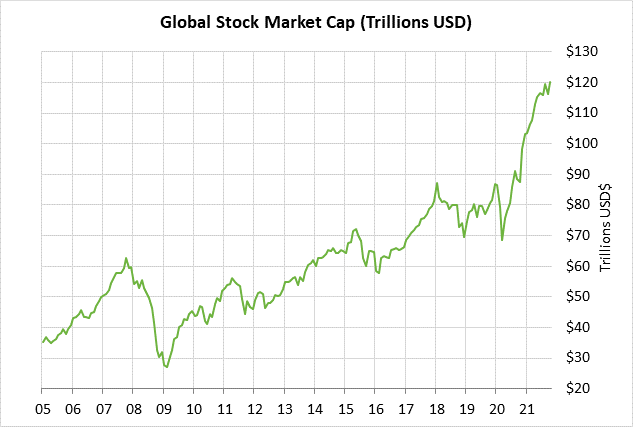

Data from Bloomberg Economics shows that the world’s top 50 companies by value added $4.5 trillion of stock market capitalization in 2020, taking their combined worth to about 28% of global GDP. In 1990 the equivalent figure was less than 5% of global GDP.

The advantages for superstar companies were even more pronounced during the pandemic. Technology giants such as Amazon.com (AMZN) have business models made for social distancing, while most competitors are dependent on foot traffic. Also, government rescue plans worked best for the biggest companies, which benefited from central bank backstops that kept borrowing costs low and stock prices high.

Efforts by national governments to make these superstar companies pay a larger share of taxes are building momentum. The Biden administration is pushing for a global tax deal that would make it harder for the biggest companies to lower their tax bills by shifting profits to low-tax jurisdictions.

A study from the International Monetary Fund (IMF) showed that as much as 40% of what looks like foreign direct investment is “phantom investment into corporate shells with no substance and no real links to the local economy.â€

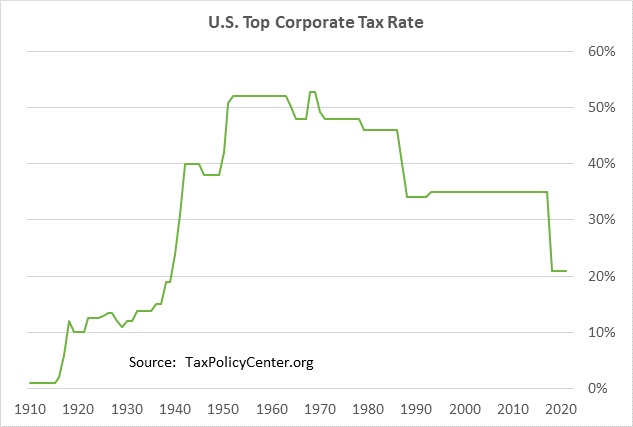

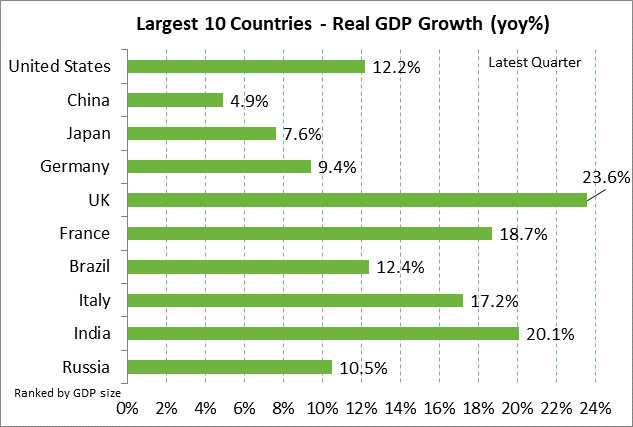

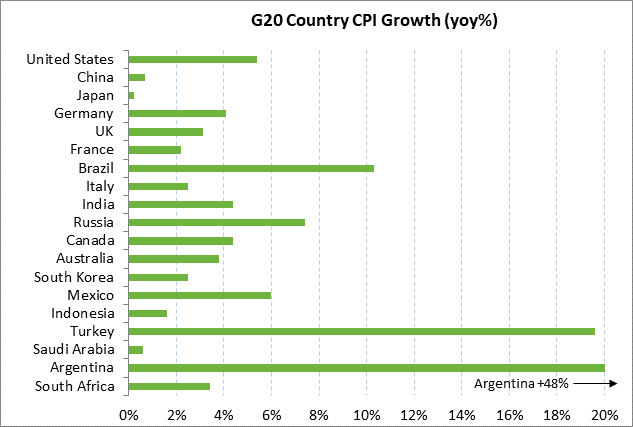

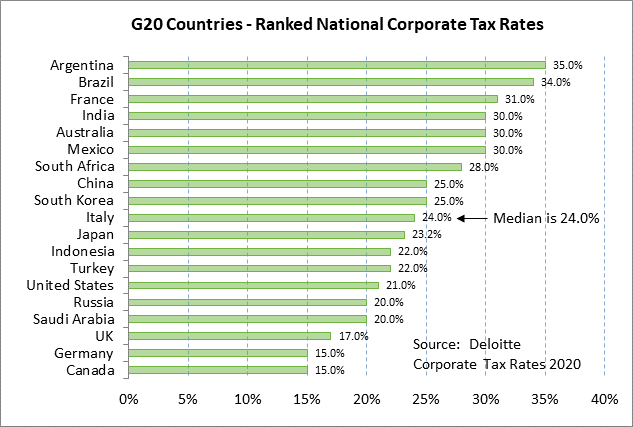

U.S. Treasury Secretary Yellen cited a global “30-year race to the bottom on corporate tax rates.†She said that an agreement among the Group of 20 countries on a global minimum tax charge will create “a more level playing field in the taxation of multinational corporations.†Bloomberg Economic data shows that the median effective tax rate of 35% in 1990 had fallen sharply to 17% by last year, while profit margins soared from 7% to 18% over the same period.

Despite the surge in profits, firms are devoting a smaller portion of their earnings to job-creating investments. In 1990, IBM (IBM), the world’s biggest publicly listed company at the time, devoted 9% of its revenue to capital expenditures. In 2020, Apple (APPL), now the world’s biggest publicly listed company, spent just 3%.

Regarding U.S. corporate tax rates, Republicans in 2017 slashed the corporate tax rate to 21% from 38%. Democrats would like to raise the corporate tax rate to bring in more revenue for their spending programs. President Biden originally wanted to raise the corporate tax rate to 28% from the current 21% level, but Democrats have since reduced that target due to opposition from moderate Democratic Senators such as Manchin and Sinema.

Democrats argue that there is room to raise the corporate tax rate from the current 21% level since the median G20 corporate tax rate is 24%. The U.S. could raise its corporate tax rate to 24% and still be at only the G20 median rate.

However, a closer look indicates that the U.S. would be well-advised to keep its corporate tax rate as low as possible to maintain its competitiveness since some major developed countries have lower tax rates than the current U.S. rate of 21%. Specifically, Germany and Canada have a corporate tax rate of 15% and the UK has a rate rate of 17%.

Ireland isn’t a G20 country, but is a well-known destination for U.S. companies seeking lower corporate taxes through tax inversion mergers. Ireland’s corporate tax rate is only 15%, which is six percentage points below the U.S. rate of 21%.

The U.S. has no inherent claim on corporations and corporate taxes. Private companies are free to do business where they want. To the extent that the U.S. imposes punitive taxes, corporations are free to move their operations and headquarters. U.S. policymakers must recognize that capital becomes more mobile all the time, meaning that the U.S. must improve its competitiveness if it wants to maintain and attract global corporations and foreign direct investment. Competitiveness involves a range of factors such as low taxes, a stable legal system, communications infrastructure, and transportation infrastructure. Anything that U.S. policymakers can do to attract more global business to the U.S. will ultimately be beneficial to the entire country, including all its citizens.