- 3-year T-note auction to yield near 1.09%

- Smaller decline in China’s forex reserves is a supportive factor for Chinese and U.S. stocks

- EIA report expected to show a further increase in U.S. crude oil inventories

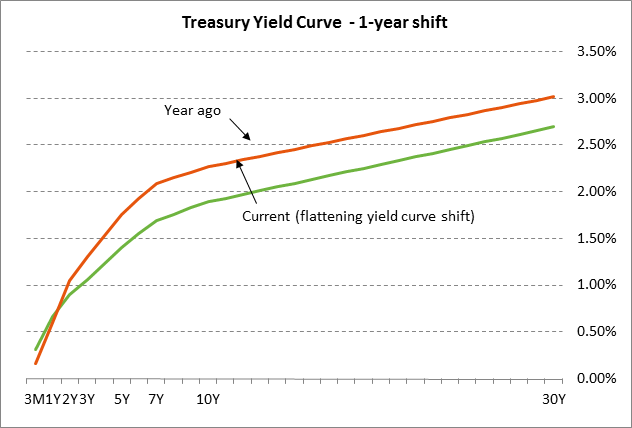

3-year T-note auction to yield near 1.09% — The Treasury today will sell $24 billion of 3-year T-notes. The Treasury will then continue this week’s $56 billion coupon package by selling $20 billion of 10-year T-notes on Wednesday and $12 billion of 30-year T-bonds on Thursday. This week’s 10-year and 30-year auctions will be the first reopenings of the securities first sold in February. The size of this week’s 10-year and 30-year auctions are $1 billion smaller than the sizes seen over the last six years. The Treasury has reduced the size of coupon auctions in favor of boosting T-bill auction sizes in an effort to dampen long-term yields.

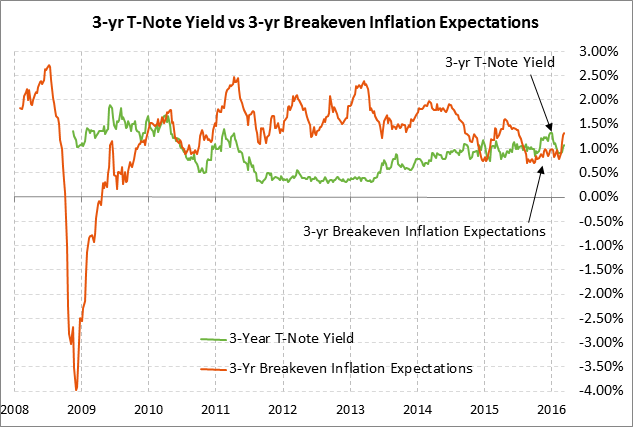

Today’s 3-year T-note issue was trading at 1.09% in when-issued trading late yesterday afternoon. That translates to an inflation-adjusted yield of -0.23% against the current 3-year breakeven inflation expectations rate of 1.32%.

The 12-auction averages for the 3-year are as follows: 3.20 bid cover ratio, $64 million in non-competitive bids to mostly retail investors, 3.6 bp tail to the median yield, 23.0 bp tail to the low yield, and 52% taken at the high yield. The 3-year is the second least popular security among foreign investors and central banks behind the 2-year T-note. Indirect bidders, a proxy for foreign buying, have taken an average of only 49.7% of the last twelve 3-year T-note auctions, which is well below the average of 55.4% for all recent Treasury coupon auctions.

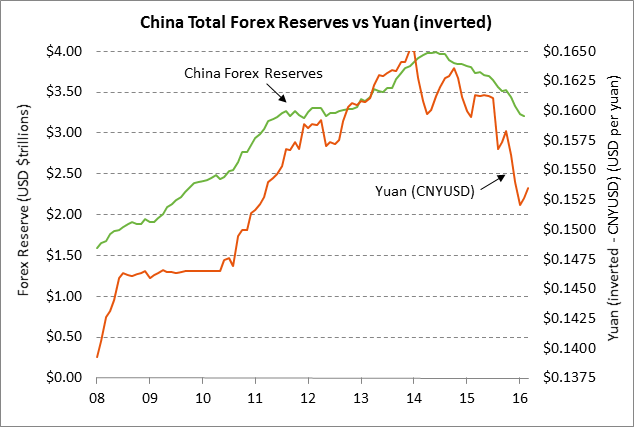

Smaller decline in China’s forex reserves is a supportive factor for Chinese and U.S. stocks — China reported yesterday that its foreign exchange reserves fell by -$29 billion in February to $3.202 trillion. However, the size of the decline was the smallest in four months. Reserves earlier fell sharply during Nov (-$87 billion), Dec (-$108 billion), and Jan (-$99 billion). The softer decline in reserves was interpreted as a sign that the PBOC is under less pressure to intervene to support the yuan and that Chinese corporations need fewer dollars to pay overseas debts. The markets had been getting worried that the PBOC might be spending so much in trying to support the yuan that its reserve levels could fall to dangerously low levels.

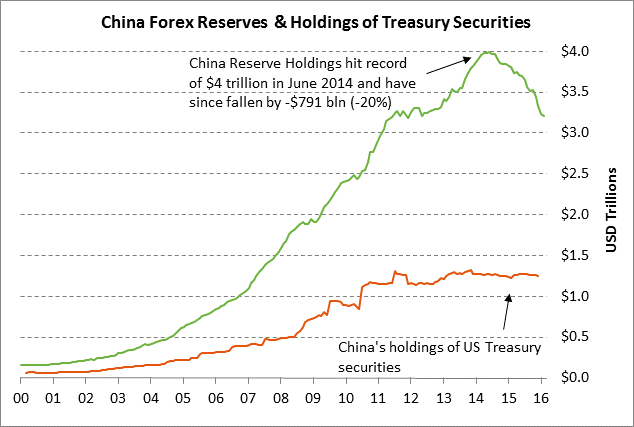

China’s FX reserves have so far fallen by a total of $791 billion (-19.8%) to $3.20 trillion from the record high of $3.99 trillion posted in June 2014. Despite that decline, China still has a massive amount of FX reserves to protect itself against a run on its currency and to provide dollars to Chinese corporations that need them to service overseas dollar-denominated debt, assuming the official reserve figures are correct.

U.S. hedge fund manager Kyle Bass recently said that he does not believe China’s office reserve numbers and that he thinks China’s actual reserve levels may be $1 trillion below the government’s figures. He suspects that the Chinese government includes in its reserve figures illiquid assets such as real estate and private-equity investments that could not be liquidated quickly to help in a currency crisis.

However, PBOC deputy governor Yi Gang said this past Sunday at a press conference that China’s reserve figures are correct and that China includes only highly liquid assets in its reserve totals. He said, “I can clearly tell everyone here, those assets that don’t meet liquidity standards are entirely deducted from official foreign exchange reserves. For example, some illiquid equity investments, some capital injections and some other assets where liquidity isn’t good are entirely outside our foreign exchange reserves.”

The yuan has fallen sharply by -8.2% since 2014. The recent sharp declines in the yuan in Aug 2015 and again in Nov-Jan caused sharp sell-offs in the Chinese stock market and, in reaction, the global stock markets as well. The U.S. stock market is therefore closing watching the Chinese currency situation. Yesterday’s report of a smaller decline in China’s FX reserves was therefore a supportive factor for the Chinese stock market as well as the U.S. stock market.

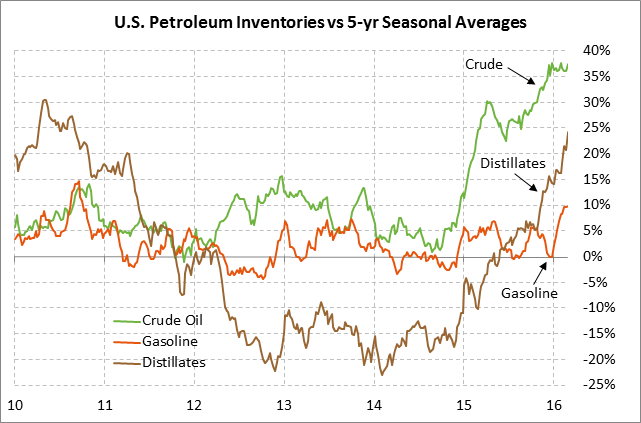

EIA report — The market consensus for Wednesday’s weekly EIA report is for a +3.5 million bbl rise in U.S. crude oil inventories, a -1.5 million bbl decline in gasoline inventories, a +900,000 bbl rise in distillate inventories, and a -0.4 point decline in the refinery utilization rate to 87.9%.

U.S. crude oil inventories last week soared by +10.4 million bbl to a record high of 517.981 million bbls. U.S. oil inventories are now a massive +141 million bbls (+37.5%) above the 5-year seasonal average. Moreover, crude oil inventories at the Cushing hub, where Nymex WTI futures are priced, rose to a record high of 66.256 million bbls in last week’s EIA report. The EIA says that Cushing has a total storage capacity of 73 million bbls, meaning that inventories have room to rise by only another 6.7 million bbls.

Meanwhile, there are more than ample supplies of U.S. product inventories, which are keeping downward pressure on gasoline and distillate prices. U.S. gasoline inventories are +9.8% above the 5-year seasonal average and distillate inventories are +24.2% above average.

U.S. oil production has recently dropped on a sustained basis with a 6-week decline of -1.4% to last week’s new 1-1/3 year low of 9.077 million bpd. U.S. oil production has now fallen by -5.5% from the 43-year high posted in June 2015. The latest drop in production is being caused by the fact that another 146 oil rigs have closed just since the beginning of the year. The number of active U.S. oil rigs has now plunged by a total of 1,217 rigs (-76%) to a 6-1/4 year low of 392 rigs from the peak of 1,609 rigs seen in Oct 2014.