- Chinese authorities allow the yuan to fall to new 1-year low

- U.S. unemployment claims expected to remain very favorable

- LEI expected to indicate continued U.S. economic strength

- Higher 10-year TIPS yield illustrates improved U.S. economy

Chinese authorities allow the yuan to fall to new 1-year low — The Chinese yuan yesterday fell to a new 1-year low of 6.7255 yuan/USD and closed the day down -0.18% at 6.7189 yuan/USD. The yuan in the past four months has fallen sharply by -7.6% from March’s 3-year high of 6.2431 yuan/USD.

The slide in the yuan has been caused by (1) weaker Chinese economic data, (2) talk that the PBOC may need to eventually ease monetary policy, (3) reduced yuan interest rate differentials due to the sharp -50 bp drop in the 10-year Chinese bond yield to 3.48% from last November’s 3-year high of 4.04%, and (4) concern about worsening trade tensions with the U.S.

The Chinese markets are particularly worried about U.S./Chinese trade tensions. China has already retaliated against U.S. steel and aluminum tariffs. The U.S. and China on July 6 then exchanged tariffs on $34 billion worth of goods and another $16 billion is on the way for a total of $50 billion. President Trump on July 10 then said he plans to slap a 25% tariff on another $200 billion worth of Chinese goods after the procedures are completed by August 30. If the U.S. goes ahead with tariffs on a total of $250 billion of Chinese goods, that is likely to cause a hit of 0.3-0.4 points to Chinese GDP. China’s GDP is already easing and fell to a 7-quarter low of 6.7% in Q2 from 6.8% in Q1.

Chinese authorities appear to be willing to allow the yuan to depreciate in response to fundamental factors. However, Chinese authorities cannot afford to allow the sell-off to get out of hand because that could cause investor panic and could also antagonize President Trump and spark new trade tensions. China in 2015 unexpectedly devalued the yuan and the result was a Chinese stock market plunge and capital flight. China was forced to substantially tighten exchange controls to slow the outflow of yuan from the country.

The Shanghai Composite index is in weak shape as well and is consolidating just mildly above the early-July 2-1/4 year low. Yesterday’s new 1-year low in the yuan was a bearish factor for stocks and threatens to grease the skids for further stock losses. The nearby chart illustrates how Chinese stocks and the yuan have sold off in unison in the past several months, which is a dangerous interaction since it could easily spiral into further losses.

U.S. unemployment claims expected to remain very favorable — U.S. unemployment claims remain in very favorable shape and support the view of a very strong U.S. labor market with layoffs at the lowest level in more than four decades. The initial claims series is only 5,000 above April’s 48-3/4 year low of 209,000 and the continuing claims series is only 38,000 above June’s 44-3/4 year low of 1.701 million.

The consensus is for today’s initial unemployment claims report to show a +6,000 increase to 220,000, reversing part of last week’s -18,000 decline to 214,000. The consensus is for today’s continuing claims report to show a -10,000 decline to 1.729 million, adding to last week’s small -3,000 decline to 1.739 million.

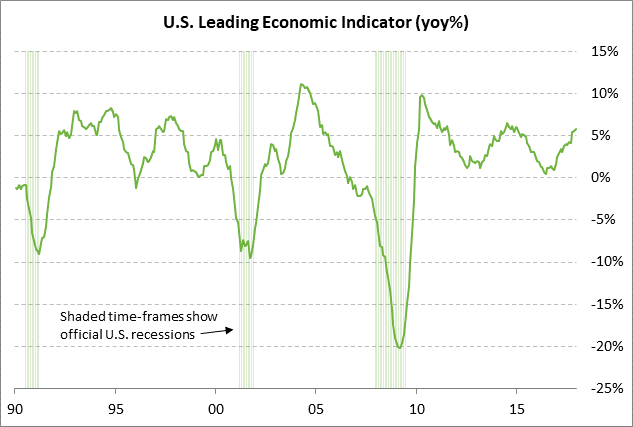

LEI expected to indicate continued U.S. economic strength — The consensus is for today’s June leading indicators index to show an increase of +0.4%, adding to May’s increase of +0.2%. The LEI has been very strong since late 2017 when Congress passed the tax cut bill. The LEI has shown an average monthly increase of +0.6% since October 2017. On a year-on-year basis, the LEI in May was very strong at +6.1% y/y, which was only 0.2 points below Feb’s 3-3/4 year high of +6.3% y/y.

The LEI points to continued strength in the U.S. economy. U.S. GDP growth was respectable at +2.8% in Q1 and is expected to strengthen to at least +3.4% in Q2 with some estimates going as high as 4% or even 5%. The consensus is for GDP growth of +2.9% in 2018 due in large part to the tax cuts. GDP growth is then expected to tail off to +2.5% in 2019 and +1.8% in 2020 as the tax effects dissipate.

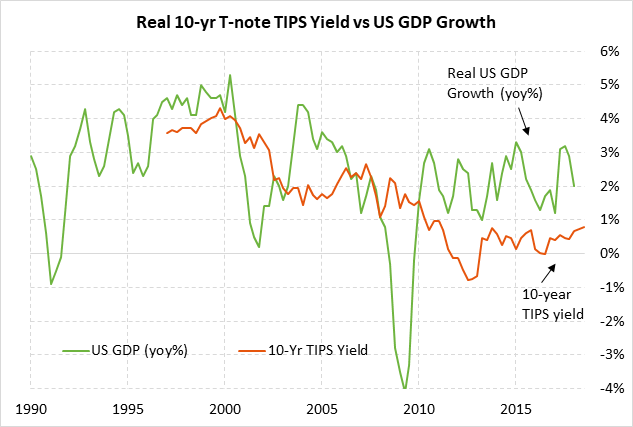

Higher 10-year TIPS yield illustrates improved U.S. economy — The Treasury today will auction $13 billion of 10-year TIPS. Today’s auction will be a new issue as opposed to a reopening of an existing issue. The $13 billion size of today’s auction is unchanged from the level seen since July 2016.

Today’s 10-year TIPS issue was trading at 0.76% in when-issued trading late yesterday afternoon. The benchmark 10-year TIPS yesterday rose to a new 1-month high and closed the day up +3 bp at 0.79%.

The 10-year TIPS yield has risen sharply by about 30 bp since Congress in December 2017 approved the tax cut bill. The current level of 0.79% is only 16 bp below May’s 7-1/4 year high of 0.95%. The 10-year TIPS has risen due in large part to the strong U.S. economy that has been boosted by the Jan 1 tax cuts and fiscal stimulus from $300 billion extra in government spending.

The 12-auction averages for the 10-year TIPS are as follows: 2.42 bid cover ratio, $23 million in non-competitive bids to mostly retail investors, 5.6 bp tail to the median yield, 11.9 bp tail to the low yield, and 58% taken at the high yield. The 10-year TIPS is second most popular security among foreign investors and central banks behind the 30-year TIPS. Indirect bidders, a proxy for foreign buyers, have taken an average of 69.1% of the last twelve 10-year TIPS auctions, which is well above the median of 63.3% for all recent Treasury coupon auctions.