- Weekly market focus

- FOMC expected to announce QE tapering at next meeting in two weeks

- Congress returns to Washington to resume battle over infrastructure and reconciliation bills

- U.S. Covid infections are down by -50% from September’s high

- Q3 earnings season kicks into gear

Weekly market focus — The markets this week will focus on (1) anticipation of the FOMC meeting in two weeks, (2) whether the Covid infection figures continue to decline, (3) Q3 earnings season with 78 of the S&P 500 companies reporting this week, (4) the Treasury’s sale of 20-year T-bonds and 5-year TIPS, (5) the crypto markets as a bitcoin ETF is expected to be approved by the SEC this week, and (6) any carry-over from the ongoing debt crisis among Chinese property developers led by Evergrande.

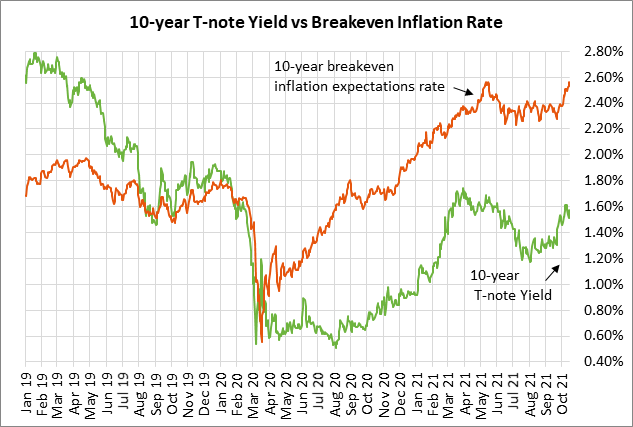

FOMC expected to announce QE tapering at next meeting in two weeks — The markets are discounting a strong chance that the FOMC at its next meeting on Nov 2-3 will announce QE tapering. The minutes from the last FOMC meeting on Sep 21-22, which were released last Wednesday, said, “Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

The FOMC at the Sep 21-21 meeting went so far as to discuss a specific tapering path. The minutes said, “The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities.

The FOMC might decide to delay its tapering decision until its Dec 14-15 meeting due to the weak Sep payroll report of +194,000, which was well below expectations of +500,000. However, there was also some strength in the Sep unemployment report with the news that the unemployment rate fell -0.4 points to a new 1-1/2 year low of 4.8%.

The next unemployment report won’t be released until Nov 5, a few days after the next FOMC meeting. The Fed may decide to go ahead with tapering at its Nov 2-3 meeting, expecting the job picture to strengthen in October and November due to the sharp drop in the Covid infection figures that began in mid-September.

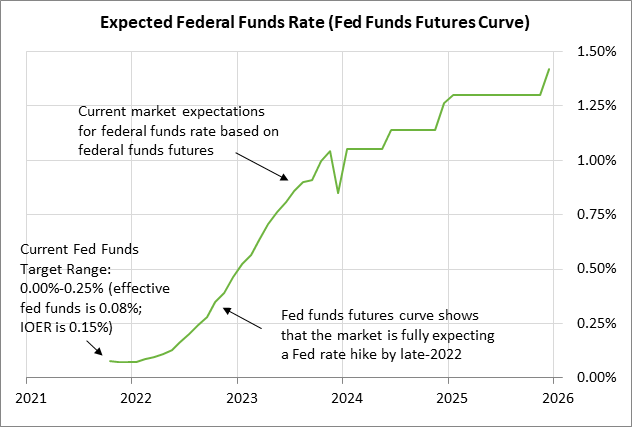

The federal funds futures market is now discounting the Fed’s first +25 rate hike by the end of 2022. The Dec 2022 federal funds futures contract is currently trading at a yield of 0.465%, which is 34 bp above the current target midpoint of 0.125% and 38.5 bp above the current effective federal funds rate of 0.08%.

Congress returns to Washington to resume battle over infrastructure and reconciliation bills — The House and Senate will return to Washington early this week from their Columbus Day recess. The good news is that President Biden signed the debt ceiling hike last week, which means that the threat of a Treasury default will not emerge again until the new debt ceiling hike runs out on December 3. The continuing resolution also expires on December 3, which means that there will be a partial government shutdown beginning on December 4 if Congress does not pass a new spending bill. Senate Minority Leader McConnell says Republicans will not help Democrats pass a debt ceiling suspension or hike by December 3, which means Democrats may be forced into raising the debt ceiling through reconciliation.

Democrats this week will continue to haggle over the infrastructure and reconciliation bills. House Speaker Pelosi has a goal of getting both those bills passed by the House by next Friday, which is a very tight deadline considering the wide differences within the caucus. Ms. Pelosi is working on trimming the size of the reconciliation bill down to the $2 trillion area from $3.5 trillion in an attempt to gain support from moderate Democratic Senators such as Manchin and Sinema.

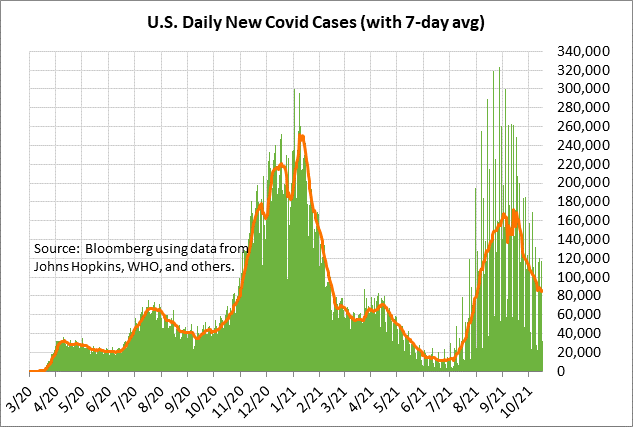

U.S. Covid infections are down by -50% from September’s high — U.S. Covid infections have fallen sharply by -50.6% in the past month but are still about four times higher than June’s temporary trough. The 7-day average of new daily U.S. Covid infections last Friday fell to a new 2-1/2 month low of 84,928.

The sharp decline in Covid infections seen in the past month is leading to hopes that the pandemic may be starting to fade permanently. The U.S. is still far from herd immunity, but more people every day are getting some immunity to Covid from vaccinations or from recovering from the disease itself.

The U.S. has administered a daily average of 675,562 vaccination doses over the past week, according to Bloomberg. That number should rise in the coming weeks once the Moderna and J&J booster shots come online. Bloomberg reports that 56.8% of the total U.S. population has now been fully vaccinated.

Q3 earnings season kicks into gear — Q3 earnings season kicks into gear this week with 78 of the S&P 500 companies reporting. Notable reports include Netflix and United Airlines on Tuesday; Tesla on Wed; American Airlines, AT&T, and Intel on Thursday; and Amex on Friday.

The consensus is for Q3 earnings growth of +32.0% y/y for the S&P 500 companies, according to Refinitiv. Earnings season has so far been positive, with 82.9% of reporting S&P companies having beaten the consensus, higher than the long-term average of 65.8% although below the 4-quarter average of 84.7%, according to Refinitiv. On a calendar year basis, S&P earnings growth in 2021 is expected to be stellar at +46.4%, but is then expected to fade to the more normal level of +9.2% in 2022.