- Unemployment claims remain favorable near decade-plus lows

- March payrolls are expected to show another respectable increase

- Chicago PMI expected to move back above 50.0

- China manufacturing PMI is expected to show some stabilization

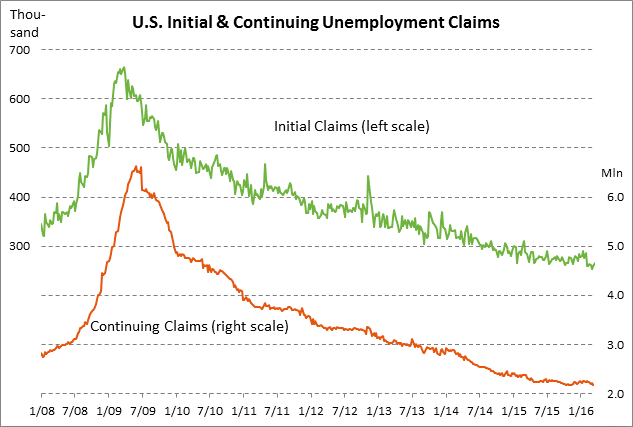

Unemployment claims remain favorable near decade-plus lows — Initial unemployment claims have risen mildly in the past two reporting weeks but are still only +12,000 above the 42-1/2 year low of 253,000 that was posted in the first week of March. The continuing claims series is also in good shape at only +8,000 above the 15-1/2 year low of 2.171 million posted in October 2015.

The low level of unemployment claims indicates that businesses are holding on to their employees and are not engaging in layoffs despite the recent financial market uncertainty. The markets are expecting today’s initial unemployment claims report to be unchanged at 265,000 after last week’s +6,000 increase to 265,000. Meanwhile, the markets are expecting today’s continuing claims report to show a +15,000 increase to 2.194 million, giving back part of last week’s -39,000 decline to 2.179 million.

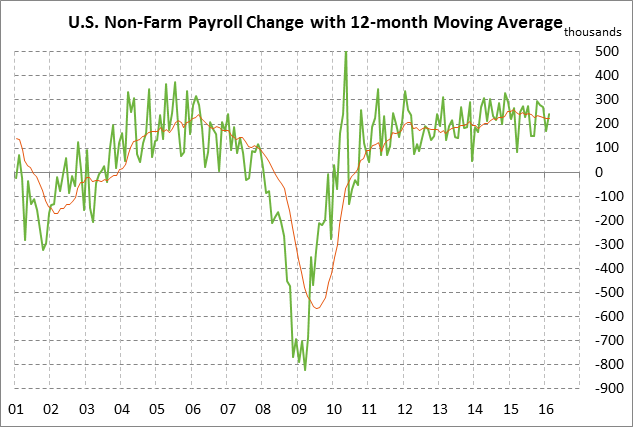

March payrolls are expected to show another respectable increase — On the labor front, the market is mainly looking ahead to Friday’s March unemployment report. The market is expecting Friday’s March payroll report to show an increase of +205,000, down from Feb’s strong +242,000 and mildly below the trend 12-month average of +223,000. Payrolls were a bit weak at +172,000 in January but the Jan-Feb average was much better at +207,000 after taking into account Feb’s strong increase of +242,000. Wednesday’s ADP report of +200,000 for March supported expectations for Friday’s payroll report.

The markets were pleased that job growth held up during January and February when the U.S. stock market was in a full-blown downside correction and there was significant turmoil in China. However, the question is whether job growth will continue to hold up at strong levels going into spring. U.S. corporations are currently in a profit recession and they may be looking to curb their hiring and their labor costs, particularly due to poor labor productivity at present.

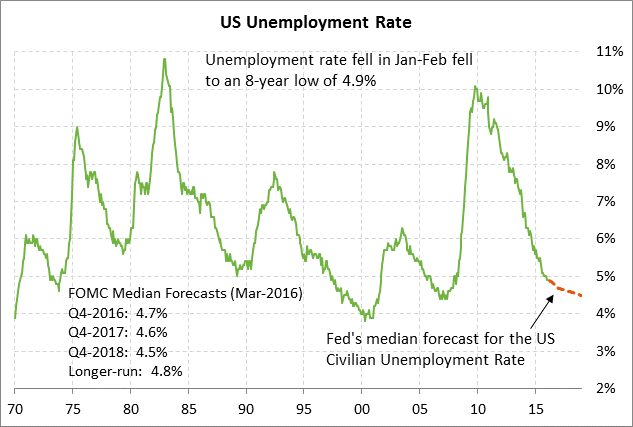

Meanwhile, the market is expecting Friday’s March unemployment rate to be unchanged from Feb’s 8-year low of 4.9%. The current U.S. unemployment rate of 4.9% is near the Fed’s idea of full employment considering that the FOMC is forecasting that the unemployment rate will drop by only another -0.4 points to 4.5% over the next three years and is forecasting the longer-run unemployment rate of 4.8%.

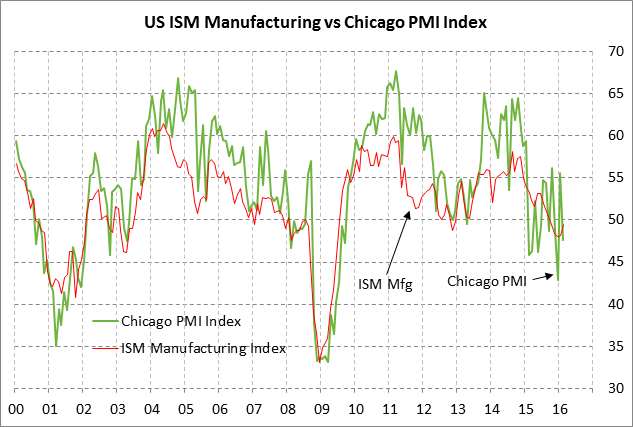

Chicago PMI expected to move back above 50.0 — The market is expecting today’s March Chicago PMI report to show a +3.2 point increase to 50.8, recovering part of February’s sharp -8.0 drop to 47.6. The February drop was likely sparked by the sharp downward U.S. stock market correction seen in January and the first half of February. In any case, the Chicago PMI has been volatile in recent months, bouncing back and forth across the expansion-contraction level of 50.0 and indicating that the Chicago-area manufacturing sector is not currently seeing much growth.

On the national front, the market is mainly looking ahead to Friday’s Mar ISM manufacturing report, which is expected to show a +1.3 point increase to 50.8, adding to Feb’s +1.3 point increase to 49.5. The ISM manufacturing index has been below the expansion-contraction level of 50.0 for the past five months and a rise in the index back above the 50.0 mark would be a welcome development. The ISM manufacturing index bottomed out at a 6-1/2 year low of 48.0 in December 2015 and then showed a combined +1.5 point recovery in Jan-Feb to 49.5

The rise in the ISM index indicates that U.S. executives are starting to see an improvement in the U.S. manufacturing sector after the weakness seen in 2015 caused by the strong dollar, weak overseas economic growth, and the recessions in the petroleum and mining industries. Indeed, the ISM manufacturing orders sub-index has been above 50.0 at 51.5 in the past two months (Jan-Feb), indicating an improvement in order flow. Still, the U.S. manufacturing sector in general remains weak and vulnerable to any fresh negative shocks.

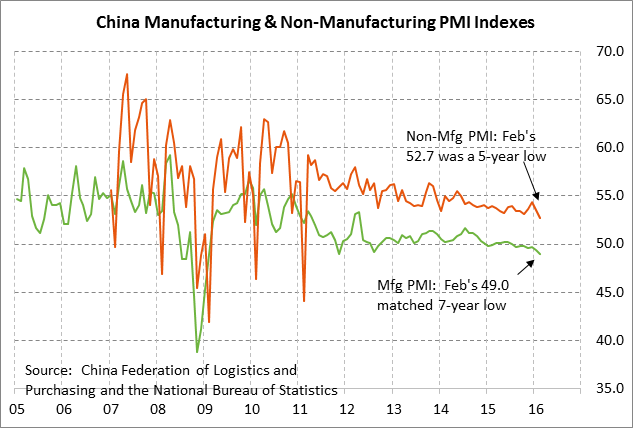

China manufacturing PMI is expected to show some stabilization — The market is expecting this evening’s China Mar manufacturing PMI from the National Bureau of Statistics to show a +0.3 point increase to 49.3, which would be the largest increase in 20 months. The PMI index fell by a total of -0.7 points in Jan-Feb to match a 7-year low of 49.0, indicating that Chinese manufacturing confidence is at the lowest level since early 2009. The markets would welcome any increase in the manufacturing PMI as a sign of stabilization in China, although the index is still expected to remain below the expansion-contraction level of 50.0 where it has been since August 2015.

The markets will also be hoping for some stabilization in this evening’s March Chinese non-manufacturing PMI, which fell by -0.8 points to a 5-year low of 52.7 in February. The non-manufacturing PMI is still above 50.0, which suggests that the non-manufacturing sectors of the Chinese economy are still expanding. Nevertheless, confidence in the non-manufacturing sectors is still at the lowest level in five years.