- Oct U.S. consumer sentiment expected to show a small rise but remain weak

- U.S. retail sales expected to fade

- Two Fed officials speak today

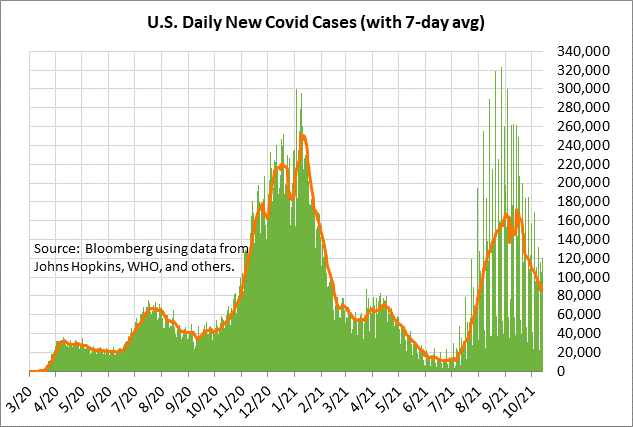

- U.S. Covid infections are down by -50% from September’s high

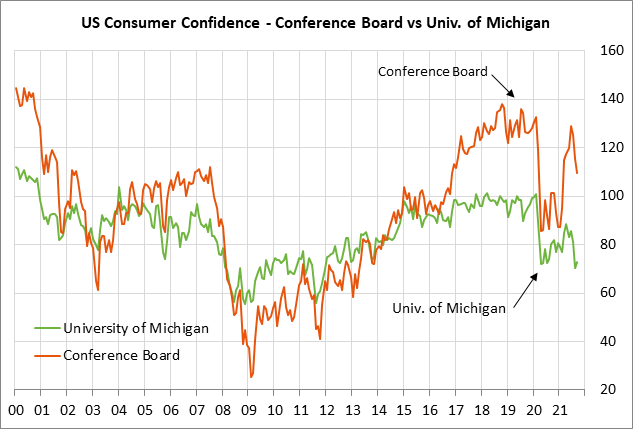

Oct U.S. consumer sentiment expected to show a small rise but remain weak — The consensus is for today’s preliminary-Oct University of Michigan U.S. consumer sentiment index to show a small +0.2 point increase to 73.0, adding to September’s +2.5 rise to 72.8.

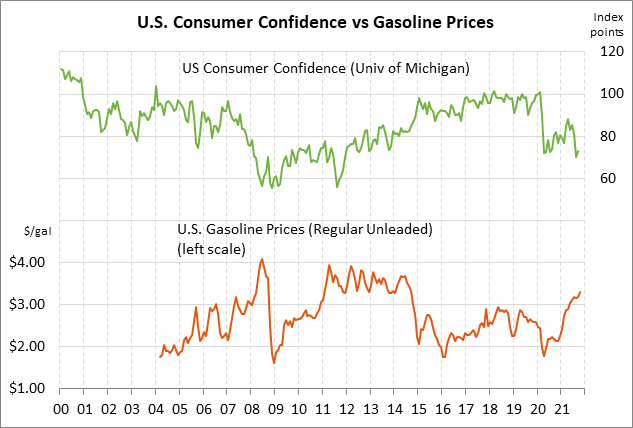

U.S. consumer sentiment remains in poor shape due to the pandemic’s resurgence that didn’t peak until mid-September. The U.S. consumer sentiment index in August plunged by -10.9 points to a 10-year low of 70.3 as the pandemic surged. The August consumer sentiment level was even lower than the worst level of 71.8 seen in April 2020 during the depths of the economic shutdowns in spring 2020. Consumers this July and August were unsure about how bad the pandemic’s resurgence might get and whether there might be new shutdowns in the U.S. economy.

U.S. consumer sentiment has also been hurt by the surge in gasoline prices, which is taking a bite out of consumer pocketbooks. Consumers are also being hurt by inflation and the general rise in the price of many products and services, which is reducing their purchasing power.

However, consumers seem to be overly pessimistic at present given that the pandemic’s summer resurgence seems to be over. U.S. Covid infections have plunged by -50% since mid-September. If the Covid infection figures continue to decline, then consumers can feel more comfortable venturing out to shop, visit restaurants, attend entertainment events, and travel.

Consumers should also feel better due to sharp rise in home and stock prices, which has substantially boosted household wealth. Also, wages are rising and jobs are plentiful. All in all, the picture looks favorable for consumers over at least the next few quarters.

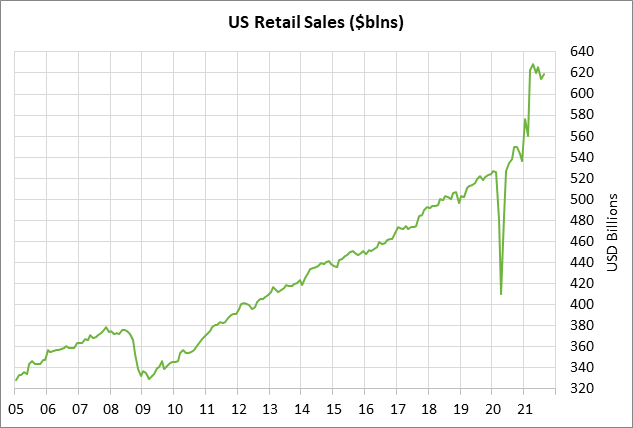

U.S. retail sales expected to fade — The consensus is for today’s Sep retail sales report to show a decline of -0.2% m/m, although retail sales excluding autos are expected to rise by +0.5% m/m. Retail sales were very strong in August at +0.7% m/m and +1.8% m/m ex-autos.

U.S. retail sales continue to be at an extremely high level near $620 billion. U.S. consumers saved up cash during the pandemic and are still spending that cash. However, retail sales might be falling back to earth in the coming months once pent-up demand has been met and consumers start spending more in line with normal levels.

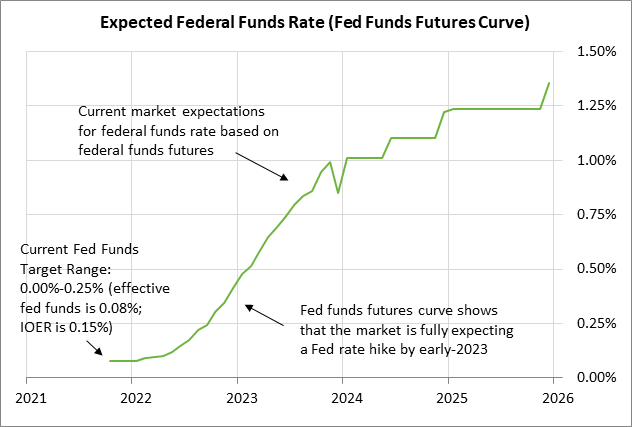

Two Fed officials speak today — The markets will be carefully listening to comments today by two Fed officials for any fresh information on the Fed’s opinion on inflation and the chances for a QE tapering announcement at the upcoming FOMC meeting on Nov 2-3.

St. Louis Fed President James Bullard today will participate in a virtual discussion on the post-Covid monetary and financial environment, hosted by the Euro 50 Group. Also, Atlanta Fed President Raphael Bostic today will participate in a virtual panel discussion on inclusive growth.

Mr. Bostic earlier this week made rather strident comments on inflation, saying that inflation can no longer be considered “transitory.” He added, “I believe evidence is mounting that price pressures have broadened beyond the handful of items most directly connected to supply-chain issues or the reopening of the services sector.”

This past Wednesday’s release of the minutes from the Sep 21-22 FOMC meeting seemed to confirm that the Fed is planning to announce QE tapering at its next meeting on Nov 2-3. The minutes said, “Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December. The minutes added, “Participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate.”

The FOMC even went so far as to lay out an illustrative tapering path, saying, “The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities.

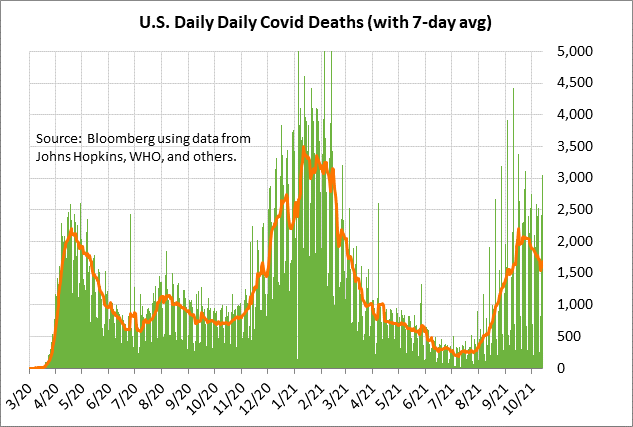

U.S. Covid infections are down by -50% from September’s high — U.S. Covid infections have fallen sharply by -50% in the past month but are still about four times higher than June’s temporary trough. The 7-day average of new daily U.S. Covid infections fell to a new 2-1/2 month low of 86,241 on Monday before rebounding mildly higher to 88,972 by Wednesday.

The sharp decline in Covid infections seen in the past month is leading to hopes that the pandemic may be starting to fade away permanently. The U.S. is still far from herd immunity, but more people are getting some immunity to Covid everyday from vaccinations and from recovering from the disease itself.

The U.S. has administered a daily average of 801,889 vaccination doses over the past week, which is higher than recent levels since many people are now getting their third booster shot. That number should see a fresh rise in the coming weeks once the FDA approves the Moderna booster shot. Bloomberg reports that 56.6% of the total U.S. population has now been fully vaccinated.