Beige Book likely to show improved economy as pandemic ebbs

Schumer wants spending framework deal this week

20-year T-bond auction

Beige Book likely to show improved economy as pandemic ebbs — The Fed today will release its Beige Book report ahead of the FOMC meeting in less than two weeks on November 2-3.

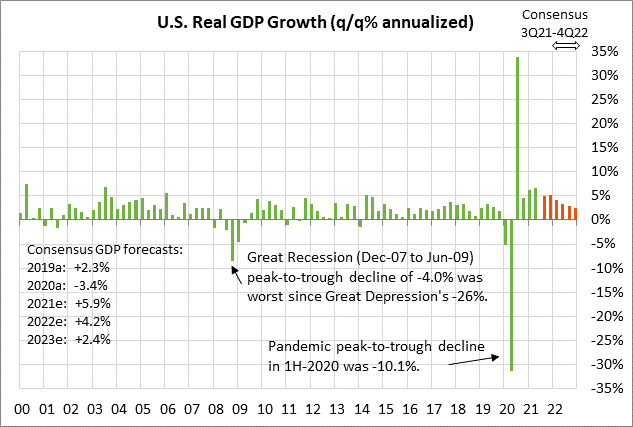

The last Beige Book report was released on September 8 when U.S. Covid infections were still climbing, which means the economy at that time was seeing the worst of the pandemic’s resurgence. Today’s new Beige Book report, by contrast, should show an improved economic outlook since U.S. Covid infections have plunged by more than 50% since peaking in mid-September.

The last Beige Book report said, “Economic growth downshifted slightly to a moderate pace in early July through August. The stronger sectors of the economy of late included manufacturing, transportation, nonfinancial services, and residential real estate. The deceleration in economic activity was largely attributable to a pullback in dining out, travel, and tourism in most Districts, reflecting safety concerns due to the rise of the Delta variant, and, in a few cases, international travel restrictions. The other sectors of the economy where growth slowed or activity declined were those constrained by supply disruptions and labor shortages, as opposed to softening demand.”

Today’s Beige Book report is likely to indicate that economic growth improved in pandemic-sensitive areas of the economy such as restaurants, travel, and tourism. However, the Beige Book is also likely to highlight ongoing supply-chain disruptions, chip shortage, shipping delays, and labor shortages. Those obstacles are preventing the economy from reaching its potential. However, those problems should ease going into next year as the overall economy cools and as businesses catch up with demand.

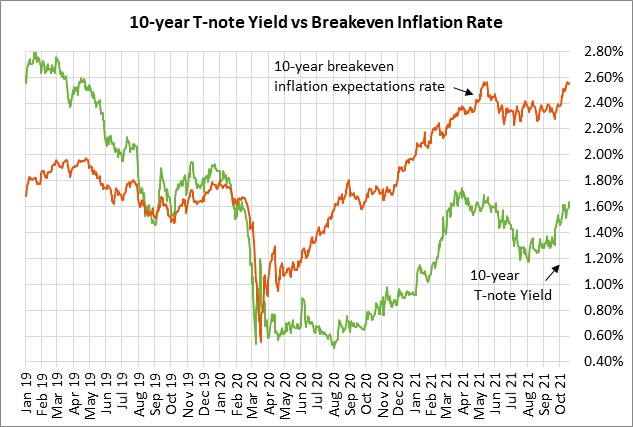

There is a strong chance that the FOMC at its upcoming meeting on November 2-3 will announce QE tapering. The minutes from the last meeting on Sep 21-22 clearly telegraphed the likelihood of a QE tapering announcement at the next FOMC meeting. The Sep 21-22 FOMC minutes said, “Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

The FOMC at the Sep 21-22 meeting went so far as to discuss a specific tapering path. The minutes said, “The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities.

The FOMC might decide to delay its tapering decision until its Dec 14-15 meeting due to the weak Sep payroll report of +194,000, which was well below expectations of +500,000. However, there was also some strength in the Sep unemployment report with the news that the unemployment rate fell -0.4 points to a new 1-1/2 year low of 4.8%.

The next unemployment report won’t be released until Nov 5, a few days after the next FOMC meeting. Nevertheless, the Fed may decide to go ahead with tapering at its Nov 2-3 meeting despite not having an improved job report in hand, expecting the job picture to strengthen in October and November due to the sharp drop in the Covid infection figures seen since mid-September.

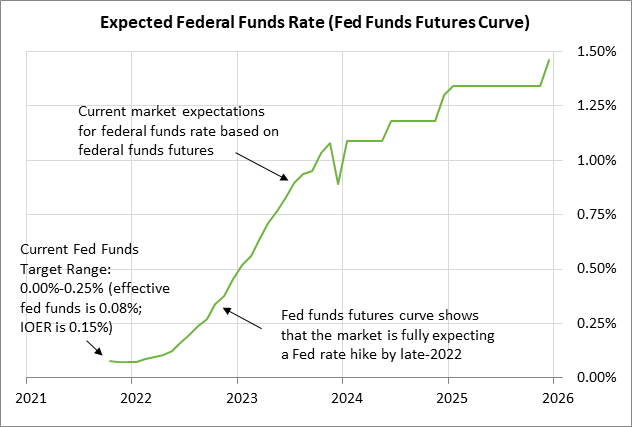

The federal funds futures market is now discounting the Fed’s first +25 rate hike by the end of 2022. The Dec 2022 federal funds futures contract is currently trading at a yield of 0.45%, which is 32.5 bp above the current target midpoint of 0.125% and 37 bp above the current effective federal funds rate of 0.08%.

Schumer wants spending framework deal this week — Senate Majority Leader Schumer said that Democrats aim to get a framework deal on their spending program by the end of this week. A deal this week is necessary considering that House Speaker Pelosi wants to get both the spending bill and the infrastructure bill passed by the end of next week, meeting her deadline of October 31 when some highway spending bills expire. Democrats would also like to have a deal in place to give Democrat Terry McAuliffe a possible boost for the politically-important Governor’s election in Virginia on November 2.

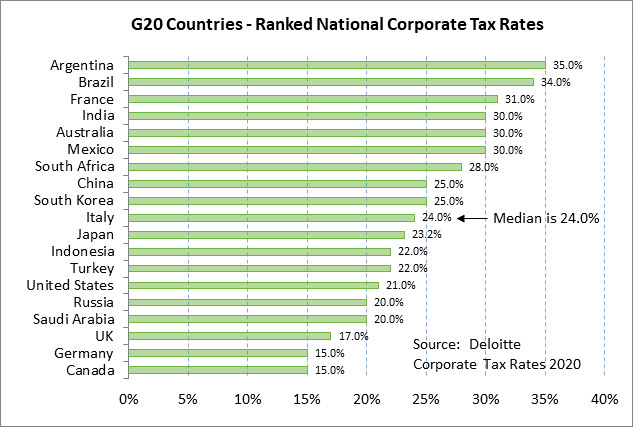

President Biden met separately yesterday with progressives, moderates, and Manchin-Sinema. The chances for a deal have increased this week due to direct negotiations between the progressive and moderate wings of the Democratic Party. Democrats seem to agree that the deal needs to be trimmed to the $2 trillion area from $3.5 trillion in order to get the moderates on board. The stock market wants to see the fiscal stimulus from the infrastructure and reconciliation bills, but is not happy about the increase in corporate tax rates in the reconciliation bill, which will reduce after-tax corporate profits.

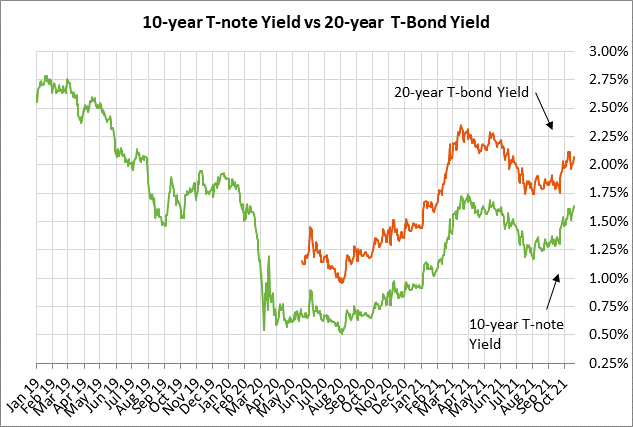

20-year T-bond auction — The Treasury today will sell $24 billion of 20-year T-bonds in the second and final reopening of the 1-3/4% 20-year bond of August 2041 that the Treasury first sold in August. The benchmark 20-year T-bond yield on Tuesday closed +5 bp at 2.06%, which was just 6 bp below last week’s 4-month high of 2.12%.

The 12-auction averages for the 20-year bond are as follows: 2.36 bid cover ratio, $2 million in non-competitive bids, 6.2 bp tail to the median yield, 113.3 bp tail to the low yield, and 52% taken at the high yield. The 20-year bond is moderately below average in popularity among foreign investors and central banks. Indirect bidders, a proxy for foreign buyers, have taken an average of 60.1% of the last twelve 20-year bond auctions, which is moderately below the median of 63.7% for all recent Treasury coupon auctions.