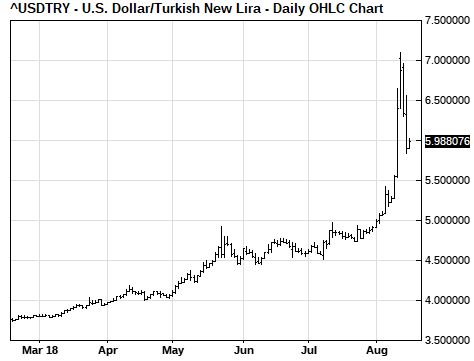

- Turkish lira continues to recover even as Erdogan steps up confrontation

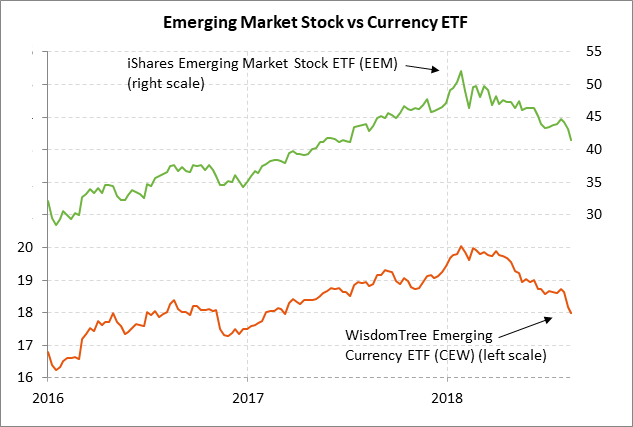

- Emerging market stocks enters bear market

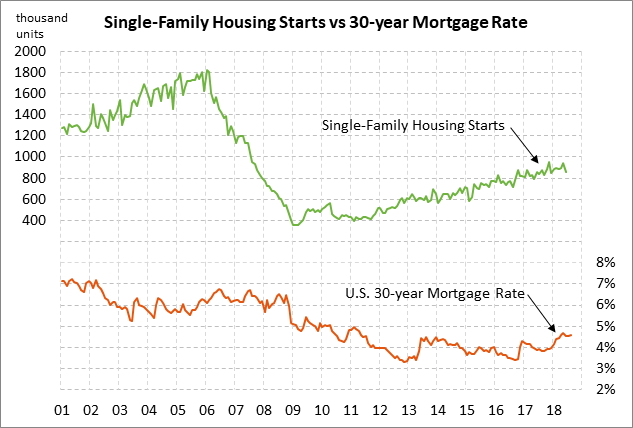

- U.S. housing starts expected to partially recover

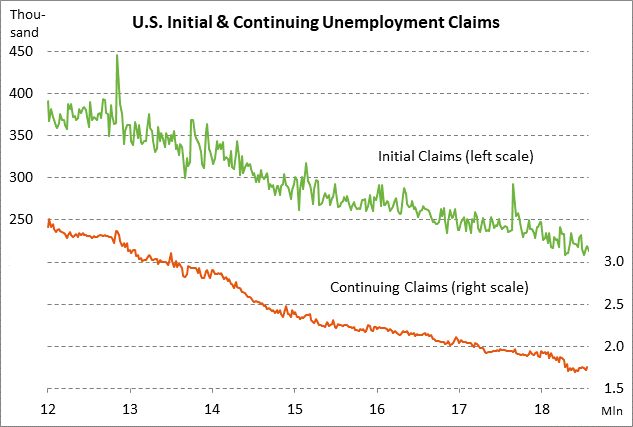

- U.S. unemployment claims expected to remain favorable

Turkish lira continues to recover even as Erdogan steps up confrontation — The Turkish lira on Wednesday rallied by +6.4%, extending Monday’s +7.8% rally. Despite the 2-day rebound, the lira is still down 56% year-to-date. Meanwhile, the iShares Turkish stock ETF (TUR) on Wednesday rallied by +4.1%, adding to Tuesday’s upward rebound of +11.3%. However, TUR is still down 22% month-to-date.

The lira showed a further recovery on Wednesday because of news that Qatar agreed to invest $15 billion in Turkey as some type of bailout and because of additional steps taken by Turkish government officials to make it more expensive to short the lira. In addition, the Turkish central bank is clamping down on bank liquidity and is forcing short-term interest rates slightly higher, although the central bank continues to refuse to implement the big interest rate hike that would be necessary to fully support the lira. The lira remains subject to a renewed plunge at virtually any time since Turkish fundamentals remain grim, including high inflation, a huge current account deficit, high external debt, and low foreign currency reserves.

President Erdogan on Wednesday dug in his heels on his feud with President Trump by announcing tariffs on up to $1.8 billion worth of U.S. goods as retaliation for President Trump’s action last Friday to double U.S. tariffs on Turkish steel and aluminum. Turkey’s retaliatory tariffs were roughly equal to the new U.S. tariffs, meaning that Mr. Erdogan at least did not raise the ante. Mr. Erdogan on Tuesday earlier called for Turkish citizens to boycott U.S. electronic products such as iPhones.

There was some possible good news on Wednesday as Reuters reported that Turkey’s foreign minister said that Turkey is ready to discuss ongoing issues with the U.S. as long as there are no threats. In addition, a Turkish appeals court today is expected to issue a ruling on the case of American pastor Brunson, who is at the center of the US/Turkey feud. It is conceivable that the court, at the behest of the Erdogan government, might simply free Mr. Brunson and allow him to return to the U.S.

White House press secretary Sarah Sanders said on Wednesday that the Trump administration “would consider” lifting the sanctions on Turkey’s Justice and Interior ministers if the pastor is released. However, Ms. Sanders said that the higher tariffs on steel and aluminum would remain in place even if the pastor is released since the administration is using the pretext of national security for the tariffs.

Emerging market stocks enter bear market — The iShares MSCI Emerging Market ETF (EEM) on Wednesday gapped to a 13-month low and fell by a total of -21.0% from January’s 10-year high, exceeding a -20% sell-off and thus qualifying as a bear market. Wednesday’s sell-off was caused by continued Turkish concerns but the main negative factor was Wednesday’s sharp -2.08% sell-off in Chinese stocks. Chinese stocks make up 26.6% of the iShares Emerging Markets ETF (EEM), far outweighing other countries (e.g., South Korea 14.2%, Taiwan 12.0%, India 9.3%, etc).

The most obvious trigger for this month’s plunge in emerging market stocks has been the crisis in Turkey. However, the emerging markets have more fundamental problems such as slower Chinese economic growth and the rising dollar. The stronger dollar has negative implications for emerging market countries since downward pressure on emerging market currencies causes worries about inflation, capital flight, and corporate defaults as companies have trouble financing more expensive dollar-denominated debt.

Meanwhile, Chinese stocks are already in a bear market due to slower economic growth caused by US/Chinese trade tensions and the government’s deleveraging program. Chinese investors are bracing for what could be a long and damaging trade war as President Trump seems to be willing to eventually slap tariffs on all Chinese exports to the U.S. and cause whatever pain is necessary to force China to succumb to U.S. trade demands. The Trump administration’s aggressive tariff stance is also causing direct pain for emerging market countries that export to the U.S.

The bigger picture is that the emerging markets are being squeezed by a tighter monetary policy in the developed world, which is bullish for developed-world currencies and bearish for emerging-market currencies. The Fed has raised interest rates by a total of 175 bp over the past 2-1/2 years and that has been a powerfully bullish factor for the dollar. The ECB is due to end its QE program at the end of this year and will likely raise interest rates by mid to late 2019. The BOJ is already allowing its JGB yield target to drift higher. The tighter liquidity in the developed world reduces capital flows for the emerging markets and causes the other problems mentioned earlier such as inflation, capital flight, and corporate defaults.

U.S. housing starts expected to partially recover — The market consensus is for today’s July housing starts report to recover by +7.4% to 1.260 million after June’s sharp -12.3% decline to 1.173 million. Housing starts saw weakness in June due to softening demand for new homes combined with labor and material constraints that are causing delays for some home builders. Yesterday’s August National Association of Homebuilders confidence index fell by -1 point to a 10-month low of 67.

U.S. unemployment claims expected to remain favorable — The consensus is for today’s initial unemployment claims report to show a +2,000 increase to 215,000 and for continuing claims to show a -15,000 decline to 1.740 mln. Initial claims are only 5,000 above July’s 49-year low and continuing claims are only 54,000 above June’s 45-year low.