- Goldman downgrades U.S. GDP after Manchin rejects BBB

- Biden speaks today on Covid pandemic as omicron quickly takes over

- U.S. current account deficit expected to widen to 15-year high

Goldman downgrades U.S. GDP after Manchin rejects BBB — Goldman Sachs yesterday quickly downgraded its 2022 GDP forecast after Senator Manchin on Sunday rejected President Biden’s’ Build Back Better bill, which would have provided some fiscal stimulus to the economy next year.

Goldman downgraded its quarterly GDP forecasts to +2.0% from +3.0% for Q1, 3% from 3.5% in Q2, and +2.75% from +3.0% for Q3.

Goldman’s economists said, “We recently put the probability of a modified version of the BBB legislation passing at slightly better than even but, in light of Manchin’s comments, the odds have clearly declined and we will remove the assumption from our forecast.” Goldman added, “there is still a good chance” that Congress will pass a smaller set of fiscal proposals dealing with manufacturing incentives and supply chain issues.

Goldman also said there is a reduced chance that the FOMC will begin to raise interest rates as soon as March 2022 if Congress does not adopt more fiscal stimulus with the BBB bill.

However, the BBB bill is not completely dead. Mr. Manchin on Monday outlined some of his demands for the bill, which included the time-consuming process of the bill going through the Senate committee review process. If there is any chance of the bill passing, the timing is likely to be February or March.

The White House on Monday said it will continue to push the BBB bill and will continue to negotiate with Senator Manchin. It remains to be seen whether there is any version of the BBB bill that can receive support from every one of the 50 Democratic Senators. Mr. Manchin says he wants a deal but he is far apart from the other 49 Democratic Senators. Mr. Manchin also wants tax hikes on corporations that are opposed by Arizona Senator Sinema.

Meanwhile, Senate Majority Leader Schumer told Democratic Senators on Monday that he will put a $1.75 trillion BBB bill to a floor vote in early 2022 “so that every member of this body has the opportunity to make their position known on the Senate floor, not just on television.” He added, “We are going to vote on a revised version of the House-passed Build Back Better Act — and we will keep voting on it until we get something done.”

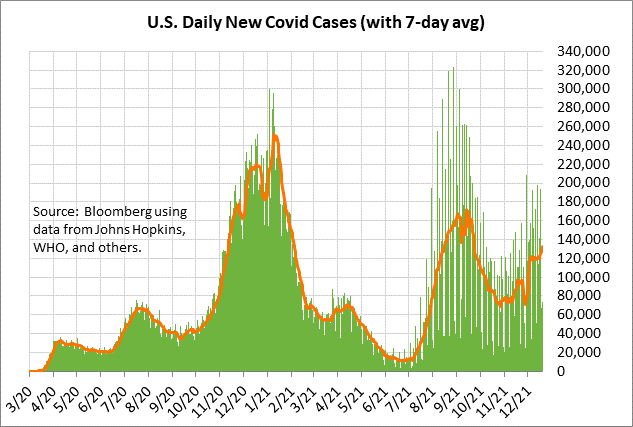

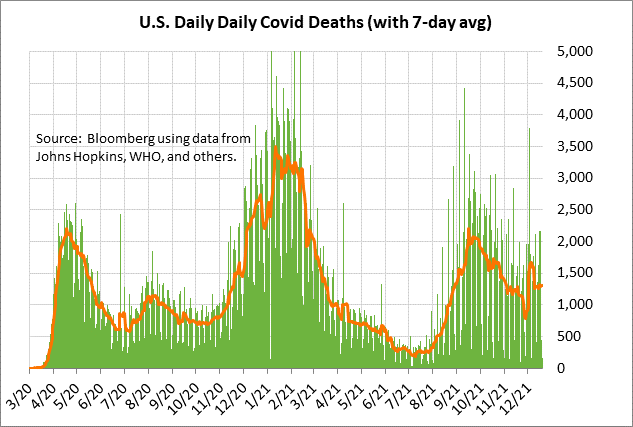

Biden speaks today on Covid pandemic as omicron quickly takes over — Global stock markets showed weakness on Monday as the omicron Covid variant sweeps the globe and prompts new restrictions that will undercut global economic growth. The 7-day average of new U.S. Covid infections on Saturday rose to a 3-month high of 127,005.

The omicron variant now accounts for 73% of new U.S. Covid cases, up from just 3% a week earlier, according to the CDC. The omicron variant has taken over at a shockingly fast pace, providing evidence of its high transmissibility. The U.S. appears to be headed for a deluge of new cases, which is likely to lead to some new restrictions and a strain on the U.S. health care system.

In the space of just the month since the variant became widely known, omicron has been found in 75 countries and 39 U.S. states. Global restrictions are increasing with the Netherlands going into lockdown, Israel banning travel from the U.S. and Canada, and France closing to the UK.

President Biden today will give a speech outlining how the U.S. government will respond to the pandemic’s coming surge. Mr. Biden’s spokeswoman said, “This is not a speech about locking the country down. This is a speech outlining and being direct and clear with the American people about the benefit of being vaccinated, the steps we’re going to take to increase access and to increase testing and the risks posed to unvaccinated individuals.â€

On the brighter side, the U.S. vaccination rate continues to climb slowly. Current vaccines appear to provide at least some protection against the omicron variant and may lessen the severity of a breakthrough infection. Bloomberg reports that 61.4% of the total U.S. population has now been fully vaccinated, and 18.1% have received a booster shot. In the past week, the U.S. has administered a daily average of 1.6 million doses.

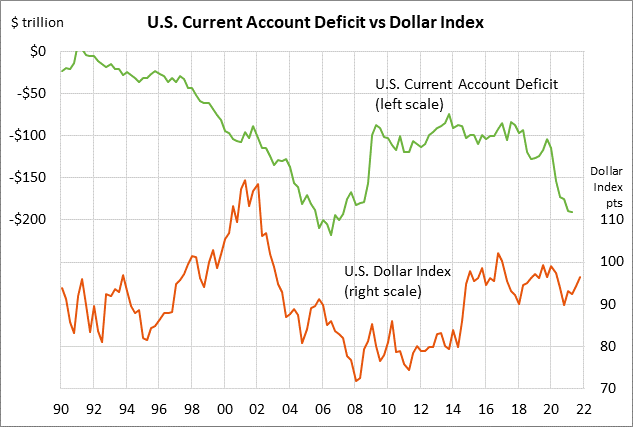

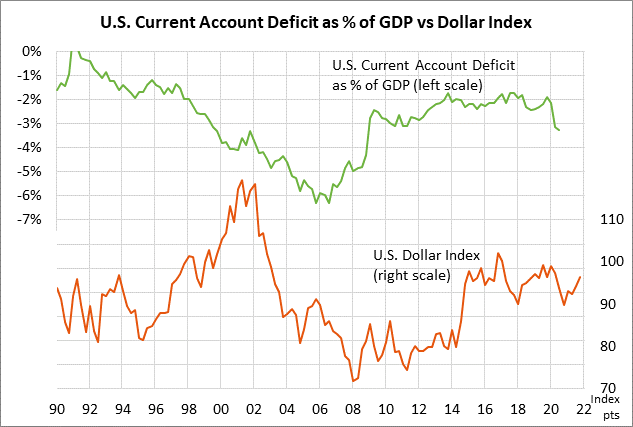

U.S. current account deficit expected to widen to 15-year high — The consensus is for today’s Q3 current account deficit to widen to a 15-year high of -$205.0 billion from Q2’s -$190.3 billion. The U.S. current account deficit has soared since the pandemic began because imports have been much stronger than exports. U.S. imports have been strong due to the massive amount of fiscal and monetary stimulus that has been injected into the U.S. economy. By contrast, weak overseas growth has undercut U.S. exports.

20-year T-note auction — The Treasury today will sell $20 billion of 20-year T-bonds in the first of two reopenings of the 2% 20-year bond of November 2041 that the Treasury first sold last month. The benchmark 20-year T-bond yield yesterday closed little changed at 1.89%.

The 12-auction averages for the 20-year T-bond are as follows: 2.34 bid cover ratio, $3 million of non-competitive bids, 6.8 bp tail to the median yield, 94.2 bp tail to the low yield, and 54% taken at the high yield. The 20-year is moderately below average in popularity among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers have taken an average of 60.1% of the last twelve 20-year bond auctions, moderately below the median of 63.5% for all recent Treasury coupon auctions.