- U.S. PCE deflator expected to show new inflation highs

- U.S. consumer confidence expected to remain weak

- U.S. new home sales expected to remain strong

- U.S. unemployment claims will be watched to see if omicron leads to some layoffs

- U.S. durable goods orders expected to show strength

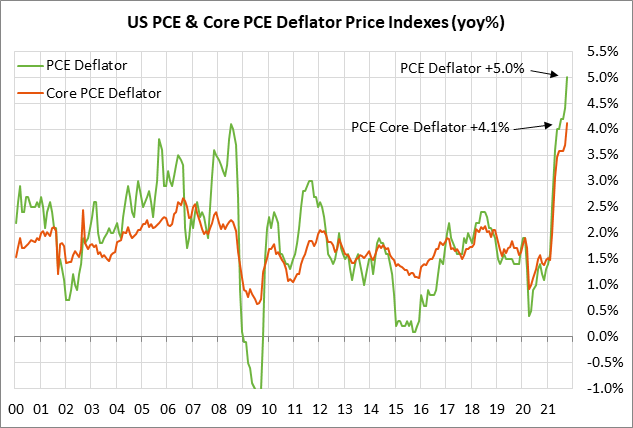

U.S. PCE deflator expected to show new inflation highs — Today’s PCE deflator, which is the Fed’s preferred inflation measure, is expected to show new year-on-year highs, thus keeping alive worries about inflation.

The consensus is for today’s Nov PCE deflator to show increases of +0.6% m/m and +5.7% y/y, following October’s report of +0.6% m/m and +5.0% y/y. The consensus is for today’s Nov core PCE deflator to show increases of +0.4% m/m and +4.5% y/y, following October’s report of +0.4% m/m and +4.1% y/y.

Today’s expected rise in the PCE deflator to +5.7% y/y would be a new 39-year high, while the expected rise in the core deflator to +4.5% would be a new 32-year high. The already-reported CPI report for November showed a rise to a new 39-year high of +6.8%, and the core CPI rose to a 30-year high of +4.9%.

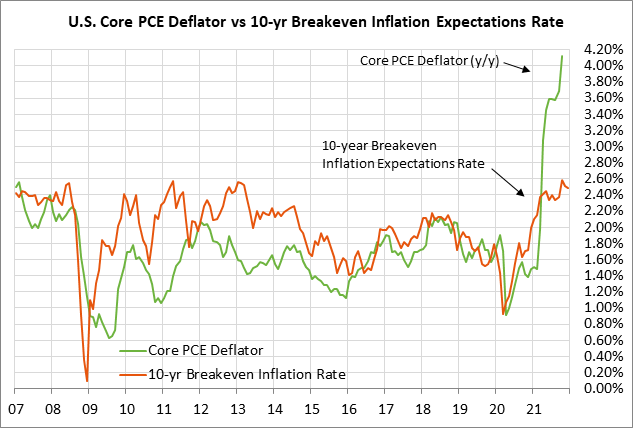

On the brighter side, the markets have become a little less worried about the inflation situation. The current 10-year breakeven inflation expectations rate of 2.50% is down by -28 bp from November’s record high of 2.78% (data since 2002).

Inflation expectations have dropped due to (1) the -15% decline in crude oil prices to the current level of $72.76 per barrel from October’s 7-1/4 year high of $85.41, (2) expectations that the global spread of the omicron variant will slow global economic growth, and (3) increased confidence that the Fed’s response will be aggressive enough to bring inflation back under control.

The recent inflation surge has forced the Fed to throw in the towel on its previous claim that the rise in inflation was transitory. The FOMC, at its meeting earlier this month, took a hawkish turn and doubled the pace of its QE tapering so that the program will end three months earlier in March 2022. That will allow the Fed to start raising interest rates as soon as the FOMC meeting in March 2022. FOMC members are now forecasting three rate hikes in 2022, three more rate hikes in 2023, and two more rate hikes in 2023.

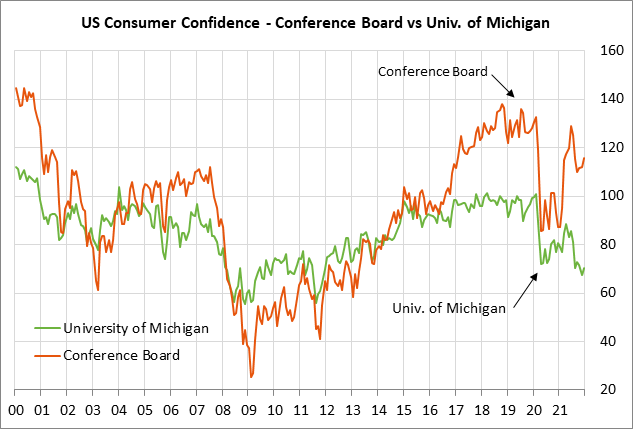

U.S. consumer confidence expected to remain weak — The consensus is for today’s final-Dec University of Michigan U.S. consumer sentiment index to be left unrevised from early-Dec at 70.4, which would leave the index up by +3.0 points from November.

The sentiment index is in very weak shape at only 3.0 points above the 10-year low of 67.4 posted in November. The index is below even the worst level of 71.8 seen in April 2020 during the pandemic shutdowns.

U.S. consumers remain in a bad mood despite the strong economy and tight labor market. Consumers are fed up with the pandemic, which is nearly two years old. Consumers are also unhappy about high gasoline prices and the worst inflation in more than 30 years.

Despite their bad mood, however, consumers are freely spending money and are supporting the economy. Retail sales in November rose by another +0.3% m/m to a record high of $639.8 billion, adding to October’s sharp increase of +1.6%. Even though consumers are in a bad mood, they are still spending lots of money, which is the important thing for the economy.

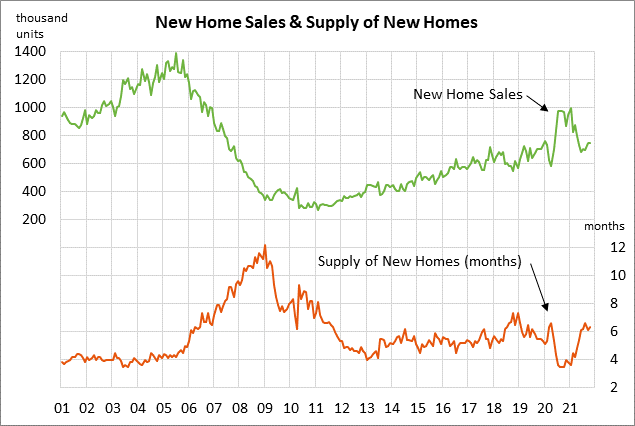

U.S. new home sales expected to remain strong — The consensus is for today’s Nov new home sales report to show an increase of +3.3% m/m to 770,000, adding to October’s +0.4% increase to 745,000. New home sales have fallen back from January’s 14-year high of 993,000 but remain in strong shape.

Demand for new homes remains strong due to the pandemic trend of moving into larger homes or moving out of multi-family units. Also, low mortgage rates continue to encourage the purchase of new homes. On the downside, however, the price of new homes has risen sharply and has priced some people out of the market. The median price of a new home rose to a record high of $407,700 in October, up +24% from the pre-pandemic level of $329,500 seen at the end of 2019.

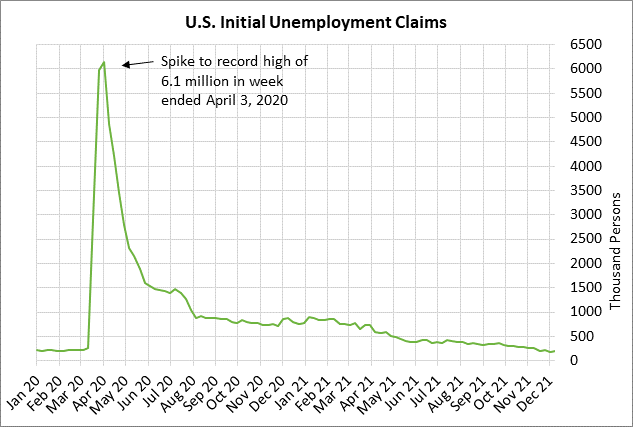

U.S. unemployment claims will be watched to see if omicron leads to some layoffs — The consensus is for today’s weekly initial unemployment claims report to show a small -1,000 decline to 205,000 following last week’s +18,000 increase to 206,000. Meanwhile, today’s continuing claims report is expected to show a -2,000 decline to 1.843 million, adding to last week’s -154,000 decline to 1.845 million.

The initial claims series is currently just 18,000 above the 52-year low of 188,000 posted in the week ended Dec 3, illustrating that very few businesses are laying off employees. Continuing claims last week fell to a new 1-3/4 year low.

However, the markets will carefully watch unemployment claims over the next few weeks to see if some businesses such as restaurants and entertainment venues start laying off employees due to the omicron variant that is sweeping the nation.

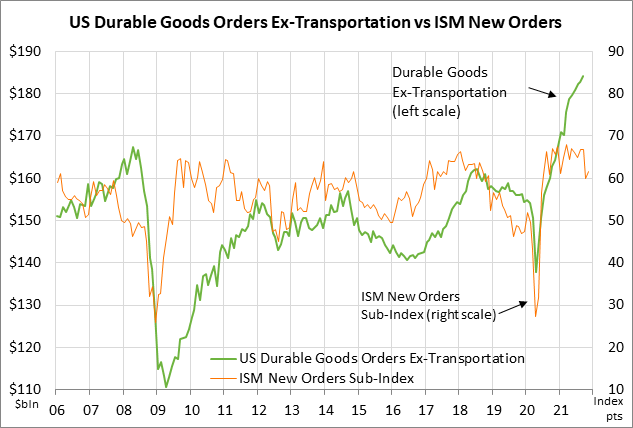

U.S. durable goods orders expected to show strength — The consensus is for today’s Nov durable goods orders report to show an increase of +1.8% m/m and +0.6% m/m ex-transportation, following October’s report of -0.5% m/m and +0.5% m/m ex-transportation. The U.S. manufacturing sector continues to see strong order flow, although companies are struggling to keep up with production due to supply-chain and transportation constraints, and labor shortages. However, manufacturing confidence remains strong, with the ISM manufacturing index at 61.1 in November.